Form Pt-01(A) - Annual Insurance Premium Tax Return - 2002 Page 3

ADVERTISEMENT

Nevada Department of Taxation

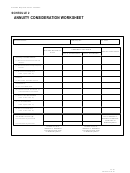

SCHEDULE 2

ANNUITY CONSIDERATION WORKSHEET

Account Name:

Company ID:

Tax Year:

PREMIUM TAX OPTION

Qualified Retirement

Total Considerations

Plans

Tax on Considerations

Tax on Annuitization

Annuity Considerations:

(1) Received as Direct Premium

Written:

(2) Received as Annuity Deposit

Funds:

(3) Gross Considerations

(Line 1 plus Line 2):

Deduct:

(4) Returned Considerations:

Surrenders:

(5) Amount Remitted:

(6) Less Amounts in Excess of

Considerations Received:

(7) Deductible Surrenders

(Line 5 less Line 6):

(8) Total Deduction

(Line 4 plus Line 7):

(9) Net Considerations

(Line 3 less Line 8):

Include this amount in

Tax Status of Line (9):

Line 1, Schedule 1,

Non-Taxable by Domicile

Statement of Premium

Tax & Fees on

Retaliatory Basis

Non-Taxable by Nevada

Include in Line 4,

Include in Line 5,

Schedule 1, Statement

Schedule 1, Statement

of Premium Tax & Fees

of Premium Tax & Fees

on Retaliatory Basis

on Retaliatory Basis

PT-02

Revised 12-23-02

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4