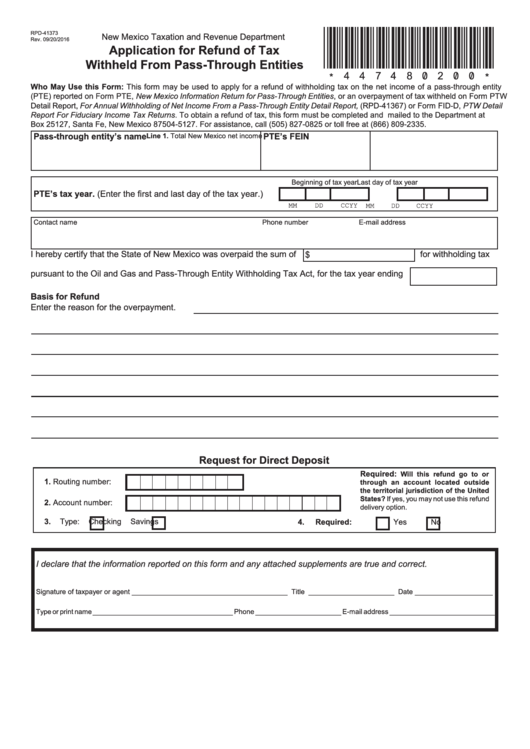

Form Rpd-41373 - Application For Refund Of Tax Withheld From Pass-Through Entities

ADVERTISEMENT

*447480200*

RPD-41373

New Mexico Taxation and Revenue Department

Rev. 09/20/2016

Application for Refund of Tax

Withheld From Pass-Through Entities

Who May Use this Form: This form may be used to apply for a refund of withholding tax on the net income of a pass-through entity

(PTE) reported on Form PTE, New Mexico Information Return for Pass-Through Entities, or an overpayment of tax withheld on Form PTW

Detail Report, For Annual Withholding of Net Income From a Pass-Through Entity Detail Report, (RPD-41367) or Form FID-D, PTW Detail

Report For Fiduciary Income Tax Returns. To obtain a refund of tax, this form must be completed and mailed to the Department at P.O.

Box 25127, Santa Fe, New Mexico 87504-5127. For assistance, call (505) 827-0825 or toll free at (866) 809-2335.

Pass-through entity’s name

PTE’s FEIN

Line 1. Total New Mexico net income

Beginning of tax year

Last day of tax year

PTE’s tax year. (Enter the first and last day of the tax year.)

MM

DD

CCYY

MM

DD

CCYY

Contact name

Phone number

E-mail address

I hereby certify that the State of New Mexico was overpaid the sum of

for withholding tax

$

pursuant to the Oil and Gas and Pass-Through Entity Withholding Tax Act, for the tax year ending

Basis for Refund

Enter the reason for the overpayment.

Request for Direct Deposit

Required:

Will this refund go to or

1.

Routing number:

through an account located outside

the territorial jurisdiction of the United

States? If yes, you may not use this refund

2.

Account number:

delivery option.

3.

Type:

Checking

Savings

4.

Required:

Yes

No

I declare that the information reported on this form and any attached supplements are true and correct.

Signature of taxpayer or agent ________________________________________ Title ______________________ Date ____________________

Type or print name ____________________________________ Phone ______________________ E-mail address ___________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1