Application For Employee Refund Of Occupational Taxes Withheld Form - Louisville/jefferson County

ADVERTISEMENT

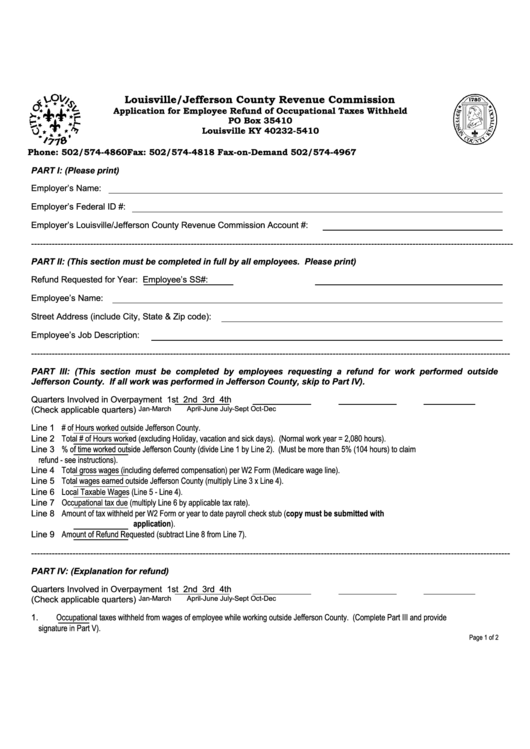

Louisville/Jefferson County Revenue Commission

Application for Employee Refund of Occupational Taxes Withheld

PO Box 35410

Louisville KY 40232-5410

Phone: 502/574-4860

Fax: 502/574-4818

Fax-on-Demand 502/574-4967

PART I: (Please print)

Employer’s Name:

Employer’s Federal ID #:

Employer’s Louisville/Jefferson County Revenue Commission Account #:

-------------------------------------------------------------------------------------------------------------------------------------------------------------------

PART II: (This section must be completed in full by all employees. Please print)

Refund Requested for Year:

Employee’s SS#:

Employee’s Name:

Street Address (include City, State & Zip code):

Employee’s Job Description:

------------------------------------------------------------------------------------------------------------------------------------------------------------------

PART III: (This section must be completed by employees requesting a refund for work performed outside

Jefferson County. If all work was performed in Jefferson County, skip to Part IV).

Quarters Involved in Overpayment

1st

2nd

3rd

4th

(Check applicable quarters)

Jan-March

April-June

July-Sept

Oct-Dec

Line 1

# of Hours worked outside Jefferson County.

Line 2

Total # of Hours worked (excluding Holiday, vacation and sick days). (Normal work year = 2,080 hours).

Line 3

% of time worked outside Jefferson County (divide Line 1 by Line 2). (Must be more than 5% (104 hours) to claim

refund - see instructions).

Line 4

Total gross wages (including deferred compensation) per W2 Form (Medicare wage line).

Line 5

Total wages earned outside Jefferson County (multiply Line 3 x Line 4).

Line 6

Local Taxable Wages (Line 5 - Line 4).

Line 7

Occupational tax due (multiply Line 6 by applicable tax rate).

Line 8

Amount of tax withheld per W2 Form or year to date payroll check stub (copy must be submitted with

application).

Line 9

Amount of Refund Requested (subtract Line 8 from Line 7).

------------------------------------------------------------------------------------------------------------------------------------------------------------------

PART IV: (Explanation for refund)

Quarters Involved in Overpayment

1st

2nd

3rd

4th

(Check applicable quarters)

Jan-March

April-June

July-Sept

Oct-Dec

1.

Occupational taxes withheld from wages of employee while working outside Jefferson County. (Complete Part III and provide

signature in Part V).

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2