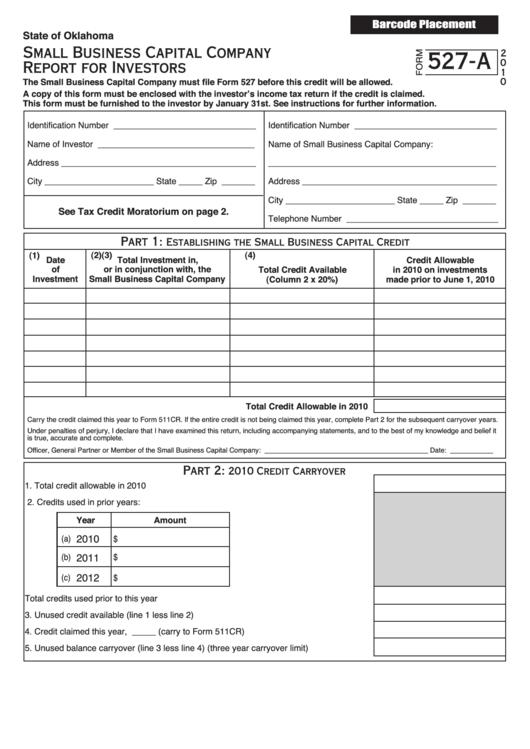

Form 527-A - Small Business Capital Company Report For Investors - 2010

ADVERTISEMENT

Barcode Placement

State of Oklahoma

Small Business Capital Company

527-A

2

0

Report for Investors

1

The Small Business Capital Company must file Form 527 before this credit will be allowed.

0

A copy of this form must be enclosed with the investor’s income tax return if the credit is claimed.

This form must be furnished to the investor by January 31st. See instructions for further information.

Identification Number ______________________________

Identification Number ______________________________

Name of Investor _________________________________

Name of Small Business Capital Company:

Address _________________________________________

________________________________________________

City _______________________ State _____ Zip _______

Address _________________________________________

City _______________________ State _____ Zip _______

See Tax Credit Moratorium on page 2.

Telephone Number ________________________________

Part 1:

Establishing the Small Business Capital Credit

(4)

(1)

(2)

(3)

Date

Total Investment in,

Credit Allowable

of

or in conjunction with, the

Total Credit Available

in 2010 on investments

Investment

Small Business Capital Company

(Column 2 x 20%)

made prior to June 1, 2010

Total Credit Allowable in 2010

Carry the credit claimed this year to Form 511CR. If the entire credit is not being claimed this year, complete Part 2 for the subsequent carryover years.

Under penalties of perjury, I declare that I have examined this return, including accompanying statements, and to the best of my knowledge and belief it

is true, accurate and complete.

Officer, General Partner or Member of the Small Business Capital Company: __________________________________________ Date: ___________

Part 2:

2010 Credit Carryover

1.

Total credit allowable in 2010 ............................................................................... 1.

2.

Credits used in prior years:

Year

Amount

2010

(a)

$

(b)

2011

$

(c)

2012

$

Total credits used prior to this year . ......................................................... 2.

3.

Unused credit available (line 1 less line 2) ........................................................... 3.

4.

Credit claimed this year, _____ (carry to Form 511CR) ...................................... 4.

5.

Unused balance carryover (line 3 less line 4) (three year carryover limit) . ........... 5.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3