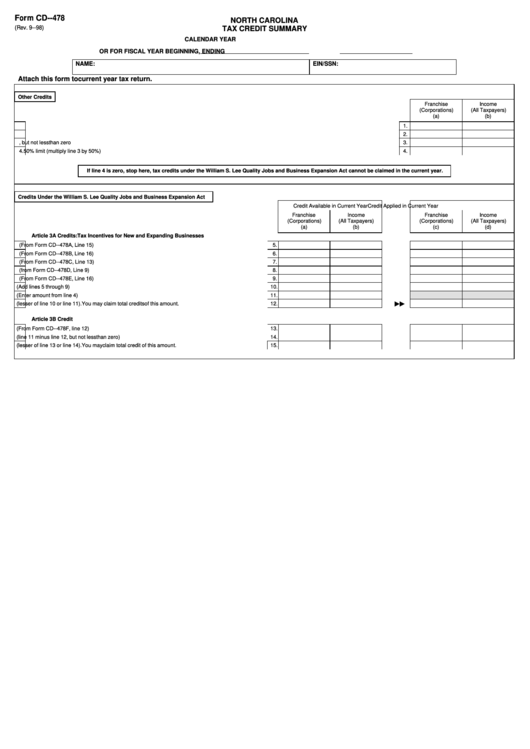

Form CD--478

NORTH CAROLINA

TAX CREDIT SUMMARY

(Rev. 9--98)

CALENDAR YEAR

OR FOR FISCAL YEAR BEGINNING

, ENDING

NAME:

EIN/SSN:

Attach this form to current year tax return.

Other Credits

Franchise

Income

(Corporations)

(All Taxpayers)

(a)

(b)

1.

Tax Liability

1.

2.

Other Credits

2.

3.

Line 1 minus line 2, but not less than zero

3.

4.

50% limit (multiply line 3 by 50%)

4.

If line 4 is zero, stop here, tax credits under the William S. Lee Quality Jobs and Business Expansion Act cannot be claimed in the current year.

Credits Under the William S. Lee Quality Jobs and Business Expansion Act

Credit Available in Current Year

Credit Applied in Current Year

Franchise

Income

Franchise

Income

(Corporations)

(All Taxpayers)

(Corporations)

(All Taxpayers)

(a)

(b)

(c)

(d)

Article 3A Credits: Tax Incentives for New and Expanding Businesses

5.

Credit for Creating Jobs (From Form CD--478A, Line 15)

5.

6.

Credit for Investing in Machinery and Equipment (From Form CD--478B, Line 16)

6.

7.

Credit for Research and Development (From Form CD--478C, Line 13)

7.

8.

Credit for Worker Training (from Form CD--478D, Line 9)

8.

9.

Credit for Investing in Central Administrative Office Property (From Form CD--478E, Line 16)

9.

10.

Total Article 3A Credits (Add lines 5 through 9)

10.

11.

Limitation (Enter amount from line 4)

11.

12.

Article 3A Credits (lesser of line 10 or line 11). You may claim total credits of this amount.

12.

" "

Article 3B Credit

13.

Business Tax Credit (From Form CD--478F, line 12)

13.

14.

Limitation (line 11 minus line 12, but not less than zero)

14.

15.

Article 3B Credit (lesser of line 13 or line 14). You may claim total credit of this amount.

15.

1

1