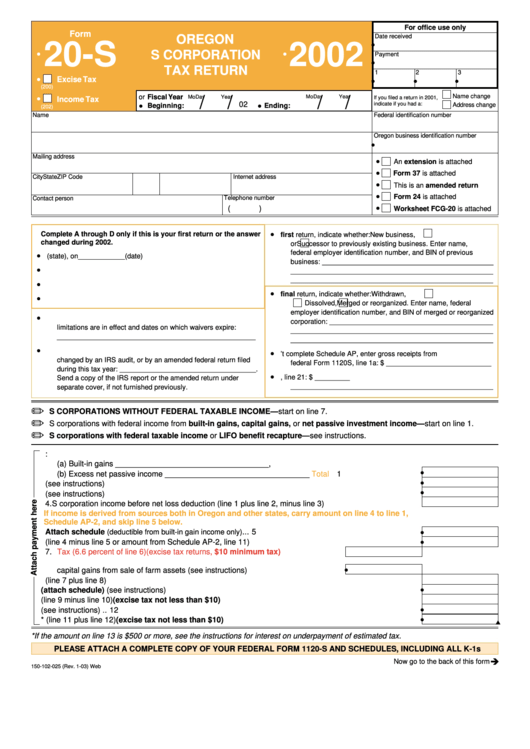

Form 20-S - Oregon S Corporation Tax Return - 2002

ADVERTISEMENT

For office use only

Form

Date received

OREGON

•

20-S

2002

•

•

S CORPORATION

Payment

•

TAX RETURN

1

2

3

•

Excise Tax

•

•

•

(200)

Name change

•

or Fiscal Year

Mo

/

Day

/

Year

Mo

/

Day

/

Year

If you filed a return in 2001,

Income Tax

02

•

•

indicate if you had a:

Address change

Beginning:

Ending:

(202)

Name

Federal identification number

Oregon business identification number

•

Mailing address

•

An extension is attached

•

Form 37 is attached

City

State

ZIP Code

Internet address

•

This is an amended return

•

Form 24 is attached

Telephone number

Contact person

•

(

)

Worksheet FCG-20 is attached

•

Complete A through D only if this is your first return or the answer

G. If this is your first return, indicate whether:

New business,

changed during 2002.

or

Successor to previously existing business. Enter name,

federal employer identification number, and BIN of previous

•

A. Incorporated in _____________ (state), on ____________ (date)

business: ____________________________________________

•

B. State of commercial domicile _____________________________

____________________________________________________

____________________________________________________

•

C. Date business activity began in Oregon ____________________

•

H. If this is your final return, indicate whether:

Withdrawn,

•

D. Business Activity Code from federal return __________________

Dissolved,

Merged or reorganized. Enter name, federal

employer identification number, and BIN of merged or reorganized

•

E. List the tax years for which federal waivers of the statute of

corporation: __________________________________________

limitations are in effect and dates on which waivers expire:

____________________________________________________

___________________________________________________

____________________________________________________

•

F. List the tax years for which your federal taxable income was

•

I. If you didn’t complete Schedule AP, enter gross receipts from

changed by an IRS audit, or by an amended federal return filed

federal Form 1120S, line 1a: $ ___________________________

during this tax year: ___________________________________.

•

J. Enter the amount from federal Form 1120S, line 21: $ _________

Send a copy of the IRS report or the amended return under

____________________________________________________

separate cover, if not furnished previously.

S CORPORATIONS WITHOUT FEDERAL TAXABLE INCOME—start on line 7.

S corporations with federal income from built-in gains, capital gains, or net passive investment income—start on line 1.

S corporations with federal taxable income or LIFO benefit recapture—see instructions.

1. Income taxed on federal Form 1120S from:

(a) Built-in gains ___________________________________,

•

(b) Excess net passive income _________________________________ ....................................

Total

1

•

2. Additions (see instructions) ........................................................................................................................ 2

•

3. Subtractions (see instructions) ................................................................................................................... 3

4. S corporation income before net loss deduction (line 1 plus line 2, minus line 3) ..................................... 4

If income is derived from sources both in Oregon and other states, carry amount on line 4 to line 1,

Schedule AP-2, and skip line 5 below.

•

5. Net loss from prior years as C corporation. Attach schedule

(deductible from built-in gain income only)

... 5

•

6. Oregon taxable income (line 4 minus line 5 or amount from Schedule AP-2, line 11) ............................... 6

7.

Tax (6.6 percent of line 6) (excise tax returns, $10 minimum tax)

......................... 7

8. Tax adjustment for interest on certain installment sales and tax on certain

•

capital gains from sale of farm assets (see instructions) ........................................ 8

9. Total tax (line 7 plus line 8) ........................................................................................................................ 9

•

10. Credits against tax (attach schedule) (see instructions) ........................................................................ 10

11. Tax after credits (line 9 minus line 10) (excise tax not less than $10) .................................................... 11

•

12. Tax adjustment for LIFO benefit recapture (see instructions) .................................................................. 12

•

13. Net tax* (line 11 plus line 12) (excise tax not less than $10) ................................................................. 13

*If the amount on line 13 is $500 or more, see the instructions for interest on underpayment of estimated tax.

PLEASE ATTACH A COMPLETE COPY OF YOUR FEDERAL FORM 1120-S AND SCHEDULES, INCLUDING ALL K-1s

Now go to the back of this form

150-102-025 (Rev. 1-03) Web

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3