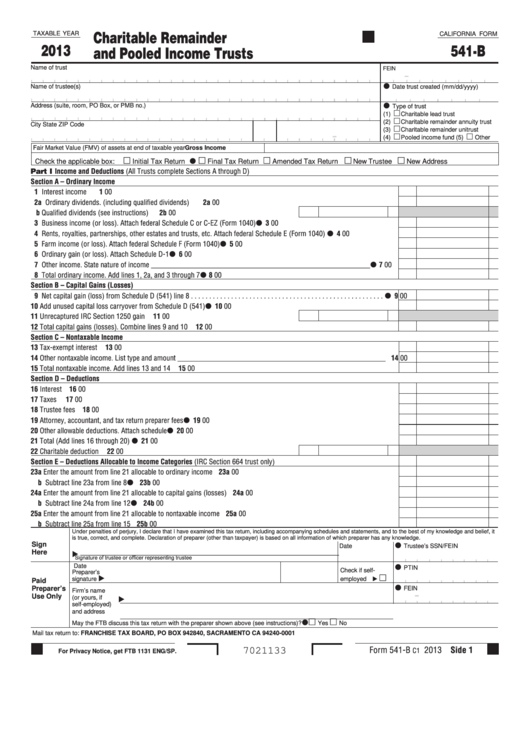

California Form 541-B - Charitable Remainder And Pooled Income Trusts - 2013

ADVERTISEMENT

Charitable Remainder

TAXABLE YEAR

CALIFORNIA FORM

2013

541-B

and Pooled Income Trusts

Name of trust

FEIN

-

Name of trustee(s)

Date trust created (mm/dd/yyyy)

Address (suite, room, PO Box, or PMB no.)

Type of trust

(1)

Charitable lead trust

(2)

Charitable remainder annuity trust

City

State

ZIP Code

(3)

Charitable remainder unitrust

-

(4)

Pooled income fund (5)

Other

Gross Income

Fair Market Value (FMV) of assets at end of taxable year

Check the applicable box:

Initial Tax Return

Final Tax Return

Amended Tax Return

New Trustee

New Address

Part I

Income and Deductions (All Trusts complete Sections A through D)

Section A – Ordinary Income

1 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

2a Ordinary dividends . (including qualified dividends) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2a

00

b Qualified dividends (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2b

00

3 Business income (or loss) . Attach federal Schedule C or C-EZ (Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4 Rents, royalties, partnerships, other estates and trusts, etc . Attach federal Schedule E (Form 1040) . . . . . . . . . . . . . . . .

4

00

5 Farm income (or loss) . Attach federal Schedule F (Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6 Ordinary gain (or loss) . Attach Schedule D-1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7 Other income . State nature of income ____________________________________________________________ . . . .

7

00

8 Total ordinary income . Add lines 1, 2a, and 3 through 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

Section B – Capital Gains (Losses)

9 Net capital gain (loss) from Schedule D (541) line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

10 Add unused capital loss carryover from Schedule D (541) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

00

11 Unrecaptured IRC Section 1250 gain . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

00

12 Total capital gains (losses) . Combine lines 9 and 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

00

Section C – Nontaxable Income

13 Tax-exempt interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

00

14 Other nontaxable income . List type and amount _________________________________________________________

14

00

15 Total nontaxable income . Add lines 13 and 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

00

Section D – Deductions

16 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

00

17 Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

00

18 Trustee fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

00

19 Attorney, accountant, and tax return preparer fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

00

20 Other allowable deductions . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

00

21 Total (Add lines 16 through 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

00

22 Charitable deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

00

Section E – Deductions Allocable to Income Categories (IRC Section 664 trust only)

23a Enter the amount from line 21 allocable to ordinary income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23a

00

b Subtract line 23a from line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23b

00

24a Enter the amount from line 21 allocable to capital gains (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24a

00

b Subtract line 24a from line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24b

00

25a Enter the amount from line 21 allocable to nontaxable income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25a

00

b Subtract line 25a from line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25b

00

Under penalties of perjury, I declare that I have examined this tax return, including accompanying schedules and statements, and to the best of my knowledge and belief, it

is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Date

Trustee’s SSN/FEIN

___________________________________________________________

Here

Signature of trustee or officer representing trustee

Date

PTIN

Check if self-

Preparer’s

employed

Paid

signature

Preparer’s

-

FEIN

Firm’s name

Use Only

(or yours, if

self-employed)

and address

May the FTB discuss this tax return with the preparer shown above (see instructions)?. . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Mail tax return to: FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA 94240-0001

Form 541-B

2013 Side 1

C1

7021133

For Privacy Notice, get FTB 1131 ENG/SP.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5