Form 51a350 - Information Sharing And Assignment Agreement For Energy Efficiency Project Incentive

ADVERTISEMENT

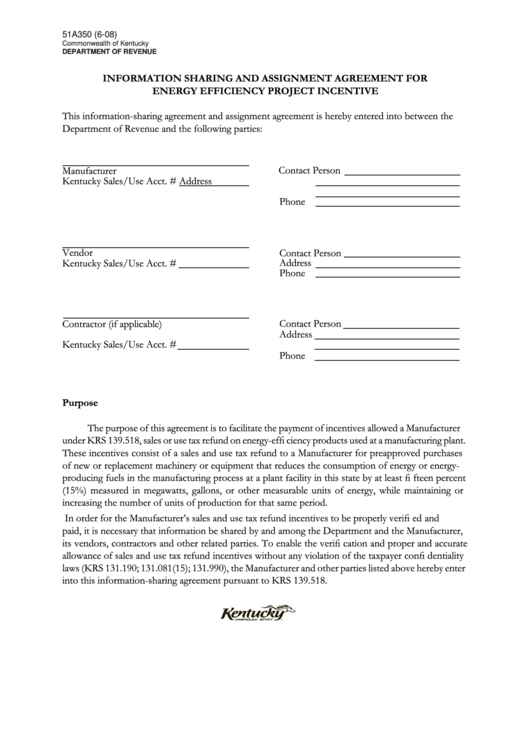

51A350 (6-08)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

INFORMATION SHARING AND ASSIGNMENT AGREEMENT FOR

ENERGY EFFICIENCY PROJECT INCENTIVE

This information-sharing agreement and assignment agreement is hereby entered into between the

Department of Revenue and the following parties:

Contact Person

Manufacturer

Kentucky Sales/Use Acct. #

Address

Phone

Vendor

Contact Person

Address

Kentucky Sales/Use Acct. #

Phone

Contact Person

Contractor (if applicable)

Address

Kentucky Sales/Use Acct. #

Phone

Purpose

The purpose of this agreement is to facilitate the payment of incentives allowed a Manufacturer

under KRS 139.518, sales or use tax refund on energy-effi ciency products used at a manufacturing plant.

These incentives consist of a sales and use tax refund to a Manufacturer for preapproved purchases

of new or replacement machinery or equipment that reduces the consumption of energy or energy-

producing fuels in the manufacturing process at a plant facility in this state by at least fi fteen percent

(15%) measured in megawatts, gallons, or other measurable units of energy, while maintaining or

increasing the number of units of production for that same period.

In order for the Manufacturer’s sales and use tax refund incentives to be properly verifi ed and

paid, it is necessary that information be shared by and among the Department and the Manufacturer,

its vendors, contractors and other related parties. To enable the verifi cation and proper and accurate

allowance of sales and use tax refund incentives without any violation of the taxpayer confi dentiality

laws (KRS 131.190; 131.081(15); 131.990), the Manufacturer and other parties listed above hereby enter

into this information-sharing agreement pursuant to KRS 139.518.

An Equal Opportunity Employer M/F/D

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2