Form Wh-1 - Withholding Tax

ADVERTISEMENT

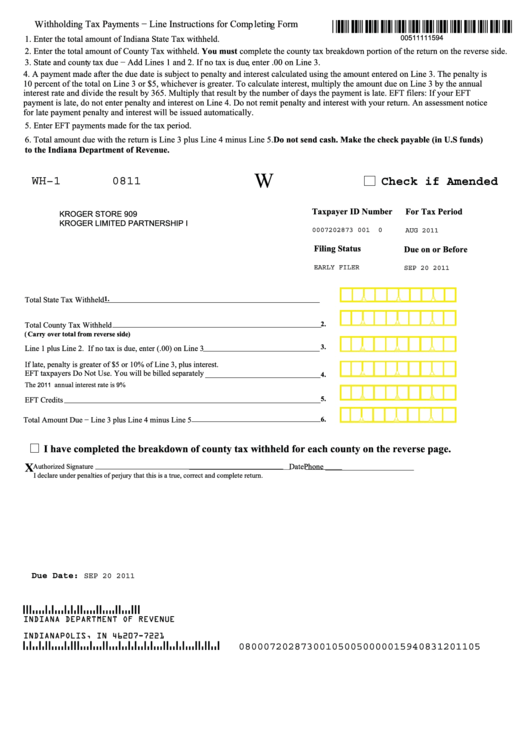

Withholding Tax Payments − Line Instructions for Completing Form

1. Enter the total amount of Indiana State Tax withheld.

2. Enter the total amount of County Tax withheld. You must complete the county tax breakdown portion of the return on the reverse side.

3. State and county tax due − Add Lines 1 and 2. If no tax is due, enter .00 on Line 3.

4. A payment made after the due date is subject to penalty and interest calculated using the amount entered on Line 3. The penalty is

10 percent of the total on Line 3 or $5, whichever is greater. To calculate interest, multiply the amount due on Line 3 by the annual

interest rate and divide the result by 365. Multiply that result by the number of days the payment is late. EFT filers: If your EFT

payment is late, do not enter penalty and interest on Line 4. Do not remit penalty and interest with your return. An assessment notice

for late payment penalty and interest will be issued automatically.

5. Enter EFT payments made for the tax period.

6. Total amount due with the return is Line 3 plus Line 4 minus Line 5. Do not send cash. Make the check payable (in U.S funds)

to the Indiana Department of Revenue.

W

WH−1

0811

Check if Amended

Taxpayer ID Number

KROGER STORE 909

For Tax Period

KROGER LIMITED PARTNERSHIP I

0007202873 001

0

AUG 2011

Filing Status

Due on or Before

EARLY FILER

SEP 20 2011

,

,

.

1.

Total State Tax Withheld

,

,

.

2.

Total County Tax Withheld

(Carry over total from reverse side)

,

,

.

3.

Line 1 plus Line 2. If no tax is due, enter (.00) on Line 3

If late, penalty is greater of $5 or 10% of Line 3, plus interest.

,

,

.

EFT taxpayers Do Not Use. You will be billed separately

4.

2011

9

The

annual interest rate is

%

,

,

.

5.

EFT Credits

,

,

.

Total Amount Due − Line 3 plus Line 4 minus Line 5

6.

I have completed the breakdown of county tax withheld for each county on the reverse page.

X

Authorized Signature

Date

Phone

____________________________

____________________________________________

I declare under penalties of perjury that this is a true, correct and complete return.

Due Date:

SEP 20 2011

(0526311(

INDIANA DEPARTMENT OF REVENUE

P.O. BOX 7221

INDIANAPOLIS, IN 46207-7221

(462077221216(

080007202873001050050000015940831201105

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2