Withholding Tax Guide - Saginaw,michigan

ADVERTISEMENT

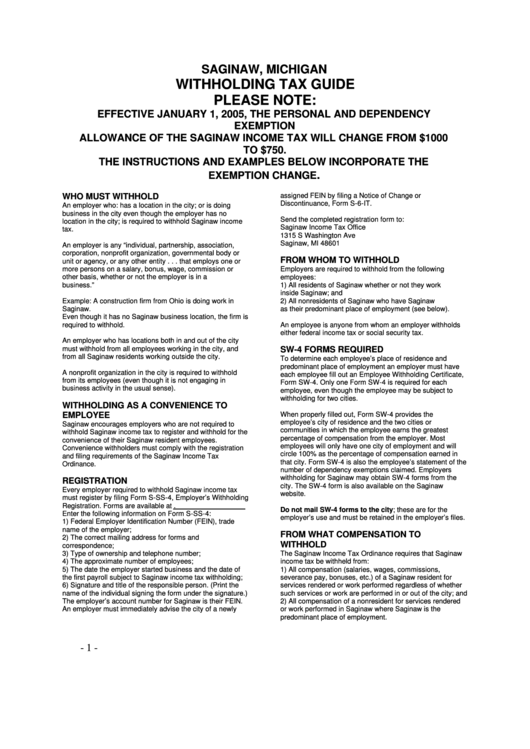

SAGINAW, MICHIGAN

WITHHOLDING TAX GUIDE

PLEASE NOTE:

EFFECTIVE JANUARY 1, 2005, THE PERSONAL AND DEPENDENCY

EXEMPTION

ALLOWANCE OF THE SAGINAW INCOME TAX WILL CHANGE FROM $1000

TO $750.

THE INSTRUCTIONS AND EXAMPLES BELOW INCORPORATE THE

.

EXEMPTION CHANGE

assigned FEIN by filing a Notice of Change or

WHO MUST WITHHOLD

Discontinuance, Form S-6-IT.

An employer who: has a location in the city; or is doing

business in the city even though the employer has no

Send the completed registration form to:

location in the city; is required to withhold Saginaw income

Saginaw Income Tax Office

tax.

1315 S Washington Ave

Saginaw, MI 48601

An employer is any “individual, partnership, association,

corporation, nonprofit organization, governmental body or

FROM WHOM TO WITHHOLD

unit or agency, or any other entity . . . that employs one or

more persons on a salary, bonus, wage, commission or

Employers are required to withhold from the following

other basis, whether or not the employer is in a

employees:

business.”

1) All residents of Saginaw whether or not they work

inside Saginaw; and

Example: A construction firm from Ohio is doing work in

2) All nonresidents of Saginaw who have Saginaw

Saginaw.

as their predominant place of employment (see below).

Even though it has no Saginaw business location, the firm is

required to withhold.

An employee is anyone from whom an employer withholds

either federal income tax or social security tax.

An employer who has locations both in and out of the city

must withhold from all employees working in the city, and

SW-4 FORMS REQUIRED

from all Saginaw residents working outside the city.

To determine each employee’s place of residence and

predominant place of employment an employer must have

A nonprofit organization in the city is required to withhold

each employee fill out an Employee Withholding Certificate,

from its employees (even though it is not engaging in

Form SW-4. Only one Form SW-4 is required for each

business activity in the usual sense).

employee, even though the employee may be subject to

withholding for two cities.

WITHHOLDING AS A CONVENIENCE TO

When properly filled out, Form SW-4 provides the

EMPLOYEE

employee’s city of residence and the two cities or

Saginaw encourages employers who are not required to

communities in which the employee earns the greatest

withhold Saginaw income tax to register and withhold for the

percentage of compensation from the employer. Most

convenience of their Saginaw resident employees.

employees will only have one city of employment and will

Convenience withholders must comply with the registration

circle 100% as the percentage of compensation earned in

and filing requirements of the Saginaw Income Tax

that city. Form SW-4 is also the employee’s statement of the

Ordinance.

number of dependency exemptions claimed. Employers

withholding for Saginaw may obtain SW-4 forms from the

REGISTRATION

city. The SW-4 form is also available on the Saginaw

Every employer required to withhold Saginaw income tax

website.

must register by filing Form S-SS-4, Employer’s Withholding

Registration. Forms are available at

Do not mail SW-4 forms to the city; these are for the

Enter the following information on Form S-SS-4:

employer’s use and must be retained in the employer’s files.

1) Federal Employer Identification Number (FEIN), trade

name of the employer;

FROM WHAT COMPENSATION TO

2) The correct mailing address for forms and

WITHHOLD

correspondence;

3) Type of ownership and telephone number;

The Saginaw Income Tax Ordinance requires that Saginaw

4) The approximate number of employees;

income tax be withheld from:

5) The date the employer started business and the date of

1) All compensation (salaries, wages, commissions,

the first payroll subject to Saginaw income tax withholding;

severance pay, bonuses, etc.) of a Saginaw resident for

6) Signature and title of the responsible person. (Print the

services rendered or work performed regardless of whether

name of the individual signing the form under the signature.)

such services or work are performed in or out of the city; and

The employer’s account number for Saginaw is their FEIN.

2) All compensation of a nonresident for services rendered

An employer must immediately advise the city of a newly

or work performed in Saginaw where Saginaw is the

predominant place of employment.

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17