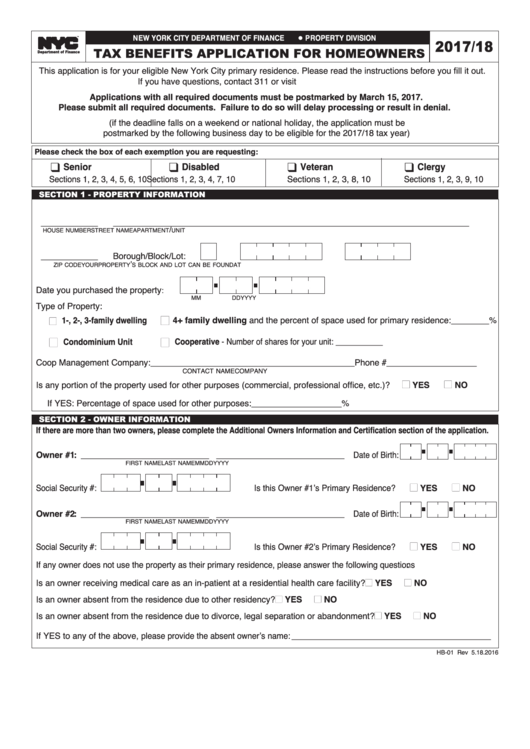

2017/18 Tax Benefits Application For Homeowners - New York City Department Of Finance

ADVERTISEMENT

2017/18

new YorK citY DePArtMent oF FinAnce

ProPertY Division

TAX BENEFITS APPLICATION FOR HOMEOWNERS

l

TM

Department of Finance

This application is for your eligible New York City primary residence. Please read the instructions before you fill it out.

If you have questions, contact 311 or visit nyc.gov/contactfinance.

Applications with all required documents must be postmarked by March 15, 2017.

Please submit all required documents. Failure to do so will delay processing or result in denial.

(if the deadline falls on a weekend or national holiday, the application must be

postmarked by the following business day to be eligible for the 2017/18 tax year)

Please check the box of each exemption you are requesting:

senior

Disabled

veteran

clergy

q

q

q

q

Sections 1, 2, 3, 4, 5, 6, 10

Sections 1, 2, 3, 4, 7, 10

Sections 1, 2, 3, 8, 10

Sections 1, 2, 3, 9, 10

SECTION 1 - PROPERTY INFORMATION

____________

____________________________________________________________

_______________

/

HOUSE NUMBER

STREET NAME

APARTMENT

UNIT

____________

Borough/Block/Lot:

’

nyc.gov/bbl

zIP CODE

YOUR PROPERTY

S BLOCK AND LOT CAN BE FOUND AT

Date you purchased the property

:

MM

DD

YYYY

Type of Property:

1-, 2-, 3-family dwelling

4+ family dwelling and the percent of space used for primary residence:________%

n

n

condominium unit

cooperative - Number of shares for your unit: ___________

n

n

Coop Management Company: ___________________________________________ Phone # ___________________

CONTACT NAME

COMPANY

Yes

no

Is any portion of the property used for other purposes (commercial, professional office, etc.)?

n

n

If YES: Percentage of space used for other purposes:___________________%

SECTION 2 - OWNER INFORMATION

if there are more than two owners, please complete the Additional owners information and certification section of the application.

owner #1: ___________________________ ___________________________ Date of Birth:

FIRST NAME

LAST NAME

MM

DD

YYYY

Yes

no

Social Security #:

Is this Owner #1’s Primary Residence?

n

n

owner #2: ___________________________ ___________________________ Date of Birth:

FIRST NAME

LAST NAME

MM

DD

YYYY

Yes

no

Social Security #:

Is this Owner #2’s Primary Residence?

n

n

If any owner does not use the property as their primary residence, please answer the following questions.

Yes

no

Is an owner receiving medical care as an in-patient at a residential health care facility?

n

n

Yes

no

Is an owner absent from the residence due to other residency?

n

n

Yes

no

Is an owner absent from the residence due to divorce, legal separation or abandonment?

n

n

If YES to any of the above, please provide the absent owner’s name:__________________________________________

HB-01 Rev 5.18.2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5