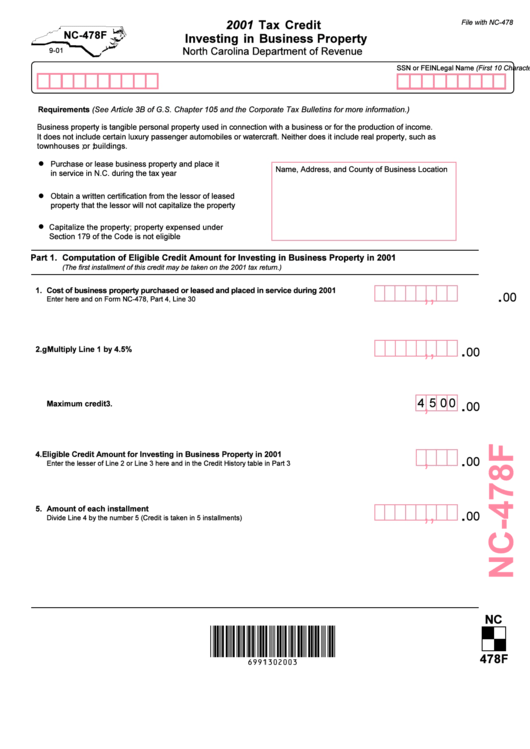

Form Nc-478f - Tax Credit Investing In Business Property - North Carolina Department Of Revenue - 2001

ADVERTISEMENT

2001 Tax Credit

File with NC-478

NC-478F

Investing in Business Property

North Carolina Department of Revenue

9-01

Legal Name (First 10 Characters)

SSN or FEIN

Requirements (See Article 3B of G.S. Chapter 105 and the Corporate Tax Bulletins for more information.)

Business property is tangible personal property used in connection with a business or for the production of income.

It does not include certain luxury passenger automobiles or watercraft. Neither does it include real property, such as

townhouses or buildings.

Purchase or lease business property and place it

Name, Address, and County of Business Location

in service in N.C. during the tax year

Obtain a written certification from the lessor of leased

property that the lessor will not capitalize the property

Capitalize the property; property expensed under

Section 179 of the Code is not eligible

Part 1.

Computation of Eligible Credit Amount for Investing in Business Property in 2001

(The first installment of this credit may be taken on the 2001 tax return.)

,

,

.

1.

Cost of business property purchased or leased and placed in service during 2001

00

Enter here and on Form NC-478, Part 4, Line 30

,

,

.

2. Multiply Line 1 by 4.5%

00

,

.

4

5 0

0

3.

Maximum credit

00

,

.

4. Eligible Credit Amount for Investing in Business Property in 2001

00

Enter the lesser of Line 2 or Line 3 here and in the Credit History table in Part 3

,

,

.

5.

Amount of each installment

00

Divide Line 4 by the number 5 (Credit is taken in 5 installments)

NC

478F

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2