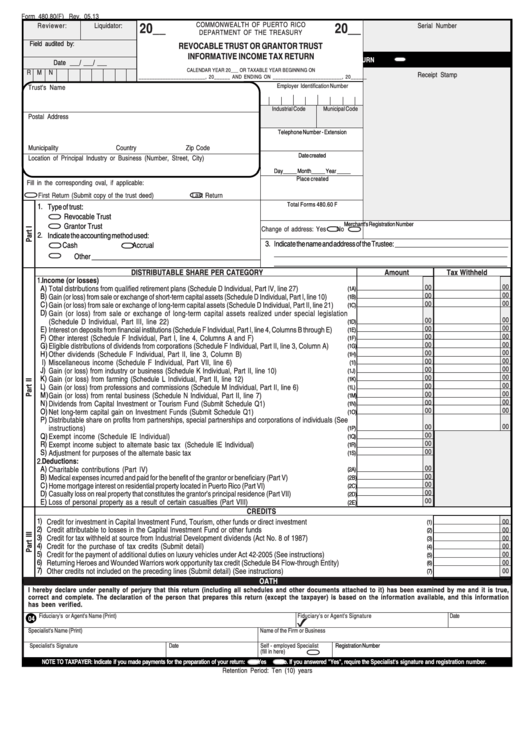

Form 480.80(F) - Revocable Trust Or Grantor Trust Informative Income Tax Return

ADVERTISEMENT

Form 480.80(F) Rev. 05.13

20__

20__

COMMONWEALTH OF PUERTO RICO

Reviewer:

Liquidator:

Serial Number

DEPARTMENT OF THE TREASURY

Field audited by:

REVOCABLE TRUST OR GRANTOR TRUST

INFORMATIVE INCOME TAX RETURN

AMENDED RETURN

Date ___/ ___/ ___

CALENDAR YEAR 20___ OR TAXABLE YEAR BEGINNING ON

R

M N

Receipt Stamp

_________________________, 20______ AND ENDING ON __________________________, 20______

Employer Identification Number

Trust's Name

Industrial Code

Municipal Code

Postal Address

Telephone Number - Extension

Municipality

Country

Zip Code

Date created

Location of Principal Industry or Business (Number, Street, City)

Day_____ Month_____ Year _____

Place created

Fill in the corresponding oval, if applicable:

First Return (Submit copy of the trust deed)

Last Return

Total Forms 480.60 F

1.

Type of trust:

Revocable Trust

Merchant's Registration Number

Grantor Trust

Change of address: Yes

No

2.

Indicate the accounting method used:

3.

Indicate the name and address of the Trustee: _________________________________

Cash

Accrual

_______________________________________________________________________

Other _______________________________________________

________________________________________________________________________

DISTRIBUTABLE SHARE PER CATEGORY

Amount

Tax Withheld

1.

Income (or losses)

00

A)

00

Total distributions from qualified retirement plans (Schedule D Individual, Part IV, line 27) ...........................

(1A)

00

B)

00

Gain (or loss) from sale or exchange of short-term capital assets (Schedule D Individual, Part I, line 10) ...........

(1B)

00

C)

00

Gain (or loss) from sale or exchange of long-term capital assets (Schedule D Individual, Part II, line 21) .......

(1C)

D)

Gain (or loss) from sale or exchange of long-term capital assets realized under special legislation

00

00

(Schedule D Individual, Part III, line 22) ............................................................................................

(1D)

00

00

E)

Interest on deposits from financial institutions (Schedule F Individual, Part I, line 4, Columns B through E) ........

(1E)

00

00

F)

Other interest (Schedule F Individual, Part I, line 4, Columns A and F) ...................................................

(1F)

00

00

G)

Eligible distributions of dividends from corporations (Schedule F Individual, Part II, line 3, Column A) .........

(1G)

00

00

H)

Other dividends (Schedule F Individual, Part II, line 3, Column B) ........................................................

(1H)

00

00

I)

Miscellaneous income (Schedule F Individual, Part VII, line 6) .............................................................

(1I)

00

00

J)

Gain (or loss) from industry or business (Schedule K Individual, Part II, line 10) ......................................

(1J)

00

00

K)

Gain (or loss) from farming (Schedule L Individual, Part II, line 12) ........................................................

(1K)

00

00

L)

Gain (or loss) from professions and commissions (Schedule M Individual, Part II, line 6) ..........................

(1L)

00

00

M)

Gain (or loss) from rental business (Schedule N Individual, Part II, line 7) ..............................................

(1M)

00

00

N)

Dividends from Capital Investment or Tourism Fund (Submit Schedule Q1) .............................................

(1N)

00

00

O)

Net long-term capital gain on Investment Funds (Submit Schedule Q1) ...................................................

(1O)

P)

Distributable share on profits from partnerships, special partnerships and corporations of individuals (See

00

00

instructions) ...................................................................................................................................

(1P)

00

Q)

Exempt income (Schedule IE Individual) ...........................................................................................

(1Q)

R)

00

Exempt income subject to alternate basic tax (Schedule IE Individual) ..................................................

(1R)

S)

00

Adjustment for purposes of the alternate basic tax ......................................................................................

(1S)

2.

Deductions:

A)

00

Charitable contributions (Part IV) .......................................................................................................

(2A)

B)

00

Medical expenses incurred and paid for the benefit of the grantor or beneficiary (Part V) .................................

(2B)

C)

00

Home mortgage interest on residential property located in Puerto Rico (Part VI) ..............................................

(2C)

D)

00

Casualty loss on real property that constitutes the grantor’s principal residence (Part VII) ...............................

(2D)

E)

00

Loss of personal property as a result of certain casualties (Part VIII) ......................................................

(2E)

CREDITS

1)

Credit for investment in Capital Investment Fund, Tourism, other funds or direct investment ...............................................................

00

(1)

2)

Credit attributable to losses in the Capital Investment Fund or other funds .......................................................................................

00

(2)

3)

Credit for tax withheld at source from Industrial Development dividends (Act No. 8 of 1987) ..............................................................

00

(3)

4)

Credit for the purchase of tax credits (Submit detail) .....................................................................................................................

00

(4)

5)

Credit for the payment of additional duties on luxury vehicles under Act 42-2005 (See instructions) .....................................................

00

(5)

6)

Returning Heroes and Wounded Warriors work opportunity tax credit (Schedule B4 Flow-through Entity) .............................................

00

(6)

7)

Other credits not included on the preceding lines (Submit detail) (See instructions) ...........................................................................

00

(7)

OATH

I hereby declare under penalty of perjury that this return (including all schedules and other documents attached to it) has been examined by me and it is true,

correct and complete. The declaration of the person that prepares this return (except the taxpayer) is based on the information available, and this information

has been verified.

Fiduciary's or Agent's Name (Print)

Fiduciary's or Agent's Signature

Date

04

x

Specialist's Name (Print)

Name of the Firm or Business

Specialist's Signature

Date

Self - employed Specialist

Registration Number

(fill in here)

NOTE TO TAXPAYER: Indicate if you made payments for the preparation of your return:

Yes

No. If you answered "Yes", require the Specialist's signature and registration number.

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8