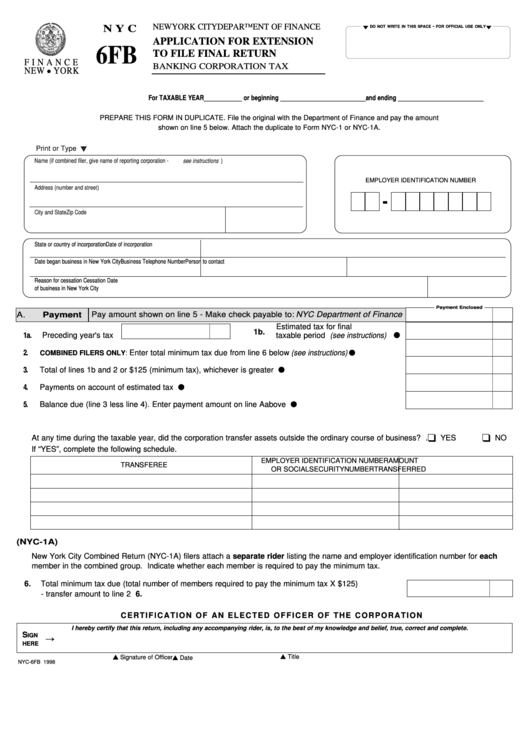

NEW YORK CITY DEPARTMENT OF FINANCE

-

N Y C

t

t

DO NOT WRITE IN THIS SPACE

FOR OFFICIAL USE ONLY

APPLICATION FOR EXTENSION

6FB

TO FILE FINAL RETURN

F I N A N C E

BANKING CORPORATION TAX

NEW

YORK

l

For TAXABLE YEAR ____________ or beginning ___________________________and ending ___________________________

PREPARE THIS FORM IN DUPLICATE. File the original with the Department of Finance and pay the amount

shown on line 5 below. Attach the duplicate to Form NYC-1 or NYC-1A.

Print or Type t

Name (if combined filer, give name of reporting corporation -

see instructions )

EMPLOYER IDENTIFICATION NUMBER

Address (number and street)

City and State

Zip Code

State or country of incorporation

Date of incorporation

Date began business in New York City

Business Telephone Number

Person to contact

Reason for cessation

Cessation Date

of business in New York City

Payment Enclosed

Pay amount shown on line 5 - Make check payable to: NYC Department of Finance

A.

Payment

Estimated tax for final

1b.

taxable period (see instructions) l

1a.

Preceding year's tax

Enter total minimum tax due from line 6 below (see instructions) ................. l

2.

COMBINED FILERS ONLY:

Total of lines 1b and 2 or $125 (minimum tax), whichever is greater ................................................... l

3.

l

4.

Payments on account of estimated tax .................................................................................................

Balance due (line 3 less line 4). Enter payment amount on line A above ............................................ l

5.

B. Asset Transfer

q

q

At any time during the taxable year, did the corporation transfer assets outside the ordinary course of business? .

YES

NO

If “YES”, complete the following schedule.

EMPLOYER IDENTIFICATION NUMBER

AMOUNT

TRANSFEREE

OR SOCIAL SECURITY NUMBER

TRANSFERRED

C. NYC Combined Return Filers (NYC-1A)

New York City Combined Return (NYC-1A) filers attach a separate rider listing the name and employer identification number for each

member in the combined group. Indicate whether each member is required to pay the minimum tax.

6.

Total minimum tax due (total number of members required to pay the minimum tax X $125)

- transfer amount to line 2 ..................................................................................................................6.

C E R T I F I C AT I O N O F A N E L E C T E D O F F I C E R O F T H E C O R P O R AT I O N

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

S

Õ

IGN

HERE

s Title

s Signature of Officer

s Date

NYC-6FB 1998

1

1