Clear Form

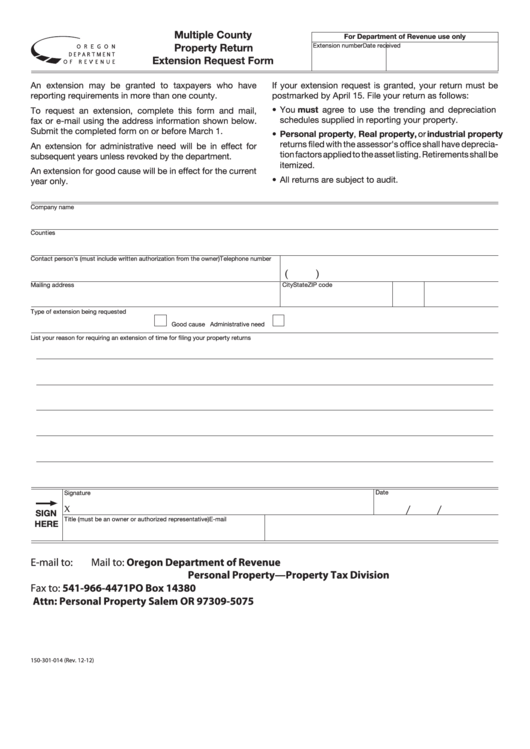

Multiple County

For Department of Revenue use only

Property Return

Extension number

Date received

Extension Request Form

An extension may be granted to taxpayers who have

If your extension request is granted, your return must be

reporting requirements in more than one county.

postmarked by April 15. File your return as follows:

• You must agree to use the trending and depreciation

To request an extension, complete this form and mail,

schedules supplied in reporting your property.

fax or e-mail using the address information shown below.

Submit the completed form on or before March 1.

• Personal property, Real property, or industrial property

returns filed with the assessor's office shall have deprecia-

An extension for administrative need will be in effect for

tion factors applied to the asset listing. Retirements shall be

subsequent years unless revoked by the department.

itemized.

An extension for good cause will be in effect for the current

• All returns are subject to audit.

year only.

Company name

Counties

Contact person's (must include written authorization from the owner)

Telephone number

(

)

Mailing address

City

State

ZIP code

Type of extension being requested

Good cause

Administrative need

List your reason for requiring an extension of time for filing your property returns

Date

Signature

X

/

/

SIGN

Title (must be an owner or authorized representative)

E-mail

HERE

E-mail to: personal.property@dor.state.or.us

Mail to: Oregon Department of Revenue

Personal Property—Property Tax Division

541-966-4471

PO Box 14380

Fax to:

Attn: Personal Property

Salem OR 97309-5075

150-301-014 (Rev. 12-12)

1

1 2

2 3

3