Oregon Enterprise Zone Tax Exemption Application - Oregon Department Of Revenue - 1999

ADVERTISEMENT

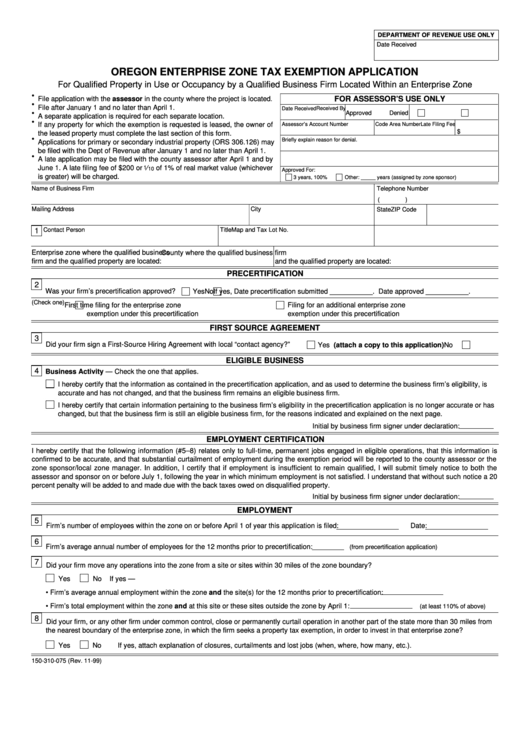

DEPARTMENT OF REVENUE USE ONLY

Date Received

OREGON ENTERPRISE ZONE TAX EXEMPTION APPLICATION

For Qualified Property in Use or Occupancy by a Qualified Business Firm Located Within an Enterprise Zone

•

File application with the assessor in the county where the project is located.

FOR ASSESSOR’S USE ONLY

•

File after January 1 and no later than April 1.

Date Received

Received By

•

Approved

Denied

A separate application is required for each separate location.

•

If any property for which the exemption is requested is leased, the owner of

Assessor’s Account Number

Code Area Number

Late Filing Fee

$

the leased property must complete the last section of this form.

•

Briefly explain reason for denial.

Applications for primary or secondary industrial property (ORS 306.126) may

be filed with the Dept of Revenue after January 1 and no later than April 1.

•

A late application may be filed with the county assessor after April 1 and by

June 1. A late filing fee of $200 or

1 10

of 1% of real market value (whichever

⁄

Approved For:

is greater) will be charged.

3 years, 100%

Other: _____ years (assigned by zone sponsor)

Name of Business Firm

Telephone Number

(

)

Mailing Address

City

State

ZIP Code

Contact Person

Title

Map and Tax Lot No.

1

Enterprise zone where the qualified business

County where the qualified business firm

firm and the qualified property are located:

and the qualified property are located:

PRECERTIFICATION

2

Was your firm’s precertification approved?

Yes

No

If yes, Date precertification submitted ___________. Date approved ___________.

(Check one)

First time filing for the enterprise zone

Filing for an additional enterprise zone

exemption under this precertification

exemption under this precertification

FIRST SOURCE AGREEMENT

3

Did your firm sign a First-Source Hiring Agreement with local “contact agency?”

Yes (attach a copy to this application)

No

ELIGIBLE BUSINESS

4

Business Activity — Check the one that applies.

I hereby certify that the information as contained in the precertification application, and as used to determine the business firm’s eligibility, is

accurate and has not changed, and that the business firm remains an eligible business firm.

I hereby certify that certain information pertaining to the business firm’s eligibility in the precertification application is no longer accurate or has

changed, but that the business firm is still an eligible business firm, for the reasons indicated and explained on the next page.

Initial by business firm signer under declaration:

EMPLOYMENT CERTIFICATION

I hereby certify that the following information (#5–8) relates only to full-time, permanent jobs engaged in eligible operations, that this information is

confirmed to be accurate, and that substantial curtailment of employment during the exemption period will be reported to the county assessor or the

zone sponsor/local zone manager. In addition, I certify that if employment is insufficient to remain qualified, I will submit timely notice to both the

assessor and sponsor on or before July 1, following the year in which minimum employment is not satisfied. I understand that without such notice a 20

percent penalty will be added to and made due with the back taxes owed on disqualified property.

Initial by business firm signer under declaration:

EMPLOYMENT

5

Firm’s number of employees within the zone on or before April 1 of year this application is filed:

Date:

6

Firm’s average annual number of employees for the 12 months prior to precertification:

(from precertification application)

7

Did your firm move any operations into the zone from a site or sites within 30 miles of the zone boundary?

Yes

No

If yes —

• Firm’s average annual employment within the zone and the site(s) for the 12 months prior to precertification:

• Firm’s total employment within the zone and at this site or these sites outside the zone by April 1:

(at least 110% of above)

8

Did your firm, or any other firm under common control, close or permanently curtail operation in another part of the state more than 30 miles from

the nearest boundary of the enterprise zone, in which the firm seeks a property tax exemption, in order to invest in that enterprise zone?

Yes

No

If yes, attach explanation of closures, curtailments and lost jobs (when, where, how many, etc.).

150-310-075 (Rev. 11-99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3