Reset Form

Print Form

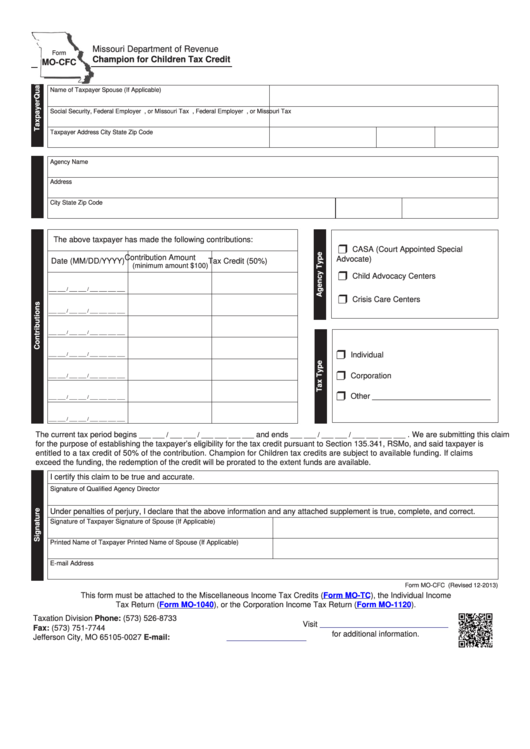

Missouri Department of Revenue

Form

Champion for Children Tax Credit

MO-CFC

Name of Taxpayer

Spouse (If Applicable)

Social Security, Federal Employer I.D., or Missouri Tax I.D. Number

Spouse Social Security, Federal Employer I.D., or Missouri Tax I.D. Number

Taxpayer Address

City

State

Zip Code

Agency Name

Address

City

State

Zip Code

The above taxpayer has made the following contributions:

r

CASA (Court Appointed Special

Contribution Amount

Advocate)

Date (MM/DD/YYYY)

Tax Credit (50%)

(minimum amount $100)

r

Child Advocacy Centers

___ ___ / ___ ___ / ___ ___ ___ ___

r

Crisis Care Centers

___ ___ / ___ ___ / ___ ___ ___ ___

___ ___ / ___ ___ / ___ ___ ___ ___

r

Individual

___ ___ / ___ ___ / ___ ___ ___ ___

r

Corporation

___ ___ / ___ ___ / ___ ___ ___ ___

r

Other ___________________________

___ ___ / ___ ___ / ___ ___ ___ ___

___ ___ / ___ ___ / ___ ___ ___ ___

The current tax period begins

and ends

. We are submitting this claim

___ ___ / ___ ___ / ___ ___ ___ ___

___ ___ / ___ ___ / ___ ___ ___ ___

for the purpose of establishing the taxpayer’s eligibility for the tax credit pursuant to Section 135.341, RSMo, and said taxpayer is

entitled to a tax credit of 50% of the contribution. Champion for Children tax credits are subject to available funding. If claims

exceed the funding, the redemption of the credit will be prorated to the extent funds are available.

I certify this claim to be true and accurate.

Signature of Qualified Agency Director

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct.

Signature of Taxpayer

Signature of Spouse (If Applicable)

Printed Name of Taxpayer

Printed Name of Spouse (If Applicable)

E-mail Address

Form MO-CFC (Revised 12-2013)

This form must be attached to the Miscellaneous Income Tax Credits

(Form

MO-TC), the Individual Income

Tax Return

(Form

MO-1040), or the Corporation Income Tax Return

(Form

MO-1120).

Taxation Division

Phone: (573) 526-8733

Visit

P.O. Box 27

Fax: (573) 751-7744

for additional information.

Jefferson City, MO 65105-0027

E-mail:

income@dor.mo.gov

1

1