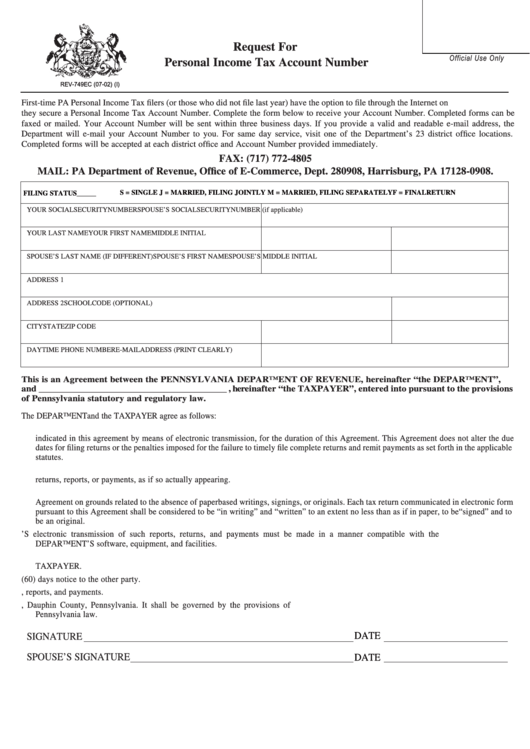

Request For

Official Use Only

Personal Income Tax Account Number

REV-749EC (07-02) (I)

First-time PA Personal Income Tax filers (or those who did not file last year) have the option to file through the Internet on pa.direct.file after

they secure a Personal Income Tax Account Number. Complete the form below to receive your Account Number. Completed forms can be

faxed or mailed. Your Account Number will be sent within three business days. If you provide a valid and readable e-mail address, the

Department will e-mail your Account Number to you. For same day service, visit one of the Department’s 23 district office locations.

Completed forms will be accepted at each district office and Account Number provided immediately.

FAX: (717) 772-4805

MAIL: PA Department of Revenue, Office of E-Commerce, Dept. 280908, Harrisburg, PA 17128-0908.

S = SINGLE

J = MARRIED, FILING JOINTLY

M = MARRIED, FILING SEPARATELY

F = FINAL RETURN

FILING STATUS ______

YOUR SOCIAL SECURITY NUMBER

SPOUSE’S SOCIAL SECURITY NUMBER (if applicable)

YOUR LAST NAME

YOUR FIRST NAME

MIDDLE INITIAL

SPOUSE’S LAST NAME (IF DIFFERENT)

SPOUSE’S FIRST NAME

SPOUSE’S MIDDLE INITIAL

ADDRESS 1

ADDRESS 2

SCHOOL CODE (OPTIONAL)

CITY

STATE

ZIP CODE

DAYTIME PHONE NUMBER

E-MAIL ADDRESS (PRINT CLEARLY)

This is an Agreement between the PENNSYLVANIA DEPARTMENT OF REVENUE, hereinafter “the DEPARTMENT”,

and ____________________________________________ , hereinafter “the TAXPAYER”, entered into pursuant to the provisions

of Pennsylvania statutory and regulatory law.

The DEPARTMENT and the TAXPAYER agree as follows:

1. The DEPARTMENT authorizes the TAXPAYER to file those Pennsylvania Tax Returns and remit payment for those taxes specifically

indicated in this agreement by means of electronic transmission, for the duration of this Agreement. This Agreement does not alter the due

dates for filing returns or the penalties imposed for the failure to timely file complete returns and remit payments as set forth in the applicable

statutes.

2. The signature of the TAXPAYER or its authorized agent affixed to this Agreement shall be deemed to appear on such electronically filed

returns, reports, or payments, as if so actually appearing.

3. Neither party shall contest the validity or enforceability of the tax returns and payments communicated in electronic form pursuant to this

Agreement on grounds related to the absence of paperbased writings, signings, or originals. Each tax return communicated in electronic form

pursuant to this Agreement shall be considered to be “in writing” and “written” to an extent no less than as if in paper, to be “signed” and to

be an original.

4. The TAXPAYER’S electronic transmission of such reports, returns, and payments must be made in a manner compatible with the

DEPARTMENT’S software, equipment, and facilities.

5. This Agreement can be amended at any time by the execution of a written addendum to this Agreement by the DEPARTMENT and the

TAXPAYER.

6. The DEPARTMENT or the TAXPAYER can cancel this Agreement at any time upon sixty (60) days notice to the other party.

7. This Agreement represents the entire understanding of the parties in relation to the electronic filing of returns, reports, and payments.

8. The place of performance of this Agreement is Harrisburg, Dauphin County, Pennsylvania. It shall be governed by the provisions of

Pennsylvania law.

DATE

SIGNATURE

SPOUSE’S SIGNATURE

DATE

1

1