Tax Instructions - Nebraska

ADVERTISEMENT

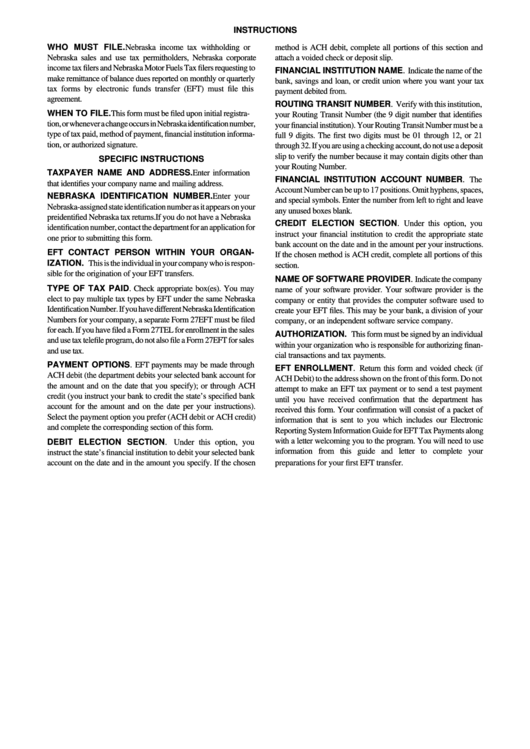

INSTRUCTIONS

WHO MUST FILE. Nebraska income tax withholding or

method is ACH debit, complete all portions of this section and

Nebraska sales and use tax permitholders, Nebraska corporate

attach a voided check or deposit slip.

income tax filers and Nebraska Motor Fuels Tax filers requesting to

FINANCIAL INSTITUTION NAME. Indicate the name of the

make remittance of balance dues reported on monthly or quarterly

bank, savings and loan, or credit union where you want your tax

tax forms by electronic funds transfer (EFT) must file this

payment debited from.

agreement.

ROUTING TRANSIT NUMBER. Verify with this institution,

WHEN TO FILE. This form must be filed upon initial registra-

your Routing Transit Number (the 9 digit number that identifies

tion, or whenever a change occurs in Nebraska identification number,

your financial institution). Your Routing Transit Number must be a

type of tax paid, method of payment, financial institution informa-

full 9 digits. The first two digits must be 01 through 12, or 21

tion, or authorized signature.

through 32. If you are using a checking account, do not use a deposit

slip to verify the number because it may contain digits other than

SPECIFIC INSTRUCTIONS

your Routing Number.

TAXPAYER NAME AND ADDRESS. Enter information

FINANCIAL INSTITUTION ACCOUNT NUMBER. The

that identifies your company name and mailing address.

Account Number can be up to 17 positions. Omit hyphens, spaces,

NEBRASKA IDENTIFICATION NUMBER. Enter your

and special symbols. Enter the number from left to right and leave

Nebraska-assigned state identification number as it appears on your

any unused boxes blank.

preidentified Nebraska tax returns. If you do not have a Nebraska

CREDIT ELECTION SECTION. Under this option, you

identification number, contact the department for an application for

instruct your financial institution to credit the appropriate state

one prior to submitting this form.

bank account on the date and in the amount per your instructions.

EFT CONTACT PERSON WITHIN YOUR ORGAN-

If the chosen method is ACH credit, complete all portions of this

IZATION. This is the individual in your company who is respon-

section.

sible for the origination of your EFT transfers.

NAME OF SOFTWARE PROVIDER. Indicate the company

TYPE OF TAX PAID . Check appropriate box(es). You may

name of your software provider. Your software provider is the

elect to pay multiple tax types by EFT under the same Nebraska

company or entity that provides the computer software used to

Identification Number. If you have different Nebraska Identification

create your EFT files. This may be your bank, a division of your

Numbers for your company, a separate Form 27EFT must be filed

company, or an independent software service company.

for each. If you have filed a Form 27TEL for enrollment in the sales

AUTHORIZATION. This form must be signed by an individual

and use tax telefile program, do not also file a Form 27EFT for sales

within your organization who is responsible for authorizing finan-

and use tax.

cial transactions and tax payments.

PAYMENT OPTIONS. EFT payments may be made through

EFT ENROLLMENT. Return this form and voided check (if

ACH debit (the department debits your selected bank account for

ACH Debit) to the address shown on the front of this form. Do not

the amount and on the date that you specify); or through ACH

attempt to make an EFT tax payment or to send a test payment

credit (you instruct your bank to credit the state’s specified bank

until you have received confirmation that the department has

account for the amount and on the date per your instructions).

received this form. Your confirmation will consist of a packet of

Select the payment option you prefer (ACH debit or ACH credit)

information that is sent to you which includes our Electronic

and complete the corresponding section of this form.

Reporting System Information Guide for EFT Tax Payments along

with a letter welcoming you to the program. You will need to use

DEBIT ELECTION SECTION. Under this option, you

information from this guide and letter to complete your

instruct the state’s financial institution to debit your selected bank

account on the date and in the amount you specify. If the chosen

preparations for your first EFT transfer.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1