Food And Beverage Tax Remittance Form - City Of Salem - 2017

ADVERTISEMENT

2017

2017

CITY OF SALEM

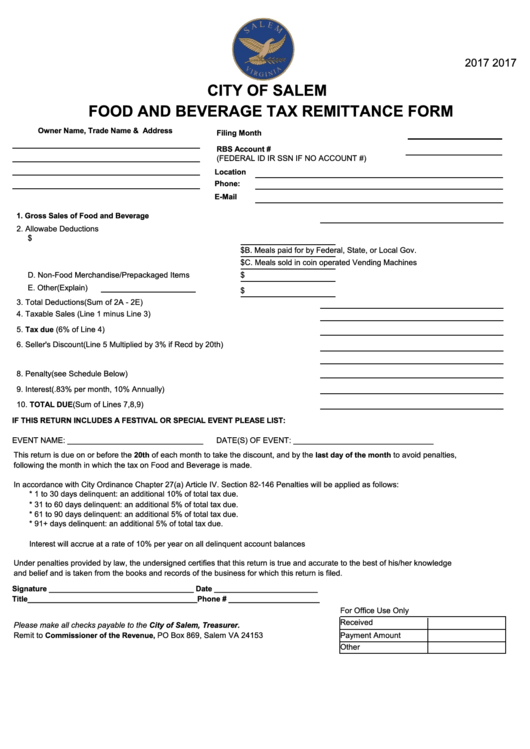

FOOD AND BEVERAGE TAX REMITTANCE FORM

Owner Name, Trade Name & Address

Filing Month

RBS Account #

(FEDERAL ID IR SSN IF NO ACCOUNT #)

Location

Phone:

E-Mail

1. Gross Sales of Food and Beverage

2. Allowabe Deductions

A.Meals to Employees when no charge is made

$

B. Meals paid for by Federal, State, or Local Gov.

$

C. Meals sold in coin operated Vending Machines

$

D. Non-Food Merchandise/Prepackaged Items

$

E. Other(Explain)

$

3. Total Deductions(Sum of 2A - 2E)

4. Taxable Sales (Line 1 minus Line 3)

5. Tax due (6% of Line 4)

6. Seller's Discount(Line 5 Multiplied by 3% if Recd by 20th)

7.Net Tax Due

8. Penalty(see Schedule Below)

9. Interest(.83% per month, 10% Annually)

10. TOTAL DUE (Sum of Lines 7,8,9)

IF THIS RETURN INCLUDES A FESTIVAL OR SPECIAL EVENT PLEASE LIST:

EVENT NAME: _______________________________

DATE(S) OF EVENT: ________________________________

This return is due on or before the 20th of each month to take the discount, and by the last day of the month to avoid penalties,

following the month in which the tax on Food and Beverage is made.

In accordance with City Ordinance Chapter 27(a) Article IV . Section 82-146 Penalties will be applied as follows:

* 1 to 30 days delinquent: an additional 10% of total tax due.

* 31 to 60 days delinquent: an additional 5% of total tax due.

* 61 to 90 days delinquent: an additional 5% of total tax due.

* 91+ days delinquent: an additional 5% of total tax due.

Interest will accrue at a rate of 10% per year on all delinquent account balances

Under penalties provided by law, the undersigned certifies that this return is true and accurate to the best of his/her knowledge

and belief and is taken from the books and records of the business for which this return is filed.

Signature ___________________________________ Date _________________________

Title_________________________________________Phone # ______________________

For Office Use Only

Received

Please make all checks payable to the City of Salem, Treasurer.

Remit to Commissioner of the Revenue, PO Box 869, Salem VA 24153

Payment Amount

Other

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1