Form Amp - Application For A Materialman To Remit Sales Tax Under The "Pay When Paid" Method - 2016

ADVERTISEMENT

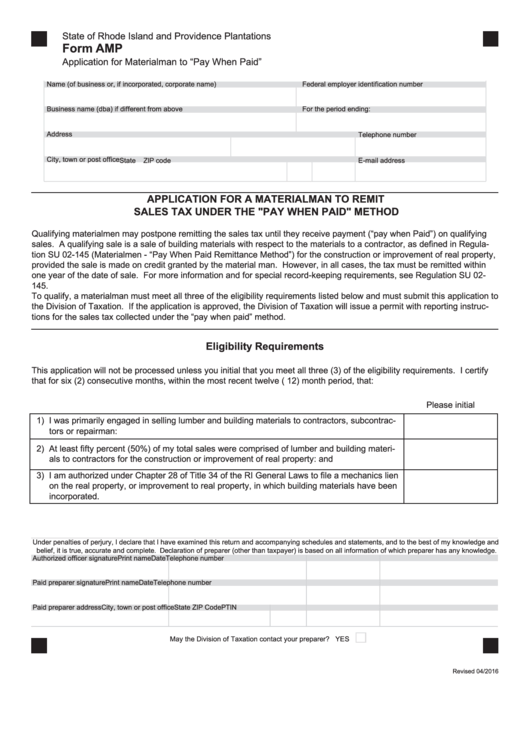

State of Rhode Island and Providence Plantations

Form AMP

Application for Materialman to “Pay When Paid”

Name (of business or, if incorporated, corporate name)

Federal employer identification number

Business name (dba) if different from above

For the period ending:

Address

Telephone number

City, town or post office

State

ZIP code

E-mail address

APPLICATION FOR A MATERIALMAN TO REMIT

SALES TAX UNDER THE "PAY WHEN PAID" METHOD

Qualifying materialmen may postpone remitting the sales tax until they receive payment (“pay when Paid”) on qualifying

sales. A qualifying sale is a sale of building materials with respect to the materials to a contractor, as defined in Regula-

tion SU 02-145 (Materialmen - “Pay When Paid Remittance Method”) for the construction or improvement of real property,

provided the sale is made on credit granted by the material man. However, in all cases, the tax must be remitted within

one year of the date of sale. For more information and for special record-keeping requirements, see Regulation SU 02-

145.

To qualify, a materialman must meet all three of the eligibility requirements listed below and must submit this application to

the Division of Taxation. If the application is approved, the Division of Taxation will issue a permit with reporting instruc-

tions for the sales tax collected under the “pay when paid” method.

Eligibility Requirements

This application will not be processed unless you initial that you meet all three (3) of the eligibility requirements. I certify

that for six (2) consecutive months, within the most recent twelve ( 12) month period, that:

Please initial

1) I was primarily engaged in selling lumber and building materials to contractors, subcontrac-

tors or repairman:

2) At least fifty percent (50%) of my total sales were comprised of lumber and building materi-

als to contractors for the construction or improvement of real property: and

3) I am authorized under Chapter 28 of Title 34 of the RI General Laws to file a mechanics lien

on the real property, or improvement to real property, in which building materials have been

incorporated.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, accurate and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Authorized officer signature

Print name

Date

Telephone number

Paid preparer signature

Print name

Date

Telephone number

Paid preparer address

City, town or post office

State

ZIP Code

PTIN

May the Division of Taxation contact your preparer? YES

Revised 04/2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1