Iowa Inheritance Tax Schedule B

ADVERTISEMENT

Iowa Department of Revenue

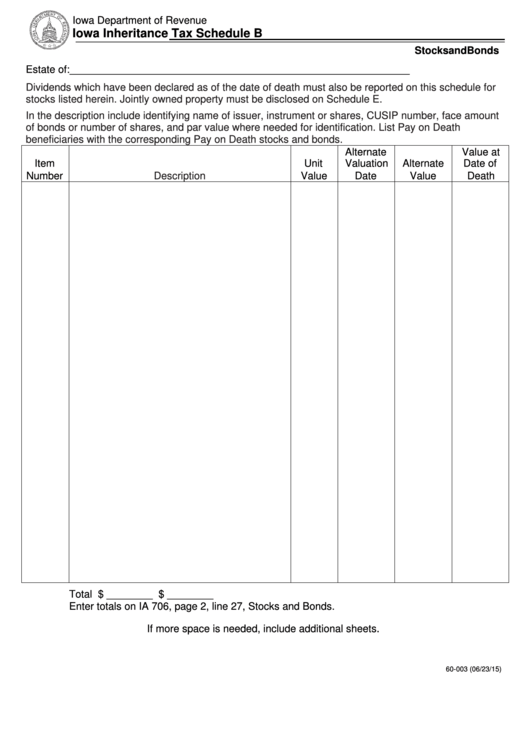

Iowa Inheritance Tax Schedule B

https://tax.iowa.gov

Stocks and Bonds

Estate of:___________________________________________________________

Dividends which have been declared as of the date of death must also be reported on this schedule for

stocks listed herein. Jointly owned property must be disclosed on Schedule E.

In the description include identifying name of issuer, instrument or shares, CUSIP number, face amount

of bonds or number of shares, and par value where needed for identification. List Pay on Death

beneficiaries with the corresponding Pay on Death stocks and bonds.

Alternate

Value at

Item

Unit

Valuation

Alternate

Date of

Number

Description

Value

Date

Value

Death

Total ...................................................................................................... $ ________ $ ________

Enter totals on IA 706, page 2, line 27, Stocks and Bonds.

If more space is needed, include additional sheets.

60-003 (06/23/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1