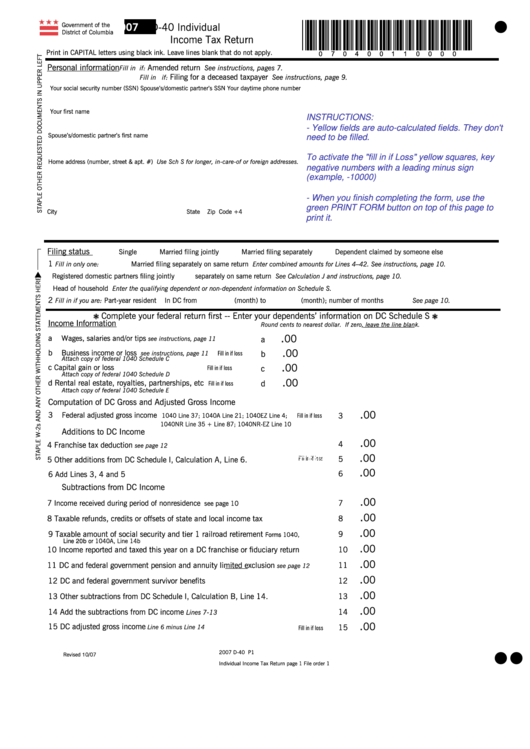

PRINT FORM

RESET FORM

l

*070400110000*

Government of the

2007

D-40 Individual

District of Columbia

Income Tax Return

Print in CAPITAL letters using black ink. Leave lines blank that do not apply.

Personal information

Amended return

Fill in

if:

See instructions, pages 7.

OFFICIAL USE ONLY

Filing for a deceased taxpayer

Fill in

if:

See instructions, page 9.

Your social security number (SSN)

Spouse’s/domestic partner’s SSN

Your daytime phone number

Your first name

M.I.

Last name

INSTRUCTIONS:

- Yellow fields are auto-calculated fields. They don't

Spouse’s/domestic partner’s first name

M.I.

Last name

need to be filled.

To activate the "fill in if Loss" yellow squares, key

Home address (number, street & apt. #) Use Sch S for longer, in-care-of or foreign addresses.

negative numbers with a leading minus sign

(example, -10000)

- When you finish completing the form, use the

green PRINT FORM button on top of this page to

City

State

Zip Code +4

print it.

Filing status

Single

Married filing jointly

Married filing separately

Dependent claimed by someone else

1

Fill in only one:

Married filing separately on same return Enter combined amounts for Lines 4–42. See instructions, page 10.

s

Registered domestic partners filing jointly

separately on same return See Calculation J and instructions, page 10.

Head of household Enter the qualifying dependent or non-dependent information on Schedule S.

2

Part-year resident

In DC from

(month) to

(month); number of months

Fill in if you are:

See page 10.

Complete your federal return first -- Enter your dependents’ information on DC Schedule S

c

c

Income Information

Round cents to nearest dollar. If zero, leave the line blank.

.

$

00

a

Wages, salaries and/or tips

a

see instructions, page 11

.

$

00

b

Business income or loss

b

see instructions, page 11

Fill in if loss

Attach copy of federal 1040 Schedule C

.

$

00

c

Capital gain or loss

c

Fill in if loss

Attach copy of federal 1040 Schedule D

.

$

00

d

Rental real estate, royalties, partnerships, etc

d

Fill in if loss

Attach copy of federal 1040 Schedule E

Computation of DC Gross and Adjusted Gross Income

.

$

00

3

Federal adjusted gross income

3

1040 Line 37; 1040A Line 21; 1040EZ Line 4;

Fill in if loss

1040NR Line 35 + Line 87; 1040NR-EZ Line 10

Additions to DC Income

.

$

00

4

4

Franchise tax deduction

see page 12

.

$

00

5

5

Other additions from DC Schedule I, Calculation A, Line 6.

Fill in if loss

TO CALC A

.

$

00

6

6

Add Lines 3, 4 and 5

Subtractions from DC Income

.

$

00

7

Income received during period of nonresidence

7

see page 10

.

$

00

8

Taxable refunds, credits or offsets of state and local income tax

8

.

$

00

9

Taxable amount of social security and tier 1 railroad retirement

9

Forms 1040,

Line 20b or 1040A, Line 14b

.

$

00

10 Income reported and taxed this year on a DC franchise or fiduciary return

10

.

$

00

11 DC and federal government pension and annuity limited exclusion

11

see page 12

.

$

00

12 DC and federal government survivor benefits

12

.

$

00

13 Other subtractions from DC Schedule I, Calculation B, Line 14.

13

TO CALC B

.

$

00

14 Add the subtractions from DC income

14

Lines 7-13

.

$

00

15 DC adjusted gross income

15

Line 6 minus Line 14

Fill in if loss

l

l

2007 D-40 P1

15

Revised 10/07

Individual Income Tax Return page 1

File order 1

1

1 2

2