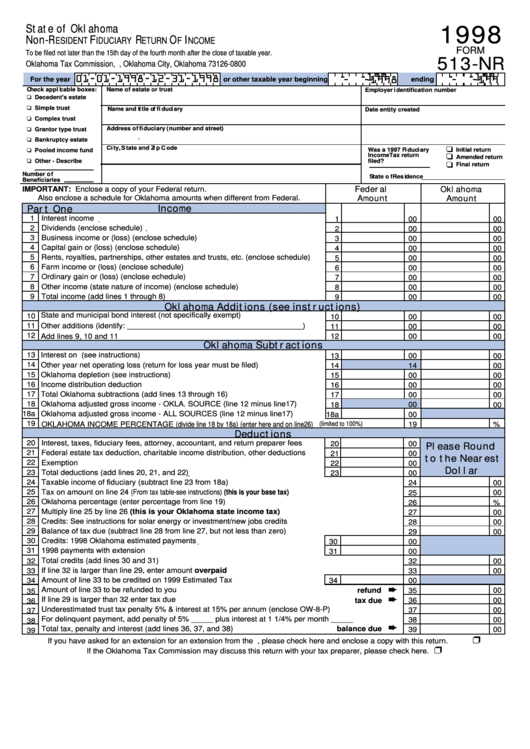

State of Oklahoma

1998

Non-R

F

R

O

I

ESIDENT

IDUCIARY

ETURN

F

NCOME

FORM

To be filed not later than the 15th day of the fourth month after the close of taxable year.

513-NR

Oklahoma Tax Commission, P.O. Box 26800, Oklahoma City, Oklahoma 73126-0800

-

-199

-

-199

01-01-1998-12-31-1998

-

-1998

-

-199

For the year

or other taxable year beginning

ending

Check applicable boxes:

Name of estate or trust

Employer identification number

Decedent's estate

Simple trust

Name and title of fiduciary

Date entity created

Complex trust

Address of fiduciary (number and street)

Grantor type trust

Bankruptcy estate

City, State and Zip Code

Was a 1997 Fiduciary

Initial return

Pooled income fund

IncomeTax return

Amended return

Other - Describe

filed?

Final return

Number of

State of Residence

Beneficiaries

IMPORTANT: Enclose a copy of your Federal return.

Federal

Oklahoma

Also enclose a schedule for Oklahoma amounts when different from Federal.

Amount

Amount

Income

Part One

1

Interest income

1

00

00

.....................................................................................................

2

Dividends (enclose schedule)

...............................................................................

2

00

00

3

Business income or (loss) (enclose schedule)

.....................................................

3

00

00

4

Capital gain or (loss) (enclose schedule)

4

00

00

.............................................................

5

Rents, royalties, partnerships, other estates and trusts, etc. (enclose schedule)

5

00

00

6

Farm income or (loss) (enclose schedule)

...........................................................

6

00

00

7

Ordinary gain or (loss) (enclose echedule)

7

00

00

..........................................................

8

Other income (state nature of income) (enclose schedule)

.................................

8

00

00

9

Total income (add lines 1 through 8)

...................................................................

9

00

00

Oklahoma Additions (see instructions)

State and municipal bond interest (not specifically exempt)

10

.................................

10

00

00

11

Other additions (identify: ________________________________________)

......

11

00

00

12

Add lines 9, 10 and 11

...........................................................................................

12

00

00

Oklahoma Subtractions

13

Interest on U.S. Obligations (see instructions)

.....................................................

13

00

00

14

Other year net operating loss (return for loss year must be filed)

.........................

14

14

00

15

Oklahoma depletion (see instructions)

.................................................................

15

00

00

16

Income distribution deduction

...............................................................................

16

00

00

17

Total Oklahoma subtractions (add lines 13 through 16)

17

00

00

.......................................

18

Oklahoma adjusted gross income - OKLA. SOURCE (line 12 minus line17)

.......

18

00

00

18a

Oklahoma adjusted gross income - ALL SOURCES (line 12 minus line17)

.........

18a

00

19

(limited to 100%)

OKLAHOMA INCOME PERCENTAGE (divide line 18 by 18a) (enter here and on line26)

...............

19

%

Deductions

20

Interest, taxes, fiduciary fees, attorney, accountant, and return preparer fees

20

00

Please Round

21

Federal estate tax deduction, charitable income distribution, other deductions

21

00

to the Nearest

22

Exemption

22

00

..............................................................................................................

Dollar

23

Total deductions (add lines 20, 21, and 22)

23

00

...........................................................

24

Taxable income of fiduciary (subtract line 23 from 18a)

24

00

............................................................................

25

Tax on amount on line 24 (From tax table-see instructions) (this is your base tax)

00

25

................................................

26

Oklahoma percentage (enter percentage from line 19)

..............................................................................

26

%

27

Multiply line 25 by line 26 (this is your Oklahoma state income tax)

27

00

.....................................................

28

Credits: See instructions for solar energy or investment/new jobs credits

00

..................................................

28

29

Balance of tax due (subtract line 28 from line 27, but not less than zero)

.................................................

29

00

30

Credits: 1998 Oklahoma estimated payments

30

00

.......................................................

31

1998 payments with extension

..............................................................................

31

00

Total credits (add lines 30 and 31)

32

..............................................................................................................

32

00

If line 32 is larger than line 29, enter amount overpaid

33

.............................................................................

33

00

Amount of line 33 to be credited on 1999 Estimated Tax

34

......................................

34

00

Amount of line 33 to be refunded to you

................................................................................

refund

35

00

35

If line 29 is larger than 32 enter tax due

..............................................................................

tax due

36

00

36

Underestimated trust tax penalty 5% & interest at 15% per annum (enclose OW-8-P)

.............................

37

00

37

For delinquent payment, add penalty of 5% _____ plus interest at 1 1/4% per month _____

...................

38

00

38

Total tax, penalty and interest (add lines 36, 37, and 38)

balance due

39

00

39

............................................

If you have asked for an extension for an extension from the I.R.S., please check here and enclose a copy with this return.

If the Oklahoma Tax Commission may discuss this return with your tax preparer, please check here.

1

1 2

2