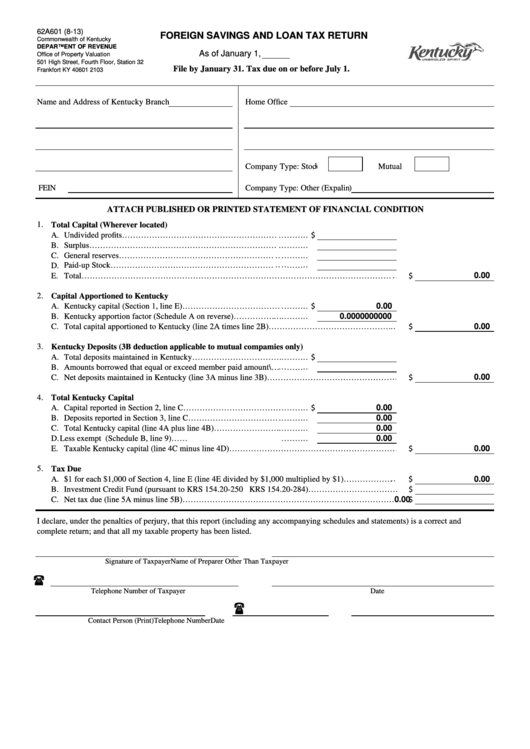

Form 62a601 (8-13) - Foreign Savings And Loan Tax Return

ADVERTISEMENT

62A601 (8-13)

FOREIGN SAVINGS AND LOAN TAX RETURN

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

As of January 1,

Office of Property Valuation

501 High Street, Fourth Floor, Station 32

File by January 31. Tax due on or before July 1.

Frankfort KY 40601 2103

Name and Address of Kentucky Branch

Home Office

Company Type: Stock

Mutual

FEIN

Company Type: Other (Expalin)

ATTACH PUBLISHED OR PRINTED STATEMENT OF FINANCIAL CONDITION

1.

Total Capital (Wherever located)

$

A.

Undivided profits……………………………………………………

…………

B.

Surplus………………………………………………………………

…………

C.

General reserves……………………………………………………

…………

Paid-up Stock………………………………………………………

…………

D.

$

0.00

E.

Total………………………………………………………………………………………………………

2.

Capital Apportioned to Kentucky

$

0.00

A.

Kentucky capital (Section 1, line E)……………………………… …………

0.0000000000

B.

Kentucky apportion factor (Schedule A on reverse)……………… …………

$

0.00

C.

Total capital apportioned to Kentucky (line 2A times line 2B)…………………………………………

3. Kentucky Deposits (3B deduction applicable to mutual compamies only)

$

A.

Total deposits maintained in Kentucky……………………………

…………

B.

Amounts borrowed that equal or exceed member paid amount\……

…………

$

0.00

C.

Net deposits maintained in Kentucky (line 3A minus line 3B)…………………………………………

4.

Total Kentucky Capital

$

0.00

A.

Capital reported in Section 2, line C………………………………

…………

0.00

B.

Deposits reported in Section 3, line C………………………………

…………

0.00

C.

Total Kentucky capital (line 4A plus line 4B)………………………

… ………

D.

Less exempt U.S. government securities (Schedule B, line 9)…… …………

0.00

$

0.00

E.

Taxable Kentucky capital (line 4C minus line 4D)………………………………………………………

5. Tax Due

$

0.00

A.

$1 for each $1,000 of Section 4, line E (line 4E divided by $1,000 multiplied by $1)…………………

$

B.

Investment Credit Fund (pursuant to KRS 154.20-250 KRS 154.20-284)……………………………

$

0.00

C.

Net tax due (line 5A minus line 5B)……………………………………………………………………

I declare, under the penalties of perjury, that this report (including any accompanying schedules and statements) is a correct and

complete return; and that all my taxable property has been listed.

Signature of Taxpayer

Name of Preparer Other Than Taxpayer

Telephone Number of Taxpayer

Date

Contact Person (Print)

Telephone Number

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3