Form Ia 137 - Ethanol Promotion Tax Credit - 2011

ADVERTISEMENT

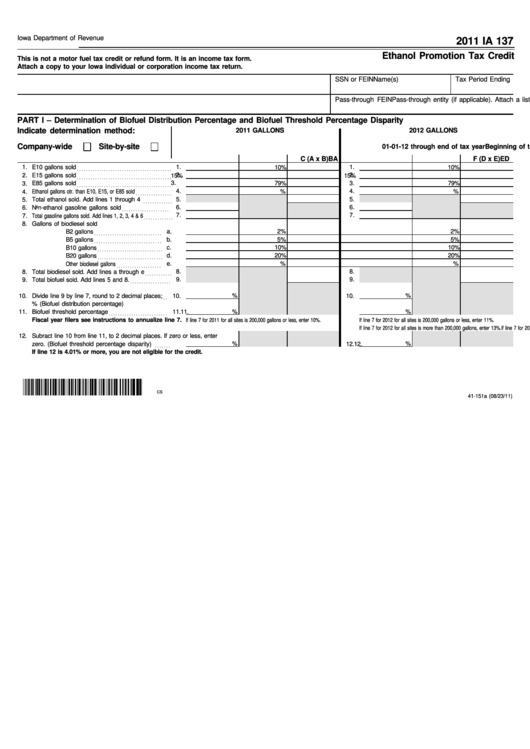

Iowa Department of Revenue

2011 IA 137

Ethanol Promotion Tax Credit

This is not a motor fuel tax credit or refund form. It is an income tax form.

Attach a copy to your Iowa individual or corporation income tax return.

Name(s)

SSN or FEIN

Tax Period Ending

Pass-through entity (if applicable). Attach a list if multiple pass-through entities.

Pass-through FEIN

PART I – Determination of Biofuel Distribution Percentage and Biofuel Threshold Percentage Disparity

Indicate determination method:

2011 GALLONS

2012 GALLONS

Company-wide

Site-by-site

Beginning of tax year through 12-31-11

01-01-12 through end of tax year

A

B

C (A x B)

D

E

F (D x E)

1.

E10 gallons sold

1.

1.

10%

10%

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

E15 gallons sold

2.

15%

2.

15%

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

E85 gallons sold

3.

79%

3.

79%

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Ethanol gallons otr. than E10, E15, or E85 sold

4.

4.

%

4.

%

. . . . . . . . . . . . . . . .

5.

5.

5.

Total ethanol sold. Add lines 1 through 4

. . . . . . . . . . . . .

Non-ethanol gasoline gallons sold

6.

6.

6.

. . . . . . . . . . . . . . . . . . . . .

7.

Total gasoline gallons sold. Add lines 1, 2, 3, 4 & 6

7.

7.

. . . . . . . . . . . . .

8.

Gallons of biodiesel sold

a.

2%

2%

B2 gallons

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b.

5%

5%

B5 gallons

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

B10 gallons

c.

10%

10%

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d.

20%

20%

B20 gallons

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other biodiesel gallons

e.

%

%

. . . . . . . . . . . . . . . . . . . .

8.

8.

8.

Total biodiesel sold. Add lines a through e

. . . . . . . . . . . .

9.

9.

9.

Total biofuel sold. Add lines 5 and 8.

. . . . . . . . . . . . . . . . . .

10.

Divide line 9 by line 7, round to 2 decimal places;

10.

%

10.

%

. .

i.e. 12.05% (Biofuel distribution percentage)

%

%

11.

Biofuel threshold percentage

11.

11.

. . . . . . . . . . . . . . . . . . . . . . . . . .

Fiscal year filers see instructions to annualize line 7.

If line 7 for 2011 for all sites is 200,000 gallons or less, enter 10%.

If line 7 for 2012 for all sites is 200,000 gallons or less, enter 11%.

If line 7 for 2011 for all sites is more than 200,000 gallons, enter 12%.

If line 7 for 2012 for all sites is more than 200,000 gallons, enter 13%.

12.

Subract line 10 from line 11, to 2 decimal places. If zero or less, enter

zero. (Biofuel threshold percentage disparity)

12.

%

12.

%

. . . . . . .

If line 12 is 4.01% or more, you are not eligible for the credit.

CS

41-151a (08/23/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2