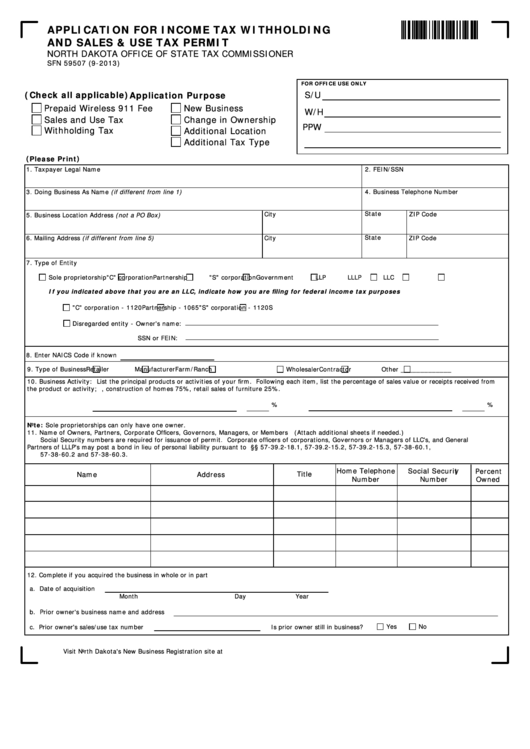

APPLICATION FOR INCOME TAX WITHHOLDING

AND SALES & USE TAX PERMIT

NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER

SFN 59507 (9-2013)

FOR OFFICE USE ONLY

S/U

(Check all applicable)

Application Purpose

Prepaid Wireless 911 Fee

New Business

W/H

Sales and Use Tax

Change in Ownership

PPW

Withholding Tax

Additional Location

Additional Tax Type

(Please Print)

1. Taxpayer Legal Name

2. FEIN/SSN

3. Doing Business As Name (if different from line 1)

4. Business Telephone Number

State

ZIP Code

City

5. Business Location Address (not a PO Box)

6. Mailing Address (if different from line 5)

State

City

ZIP Code

7. Type of Entity

Sole proprietorship

"C" corporation

Partnership

"S" corporation

Government

LLP

LLLP

LLC

If you indicated above that you are an LLC, indicate how you are filing for federal income tax purposes

"C" corporation - 1120

Partnership - 1065

"S" corporation - 1120S

Disregarded entity - Owner's name:

SSN or FEIN:

8. Enter NAICS Code if known

9. Type of Business

Retailer

Manufacturer

Farm/Ranch

Wholesaler

Contractor

Other _____________

10. Business Activity: List the principal products or activities of your firm. Following each item, list the percentage of sales value or receipts received from

the product or activity; i.e., construction of homes 75%, retail sales of furniture 25%.

%

%

Note: Sole proprietorships can only have one owner.

11. Name of Owners, Partners, Corporate Officers, Governors, Managers, or Members (Attach additional sheets if needed.)

Social Security numbers are required for issuance of permit. Corporate officers of corporations, Governors or Managers of LLC's, and General

Partners of LLLP's may post a bond in lieu of personal liability pursuant to N.D.C.C. §§ 57-39.2-18.1, 57-39.2-15.2, 57-39.2-15.3, 57-38-60.1,

57-38-60.2 and 57-38-60.3.

Home Telephone

Social Security

Percent

Name

Address

Title

Number

Number

Owned

12. Complete if you acquired the business in whole or in part

a. Date of acquisition

Month

Day

Year

b. Prior owner's business name and address

Yes

No

c. Prior owner's sales/use tax number

Is prior owner still in business?

Visit North Dakota's New Business Registration site at for general information and registration forms.

1

1 2

2