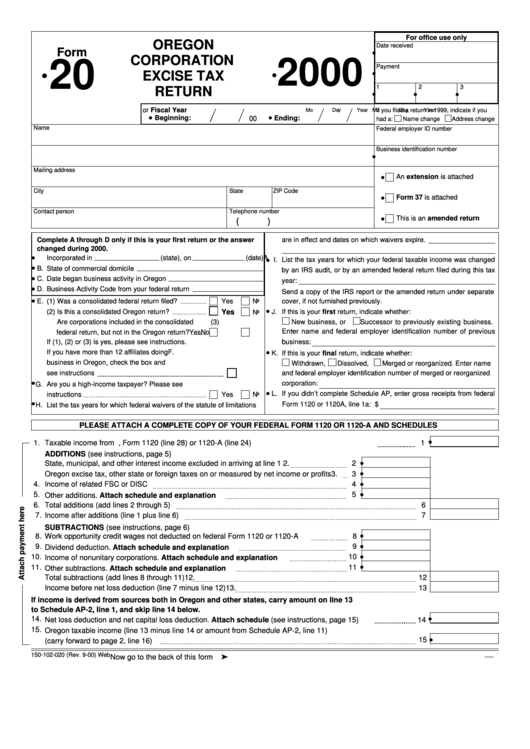

Form 20 - Oregon Corporation Excise Tax Return - 2000

ADVERTISEMENT

For office use only

OREGON

Date received

Form

•

CORPORATION

2000

20

Payment

•

•

•

EXCISE TAX

1

2

3

RETURN

•

•

•

or Fiscal Year

Mo

Day

Year

Mo

Day

Year

If you filed a return in 1999, indicate if you

•

•

Beginning:

Ending:

00

had a:

Name change

Address change

Name

Federal employer ID number

Business identification number

•

Mailing address

•

An extension is attached

City

State

ZIP Code

•

Form 37 is attached

Contact person

Telephone number

•

This is an amended return

(

)

Complete A through D only if this is your first return or the answer

are in effect and dates on which waivers expire.

changed during 2000.

•

A.

Incorporated in

(state), on

(date)

•

I.

List the tax years for which your federal taxable income was changed

•

B.

State of commercial domicile

. b y an IRS audit, or by an amended federal return filed during this tax

•

C.

Date began business activity in Oregon

.

year:

•

D.

Business Activity Code from your federal return

Send a copy of the IRS report or the amended return under separate

•

E.

(1) Was a consolidated federal return filed?

Yes

No

cover, if not furnished previously.

•

(2) Is this a consolidated Oregon return?

Yes

J.

If this is your first return, indicate whether:

No

(3)

Are corporations included in the consolidated

New business, or

Successor to previously existing business.

.

Enter name and federal employer identification number of previous

federal return, but not in the Oregon return?

Yes

No

.

If (1), (2) or (3) is yes, please see instructions.

business:

•

F.

If you have more than 12 affiliates doing

K.

If this is your final return, indicate whether:

business in Oregon, check the box and

Withdrawn,

Dissolved,

Merged or reorganized. Enter name

see instructions

and federal employer identification number of merged or reorganized

•

corporation:

G.

Are you a high-income taxpayer? Please see

•

L.

If you didn’t complete Schedule AP, enter gross receipts from federal

instructions

Yes

No

.

•

Form 1120 or 1120A, line 1a: $

H.

List the tax years for which federal waivers of the statute of limitations

PLEASE ATTACH A COMPLETE COPY OF YOUR FEDERAL FORM 1120 OR 1120-A AND SCHEDULES

•

1.

Taxable income from U.S. corporation income tax return, Form 1120 (line 28) or 1120-A (line 24)

1

ADDITIONS (see instructions, page 5)

•

2.

State, municipal, and other interest income excluded in arriving at line 1

2

•

3.

Oregon excise tax, other state or foreign taxes on or measured by net income or profits

3

•

4.

Income of related FSC or DISC

4

•

5.

5

Other additions. Attach schedule and explanation

6.

Total additions (add lines 2 through 5)

6

7.

Income after additions (line 1 plus line 6)

7

SUBTRACTIONS (see instructions, page 6)

•

8.

Work opportunity credit wages not deducted on federal Form 1120 or 1120-A

8

•

9.

9

Dividend deduction. Attach schedule and explanation

•

10.

10

Income of nonunitary corporations. Attach schedule and explanation

•

11.

11

Other subtractions. Attach schedule and explanation

12.

Total subtractions (add lines 8 through 11)

12

13.

Income before net loss deduction (line 7 minus line 12)

13

If income is derived from sources both in Oregon and other states, carry amount on line 13

to Schedule AP-2, line 1, and skip line 14 below.

•

14.

Net loss deduction and net capital loss deduction. Attach schedule (see instructions, page 15)

14

15.

Oregon taxable income (line 13 minus line 14 or amount from Schedule AP-2, line 11)

•

15

(carry forward to page 2, line 16)

150-102-020 (Rev. 9-00) Web

Now go to the back of this form

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4