Rehabilitation Of Historic Properties Tax Credit Worksheet - 2003

ADVERTISEMENT

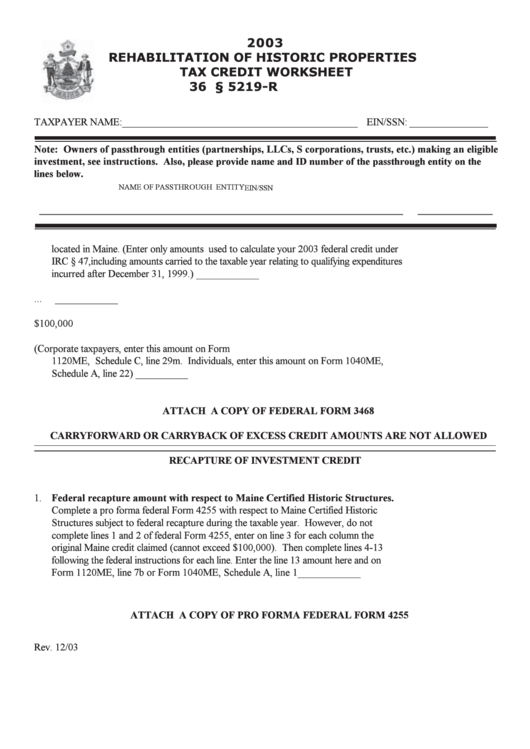

2003

REHABILITATION OF HISTORIC PROPERTIES

TAX CREDIT WORKSHEET

36 M.R.S.A. § 5219-R

TAXPAYER NAME: _____________________________________________ EIN/SSN: _______________

Note: Owners of passthrough entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible

investment, see instructions. Also, please provide name and ID number of the passthrough entity on the

lines below.

NAME OF PASSTHROUGH ENTITY

EIN/SSN

_________________________________________________________________________

_______________

1. Enter 2003 qualified rehabilitation expenditures with respect to certified historic structures

located in Maine. (Enter only amounts used to calculate your 2003 federal credit under

IRC § 47,including amounts carried to the taxable year relating to qualifying expenditures

incurred after December 31, 1999.) .................................................................................

____________

2. Line 1 X .20 ....................................................................................................................

____________

3. Credit limitation ................................................................................................................ $100,000

4. Enter the lesser of line 2 or line 3. (Corporate taxpayers, enter this amount on Form

1120ME, Schedule C, line 29m. Individuals, enter this amount on Form 1040ME,

Schedule A, line 22) .........................................................................................................

____________

ATTACH A COPY OF FEDERAL FORM 3468

CARRYFORWARD OR CARRYBACK OF EXCESS CREDIT AMOUNTS ARE NOT ALLOWED

RECAPTURE OF INVESTMENT CREDIT

1. Federal recapture amount with respect to Maine Certified Historic Structures.

Complete a pro forma federal Form 4255 with respect to Maine Certified Historic

Structures subject to federal recapture during the taxable year. However, do not

complete lines 1 and 2 of federal Form 4255, enter on line 3 for each column the

original Maine credit claimed (cannot exceed $100,000). Then complete lines 4-13

following the federal instructions for each line. Enter the line 13 amount here and on

Form 1120ME, line 7b or Form 1040ME, Schedule A, line 1 ...........................................

____________

ATTACH A COPY OF PRO FORMA FEDERAL FORM 4255

Rev. 12/03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1