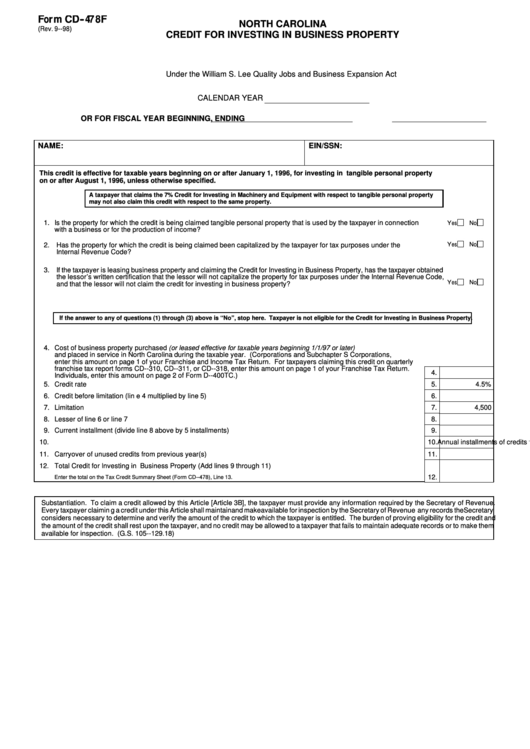

Form CD--478F

NORTH CAROLINA

(Rev. 9--98)

CREDIT FOR INVESTING IN BUSINESS PROPERTY

Under the William S. Lee Quality Jobs and Business Expansion Act

CALENDAR YEAR

OR FOR FISCAL YEAR BEGINNING

, ENDING

NAME:

EIN/SSN:

This credit is effective for taxable years beginning on or after January 1, 1996, for investing in tangible personal property

on or after August 1, 1996, unless otherwise specified.

A taxpayer that claims the 7% Credit for Investing in Machinery and Equipment with respect to tangible personal property

may not also claim this credit with respect to the same property.

1.

Is the property for which the credit is being claimed tangible personal property that is used by the taxpayer in connection

Yes

No

with a business or for the production of income?

2.

Has the property for which the credit is being claimed been capitalized by the taxpayer for tax purposes under the

Yes

No

Internal Revenue Code?

3.

If the taxpayer is leasing business property and claiming the Credit for Investing in Business Property, has the taxpayer obtained

the lessor’ s written certification that the lessor will not capitalize the property for tax purposes under the Internal Revenue Code,

Yes

No

and that the lessor will not claim the credit for investing in business property?

If the answer to any of questions (1) through (3) above is ‘ ‘ No”, stop here. Taxpayer is not eligible for the Credit for Investing in Business Property.

4.

Cost of business property purchased (or leased effective for taxable years beginning 1/1/97 or later)

and placed in service in North Carolina during the taxable year. (Corporations and Subchapter S Corporations,

enter this amount on page 1 of your Franchise and Income Tax Return. For taxpayers claiming this credit on quarterly

franchise tax report forms CD--310, CD--311, or CD--318, enter this amount on page 1 of your Franchise Tax Return.

4.

Individuals, enter this amount on page 2 of Form D--400TC.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

Credit rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

4.5%

6.

Credit before limitation (line 4 multiplied by line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

7.

Limitation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

4,500

8.

Lesser of line 6 or line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

9.

Current installment (divide line 8 above by 5 installments) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

10.

Annual installments of credits from preceding year(s), net of expired credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

11.

Carryover of unused credits from previous year(s) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

12.

Total Credit for Investing in Business Property (Add lines 9 through 11)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12.

Enter the total on the Tax Credit Summary Sheet (Form CD--478), Line 13.

Substantiation. To claim a credit allowed by this Article [Article 3B], the taxpayer must provide any information required by the Secretary of Revenue.

Every taxpayer claiming a credit under this Article shall maintain and make available for inspection by the Secretary of Revenue any records the Secretary

considers necessary to determine and verify the amount of the credit to which the taxpayer is entitled. The burden of proving eligibility for the credit and

the amount of the credit shall rest upon the taxpayer, and no credit may be allowed to a taxpayer that fails to maintain adequate records or to make them

available for inspection. (G.S. 105--129.18)

1

1