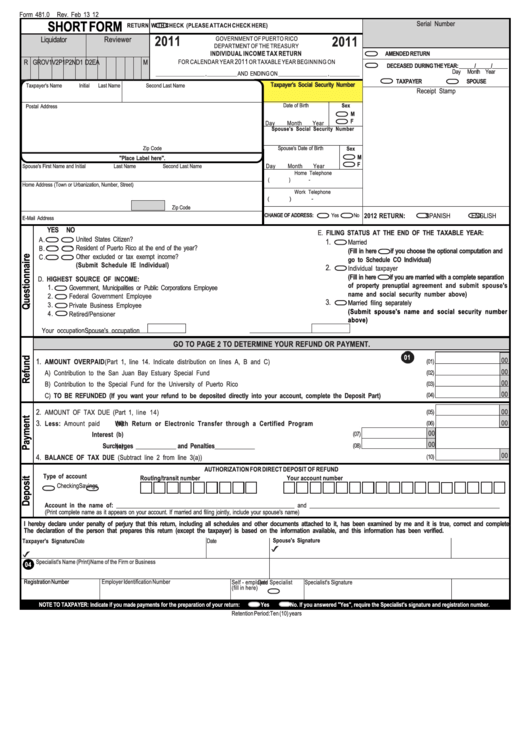

Form 481.0 - Individual Income Tax Return - 2011

ADVERTISEMENT

Form 481.0

Rev. Feb 13 12

SHORT FORM

Serial Number

RETURN WITH CHECK (PLEASE ATTACH CHECK HERE)

2011

2011

Liquidator

Reviewer

GOVERNMENT OF PUERTO RICO

DEPARTMENT OF THE TREASURY

INDIVIDUAL INCOME TAX RETURN

AMENDED RETURN

2011

R G RO V1 V2 P1 P2 N D1 D2 E A

M

FOR CALENDAR YEAR

OR TAXABLE YEAR BEGINNING ON

DECEASED DURING THE YEAR: ______/______/______

Day

Month Year

__________________ , ___________ AND ENDING ON __________________ , ___________

TAXPAYER

SPOUSE

Taxpayer's Social Security Number

Taxpayer's Name

Initial

Last Name

Second Last Name

Receipt Stamp

Date of Birth

Sex

Postal Address

M

F

Day

Month

Year

Spouse's Social Security Number

Zip Code

Spouse's Date of Birth

Sex

M

"Place Label here".

F

Day

Month

Year

Spouse's First Name and Initial

Last Name

Second Last Name

Home Telephone

(

)

-

Home Address (Town or Urbanization, Number, Street)

Work Telephone

(

)

-

Zip Code

CHANGE OF ADDRESS:

Yes

No

2012 RETURN:

SPANISH

ENGLISH

E-Mail Address

YES NO

E. FILING STATUS AT THE END OF THE TAXABLE YEAR:

United States Citizen?

A.

1.

Married

Resident of Puerto Rico at the end of the year?

B.

(Fill in here

if you choose the optional computation and

Other excluded or tax exempt income?

C .

go to Schedule CO Individual)

(Submit Schedule IE Individual)

2.

Individual taxpayer

(Fill in here

if you are married with a complete separation

D. HIGHEST SOURCE OF INCOME:

of property prenuptial agreement and submit spouse's

1.

Government, Municipalities or Public Corporations Employee

name and social security number above)

2.

Federal Government Employee

3.

Married filing separately

3.

Private Business Employee

(Submit spouse's name and social security number

4.

Retired/Pensioner

above)

Your occupation

Spouse's occupation

GO TO PAGE 2 TO DETERMINE YOUR REFUND OR PAYMENT.

01

00

1.

AMOUNT OVERPAID (Part 1, line 14. Indicate distribution on lines A, B and C) .....................................................................................

(01)

00

A) Contribution to the San Juan Bay Estuary Special Fund .............................................................................................................................

(02)

00

B) Contribution to the Special Fund for the University of Puerto Rico ............................................................................................................

(03)

00

C) TO BE REFUNDED (If you want your refund to be deposited directly into your account, complete the Deposit Part) ...........................

(04)

2.

AMOUNT OF TAX DUE (Part 1, line 14) ....................................................................................................................................

00

(05)

3.

Less: Amount paid

(a)

With Return or Electronic Transfer through a Certified Program ....................................................

00

(06)

00

(b)

Interest .........................................................................................................................

(07)

00

(c)

Surcharges _____________ and Penalties _____________ ..........................................

(08)

00

4.

BALANCE OF TAX DUE (Subtract line 2 from line 3(a)) .....................................................................................................................................

(10)

AUTHORIZATION FOR DIRECT DEPOSIT OF REFUND

Type of account

Routing/transit number

Your account number

Checking

Savings

Account in the name of: ___________________________________________________________ and _______________________________________________________________

(Print complete name as it appears on your account. If married and filing jointly, include your spouse's name)

I hereby declare under penalty of perjury that this return, including all schedules and other documents attached to it, has been examined by me and it is true, correct and complete.

The declaration of the person that prepares this return (except the taxpayer) is based on the information available, and this information has been verified.

Spouse's Signature

Taxpayer's Signature

Date

Date

x

x

Specialist's Name (Print)

Name of the Firm or Business

04

Employer Identification Number

Registration Number

Specialist's Signature

Date

Self - employed Specialist

(fill in here)

NOTE TO TAXPAYER: Indicate if you made payments for the preparation of your return:

Yes

No. If you answered "Yes", require the Specialist's signature and registration number.

Retention Period:Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2