Form D1 - Declaration Of Estimated Tax - 2002

ADVERTISEMENT

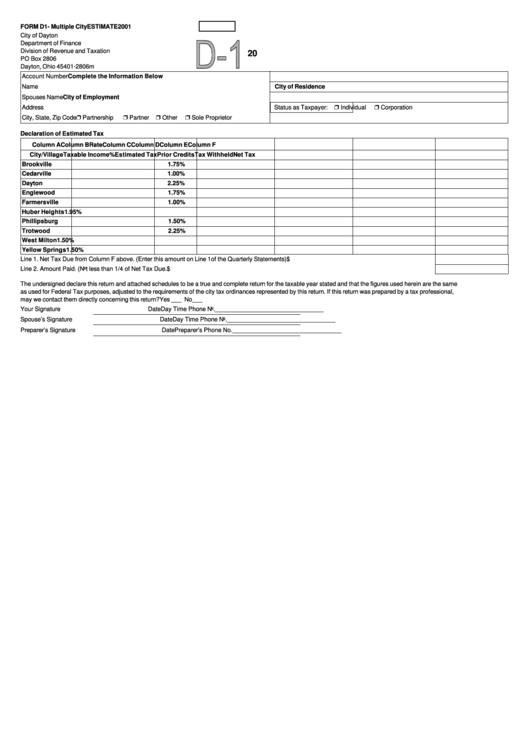

FORM D1- Multiple City

ESTIMATE

2001

City of Dayton

Department of Finance

Division of Revenue and Taxation

20

PO Box 2806

Dayton, Ohio 45401-2806

m

Account Number

Complete the Information Below

Name

City of Residence

Spouses Name

City of Employment

Address

Status as Taxpayer:

Individual

Corporation

City, State, Zip Code

Partnership

Partner

Other

Sole Proprietor

Declaration of Estimated Tax

Column A

Column B

Rate

Column C

Column D

Column E

Column F

City/Village

Taxable Income

%

Estimated Tax

Prior Credits

Tax Withheld

Net Tax

Brookville

1.75%

Cedarville

1.00%

Dayton

2.25%

Englewood

1.75%

Farmersville

1.00%

Huber Heights

1.95%

Phillipsburg

1.50%

Trotwood

2.25%

West Milton

1.50%

Yellow Springs

1.50%

Line 1. Net Tax Due from Column F above. (Enter this amount on Line 1of the Quarterly Statements)

$

Line 2. Amount Paid. (Not less than 1/4 of Net Tax Due.

$

The undersigned declare this return and attached schedules to be a true and complete return for the taxable year stated and that the figures used herein are the same

as used for Federal Tax purposes, adjusted to the requirements of the city tax ordinances represented by this return. If this return was prepared by a tax professional,

may we contact them directly concerning this return?

Yes ___ No___

Your Signature

Date

Day Time Phone No. ________________________________

Spouse’s Signature

Date

Day Time Phone No. ________________________________

Preparer’s Signature

Date

Preparer’s Phone No. ________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1