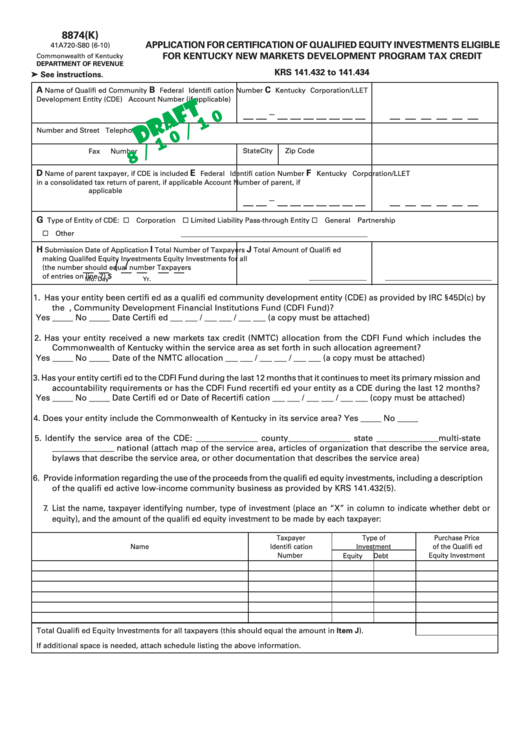

Form 8874(K) Draft - Application For Certification Of Qualified Equity Investments Eligible For Kentucky New Markets Development Program Tax Credit - 2010

ADVERTISEMENT

8874(K)

APPLICATION FOR CERTIFICATION OF QUALIFIED EQUITY INVESTMENTS ELIGIBLE

41A720-S80 (6-10)

FOR KENTUCKY NEW MARKETS DEVELOPMENT PROGRAM TAX CREDIT

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

KRS 141.432 to 141.434

➤ See instructions.

A

B

C

Name of Qualifi ed Community

Federal Identifi cation Number

Kentucky Corporation/LLET

Development Entity (CDE)

Account Number (if applicable)

_

Number and Street

Telephone

City

State

Zip Code

Fax Number

D

E

F

Name of parent taxpayer, if CDE is included

Federal Identifi cation Number

Kentucky Corporation/LLET

in a consolidated tax return

of parent, if applicable

Account Number of parent, if

applicable

_

G

Type of Entity of CDE:

Corporation

Limited Liability Pass-through Entity

General Partnership

Other

H

I

J

Submission Date of Application

Total Number of Taxpayers

Total Amount of Qualifi ed

making Qualifed Equity Investments

Equity Investments for all

/

/

(the number should equal number

Taxpayers

of entries on line 7)

$

Mo.

Day

Yr.

1. Has your entity been certifi ed as a qualifi ed community development entity (CDE) as provided by IRC §45D(c) by

the U.S. Department of Treasury, Community Development Financial Institutions Fund (CDFI Fund)?

Yes _____ No _____ Date Certifi ed ___ ___ / ___ ___ / ___ ___ (a copy must be attached)

2. Has your entity received a new markets tax credit (NMTC) allocation from the CDFI Fund which includes the

Commonwealth of Kentucky within the service area as set forth in such allocation agreement?

Yes _____ No _____ Date of the NMTC allocation ___ ___ / ___ ___ / ___ ___ (a copy must be attached)

3. Has your entity certifi ed to the CDFI Fund during the last 12 months that it continues to meet its primary mission and

accountability requirements or has the CDFI Fund recertifi ed your entity as a CDE during the last 12 months?

Yes _____ No _____ Date Certifi ed or Date of Recertifi cation ___ ___ / ___ ___ / ___ ___ (copy must be attached)

4. Does your entity include the Commonwealth of Kentucky in its service area? Yes _____ No _____

5. Identify the service area of the CDE: _______________ county_______________ state _______________multi-state

_______________ national (attach map of the service area, articles of organization that describe the service area,

bylaws that describe the service area, or other documentation that describes the service area)

6. Provide information regarding the use of the proceeds from the qualifi ed equity investments, including a description

of the qualifi ed active low-income community business as provided by KRS 141.432(5).

7. List the name, taxpayer identifying number, type of investment (place an “X” in column to indicate whether debt or

equity), and the amount of the qualifi ed equity investment to be made by each taxpayer:

Taxpayer

Type of

Purchase Price

Name

Identifi cation

Investment

of the Qualifi ed

Number

Equity Investment

Equity

Debt

Total Qualifi ed Equity Investments for all taxpayers (this should equal the amount in Item J).

If additional space is needed, attach schedule listing the above information.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3