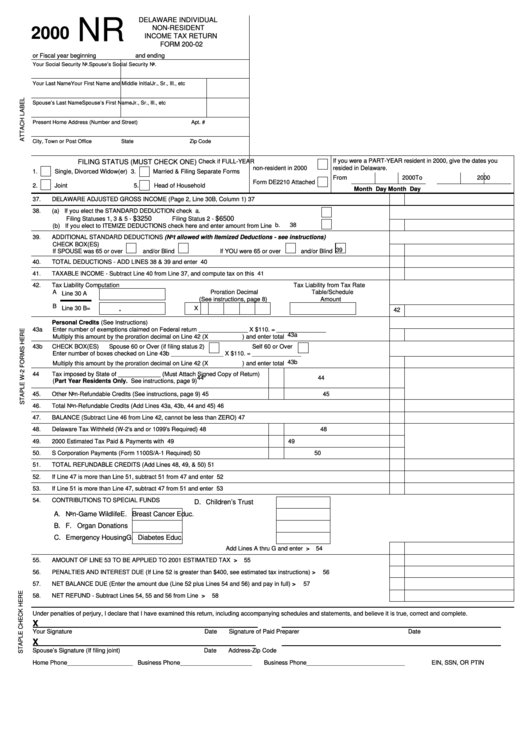

Form 200-02 - Delaware Individual Non-Resident Income Tax Return - De Division Of Revenue - 2000

ADVERTISEMENT

DELAWARE INDIVIDUAL

NR

NON-RESIDENT

2000

INCOME TAX RETURN

FORM 200-02

or Fiscal year beginning

and ending

Your Social Security No.

Spouse’s Social Security No.

Your Last Name

Your First Name and Middle Initial

Jr., Sr., III., etc

Spouse’s Last Name

Spouse’s First Name

Jr., Sr., III., etc

Present Home Address (Number and Street)

Apt. #

City, Town or Post Office

State

Zip Code

If you were a PART-YEAR resident in 2000, give the dates you

FILING STATUS (MUST CHECK ONE)

Check if FULL-YEAR

non-resident in 2000

resided in Delaware.

1.

Single, Divorced Widow(er) 3.

Married & Filing Separate Forms

From

2000

To

2000

Form DE2210 Attached

2.

Joint

5.

Head of Household

Month

Day

Month

Day

37.

DELAWARE ADJUSTED GROSS INCOME (Page 2, Line 30B, Column 1).................................................................................

37

38.

(a) If you elect the STANDARD DEDUCTION check here...................................................................

a.

$3250

$6500

Filing Statuses 1, 3 & 5 -

Filing Status 2 -

b.

38

(b) If you elect to ITEMIZE DEDUCTIONS check here and enter amount from Line 36......................

39.

ADDITIONAL STANDARD DEDUCTIONS (Not allowed with Itemized Deductions - see instructions)

CHECK BOX(ES)

39

If SPOUSE was 65 or over

and/or Blind

If YOU were 65 or over

and/or Blind

40.

TOTAL DEDUCTIONS - ADD LINES 38 & 39 and enter here......................................................................................................

40

41.

TAXABLE INCOME - Subtract Line 40 from Line 37, and compute tax on this amount...............................................................

41

42.

Tax Liability Computation

Tax Liability from Tax Rate

A

Proration Decimal

Table/Schedule

Line 30 A

(See instructions, page 8)

Amount

B

Line 30 B

=

.

X

42

Personal Credits (See Instructions)

43a

Enter number of exemptions claimed on Federal return _______________ X $110. = _______________

43a

Multiply this amount by the proration decimal on Line 42 (X

) and enter total here....................................................

43b

CHECK BOX(ES)

Spouse 60 or Over (if filing status 2)

Self 60 or Over

Enter number of boxes checked on Line 43b ________________ X $110. = _______________

43b

Multiply this amount by the proration decimal on Line 42 (X

) and enter total here....................................................

44

Tax imposed by State of _____________ (Must Attach Signed Copy of Return)

44

44

(Part Year Residents Only. See instructions, page 9)

45.

Other Non-Refundable Credits (See instructions, page 9).....................................

45

45

46.

Total Non-Refundable Credits (Add Lines 43a, 43b, 44 and 45)..................................................................................................

46

47.

BALANCE (Subtract Line 46 from Line 42, cannot be less than ZERO)......................................................................................

47

48.

Delaware Tax Withheld (W-2's and or 1099's Required).......................................

48

48

49.

2000 Estimated Tax Paid & Payments with Extensions.........................................

49

49

50.

S Corporation Payments (Form 1100S/A-1 Required)...........................................

50

50

51.

TOTAL REFUNDABLE CREDITS (Add Lines 48, 49, & 50).........................................................................................................

51

52.

If Line 47 is more than Line 51, subtract 51 from 47 and enter here............................................................AMOUNT YOU OWE

52

53.

If Line 51 is more than Line 47, subtract 47 from 51 and enter here..................................................................OVERPAYMENT

53

54.

CONTRIBUTIONS TO SPECIAL FUNDS

D. Children’s Trust

A. Non-Game Wildlife

E. Breast Cancer Educ.

B. U.S. Olympics

F. Organ Donations

C. Emergency Housing

G. Diabetes Educ.

Add Lines A thru G and enter here....................................... > 54

55.

AMOUNT OF LINE 53 TO BE APPLIED TO 2001 ESTIMATED TAX ACCOUNT..........................................................ENTER >

55

56.

PENALTIES AND INTEREST DUE (If Line 52 is greater than $400, see estimated tax instructions)............................ENTER >

56

57.

NET BALANCE DUE (Enter the amount due (Line 52 plus Lines 54 and 56) and pay in full)..............................PAY IN FULL >

57

58.

NET REFUND - Subtract Lines 54, 55 and 56 from Line 53...................................................TO BE REFUNDED/ZERO DUE >

58

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and believe it is true, correct and complete.

X

Your Signature

Date

Signature of Paid Preparer

Date

X

Spouse’s Signature (If filing joint)

Date

Address-Zip Code

Home Phone____________________ Business Phone______________________

Business Phone______________________________

EIN, SSN, OR PTIN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2