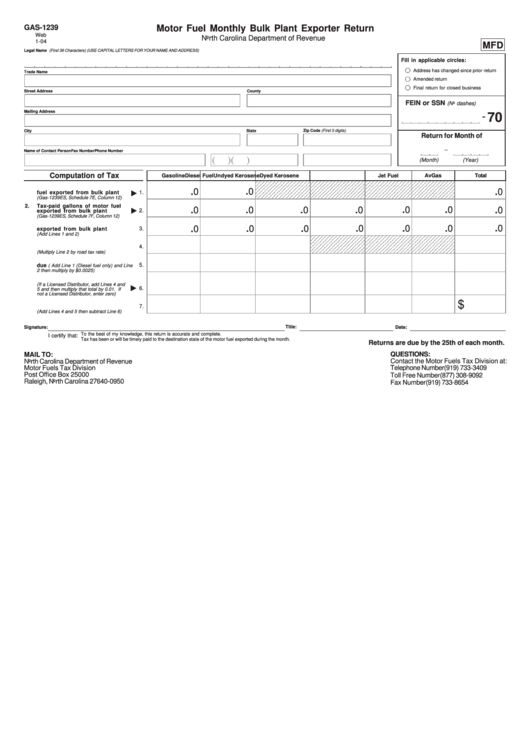

Form Gas-1239 - Motor Fuel Monthly Bulk Plant Exporter Return - 2004

ADVERTISEMENT

GAS-1239

Motor Fuel Monthly Bulk Plant Exporter Return

Web

North Carolina Department of Revenue

1-04

MFD

Legal Name (First 36 Characters) (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Fill in applicable circles:

Address has changed since prior return

Trade Name

Amended return

Final return for closed business

Street Address

County

FEIN or SSN

(No dashes)

Mailing Address

-

70

Zip Code (First 5 digits)

City

State

Return for Month of

-

Name of Contact Person

Phone Number

Fax Number

(

)

(

)

(Month)

(Year)

Computation of Tax

Gasoline

Diesel Fuel

Undyed Kerosene

Dyed Kerosene

Jet Fuel

AvGas

Total

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3

1.

Total untaxed gallons of motor

.0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3

.0

.0

fuel exported from bulk plant

1.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3

(Gas-1239ES, Schedule 7E, Column 12)

2.

Tax-paid gallons of motor fuel

.0

.0

.0

.0

.0

.0

.0

exported from bulk plant

2.

(Gas-1239ES, Schedule 7F, Column 12)

3.

Total gallons of motor fuel

.0

.0

.0

.0

.0

.0

.0

exported from bulk plant

3.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3

(Add Lines 1 and 2)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3

4.

Motor fuels road tax refund due

4.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3

(Multiply Line 2 by road tax rate)

5.

Motor fuels inspection tax refund

due

5.

( Add Line 1 (Diesel fuel only) and Line

2 then multiply by $0.0025)

6.

Tare allowance received

(If a Licensed Distributor, add Lines 4 and

6.

5 and then multiply that total by 0.01. If

not a Licensed Distributor, enter zero)

$

7.

Total Refund Due

7.

(Add Lines 4 and 5 then subtract Line 6)

Title:

Signature:

Date:

To the best of my knowledge, this return is accurate and complete.

I certify that:

Tax has been or will be timely paid to the destination state of the motor fuel exported during the month.

Returns are due by the 25th of each month.

QUESTIONS:

MAIL TO:

Contact the Motor Fuels Tax Division at:

North Carolina Department of Revenue

Telephone Number

(919) 733-3409

Motor Fuels Tax Division

Post Office Box 25000

Toll Free Number

(877) 308-9092

Raleigh, North Carolina 27640-0950

Fax Number

(919) 733-8654

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1