Form 36 M.r.s. 5216-D - Maine Fishery Infrastructure Investment Tax Credit Worksheet For Tax Year 2015

ADVERTISEMENT

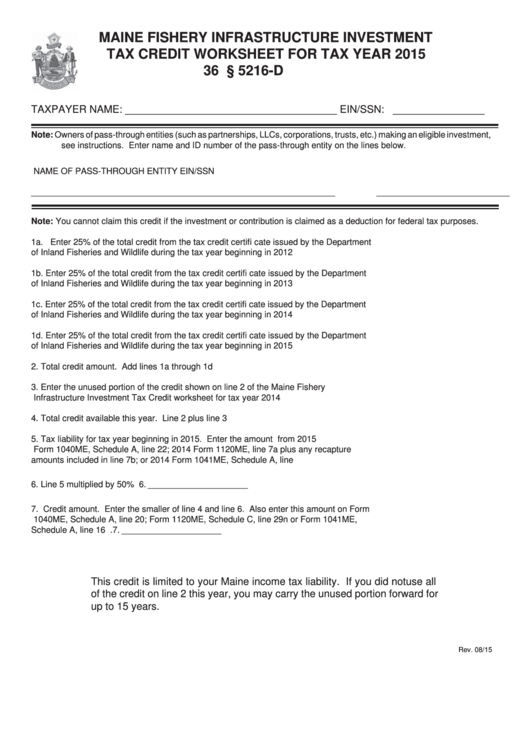

MAINE FISHERY INFRASTRUCTURE INVESTMENT

TAX CREDIT WORKSHEET FOR TAX YEAR 2015

36 M.R.S. § 5216-D

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (such as partnerships, LLCs, corporations, trusts, etc.) making an eligible investment,

see instructions. Enter name and ID number of the pass-through entity on the lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

Note: You cannot claim this credit if the investment or contribution is claimed as a deduction for federal tax purposes.

1a. Enter 25% of the total credit from the tax credit certifi cate issued by the Department

of Inland Fisheries and Wildlife during the tax year beginning in 2012 ........................... 1a. _____________________

1b. Enter 25% of the total credit from the tax credit certifi cate issued by the Department

of Inland Fisheries and Wildlife during the tax year beginning in 2013 ........................... 1b. _____________________

1c. Enter 25% of the total credit from the tax credit certifi cate issued by the Department

of Inland Fisheries and Wildlife during the tax year beginning in 2014 ........................... 1c. _____________________

1d. Enter 25% of the total credit from the tax credit certifi cate issued by the Department

of Inland Fisheries and Wildlife during the tax year beginning in 2015 ........................... 1d. _____________________

2.

Total credit amount. Add lines 1a through 1d ................................................................... 2. _____________________

3.

Enter the unused portion of the credit shown on line 2 of the Maine Fishery

Infrastructure Investment Tax Credit worksheet for tax year 2014 .................................... 3. _____________________

4.

Total credit available this year. Line 2 plus line 3 ............................................................. 4. _____________________

5.

Tax liability for tax year beginning in 2015. Enter the amount from 2015

Form 1040ME, Schedule A, line 22; 2014 Form 1120ME, line 7a plus any recapture

amounts included in line 7b; or 2014 Form 1041ME, Schedule A, line 18........................ 5. _____________________

6.

Line 5 multiplied by 50% ...................................................................................................6. _____________________

7.

Credit amount. Enter the smaller of line 4 and line 6. Also enter this amount on Form

1040ME, Schedule A, line 20; Form 1120ME, Schedule C, line 29n or Form 1041ME,

Schedule A, line 16 ........................................................................................................... 7. _____________________

This credit is limited to your Maine income tax liability. If you did not use all

of the credit on line 2 this year, you may carry the unused portion forward for

up to 15 years.

Rev. 08/15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2