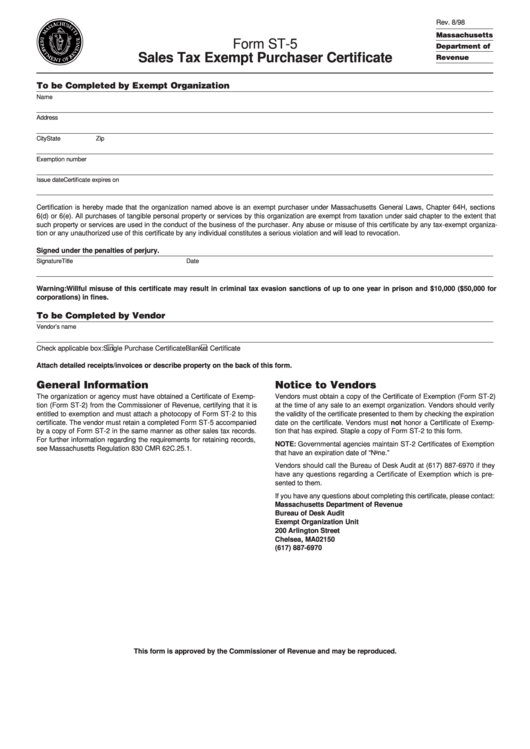

Form St-5 - Sales Tax Exempt Purchaser Certificate - Massachusetts Department Of Revenue

ADVERTISEMENT

Rev. 8/98

Massachusetts

Form ST-5

Department of

Sales Tax Exempt Purchaser Certificate

Revenue

To be Completed by Exempt Organization

Name

Address

City

State

Zip

Exemption number

Issue date

Certificate expires on

Certification is hereby made that the organization named above is an exempt purchaser under Massachusetts General Laws, Chapter 64H, sections

6(d) or 6(e). All purchases of tangible personal property or services by this organization are exempt from taxation under said chapter to the extent that

such property or services are used in the conduct of the business of the purchaser. Any abuse or misuse of this certificate by any tax-exempt organiza-

tion or any unauthorized use of this certificate by any individual constitutes a serious violation and will lead to revocation.

Signed under the penalties of perjury.

Signature

Title

Date

Warning: Willful misuse of this certificate may result in criminal tax evasion sanctions of up to one year in prison and $10,000 ($50,000 for

corporations) in fines.

To be Completed by Vendor

Vendor’s name

Check applicable box:

Single Purchase Certificate

Blanket Certificate

Attach detailed receipts/invoices or describe property on the back of this form.

General Information

Notice to Vendors

The organization or agency must have obtained a Certificate of Exemp-

Vendors must obtain a copy of the Certificate of Exemption (Form ST-2)

tion (Form ST-2) from the Commissioner of Revenue, certifying that it is

at the time of any sale to an exempt organization. Vendors should verify

entitled to exemption and must attach a photocopy of Form ST-2 to this

the validity of the certificate presented to them by checking the expiration

certificate. The vendor must retain a completed Form ST-5 accompanied

date on the certificate. Vendors must not honor a Certificate of Exemp-

by a copy of Form ST-2 in the same manner as other sales tax records.

tion that has expired. Staple a copy of Form ST-2 to this form.

For further information regarding the requirements for retaining records,

NOTE: Governmental agencies maintain ST-2 Certificates of Exemption

see Massachusetts Regulation 830 CMR 62C.25.1.

that have an expiration date of “None.”

Vendors should call the Bureau of Desk Audit at (617) 887-6970 if they

have any questions regarding a Certificate of Exemption which is pre-

sented to them.

If you have any questions about completing this certificate, please contact:

Massachusetts Department of Revenue

Bureau of Desk Audit

Exempt Organization Unit

200 Arlington Street

Chelsea, MA 02150

(617) 887-6970

This form is approved by the Commissioner of Revenue and may be reproduced.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2