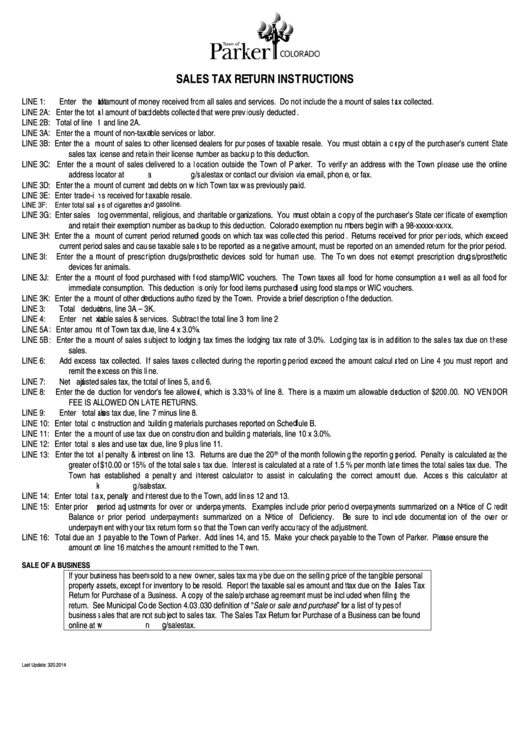

Sales Tax Return Instructions - Town Of Parker

ADVERTISEMENT

SALE

ES TAX RE

ETURN INST

TRUCTION

S

LINE 1:

Enter the tota

al amount of mo

ney received fro

om all sales and

services. Do no

ot include the am

mount of sales ta

ax collected.

LINE 2A:

: Enter the tota

al amount of bad

d debts collected

d that were previ

iously deducted.

.

LINE 2B:

: Total of line 1

1 and line 2A.

LINE 3A:

: Enter the am

mount of non-taxa

able services or

labor.

LINE 3B:

: Enter the am

mount of sales to

o other licensed

dealers for purp

poses of taxable

e resale. You m

must obtain a co

opy of the purch

aser’s current S

State

sales tax

license and reta

in their license n

number as backu

up to this deduct

tion.

LINE 3C:

: Enter the am

mount of sales d

delivered to a lo

ocation outside

the Town of Pa

arker. To verify

y an address wi

th the Town ple

ease use the on

nline

address lo

ocator at

salestax or conta

act our division v

via email, phone

e, or fax.

LINE 3D:

: Enter the am

mount of current b

bad debts on wh

hich Town tax wa

as previously pa

aid.

LINE 3E:

: Enter trade-in

ns received for t

taxable resale.

LINE 3F:

Enter total sale

es of cigarettes an

nd gasoline.

LINE 3G

: Enter sales t

to governmental

, religious, and c

charitable organ

nizations. You m

must obtain a co

opy of the purcha

aser’s State cert

tificate of exemp

ption

and retain

n their exemption

n number as bac

ckup to this dedu

uction. Colorado

o exemption num

mbers begin with

h a 98-xxxxx-xxx

xx.

LINE 3H:

: Enter the am

mount of current

period returned

d goods on whic

ch tax was collec

cted this period.

. Returns receiv

ved for prior per

riods, which exc

ceed

current perio

d sales and cau

se taxable sales

s to be reported

as a negative am

mount, must be

reported on an a

amended return

for the prior per

riod.

LINE 3I:

Enter the am

mount of prescr

iption drugs/pro

osthetic devices

sold for human

n use. The To

own does not ex

xempt prescripti

ion drugs/prosth

hetic

devices fo

or animals.

LINE 3J:

Enter the am

mount of food pu

urchased with fo

ood stamp/WIC

vouchers. The

Town taxes all

food for home

consumption as

s well as all food

d for

immediate

e consumption.

This deduction i

is only for food it

tems purchased

d using food stam

mps or WIC vouc

chers.

LINE 3K:

: Enter the am

mount of other de

eductions author

rized by the Tow

wn. Provide a bri

ief description of

f the deduction.

LINE 3:

Total deducti

ions, line 3A – 3

K.

LINE 4:

Enter net tax

xable sales & ser

rvices. Subtract

t the total line 3 f

from line 2

LINE 5A:

: Enter amoun

nt of Town tax du

ue, line 4 x 3.0%

%.

LINE 5B:

: Enter the am

mount of sales s

ubject to lodging

g tax times the

lodging tax rate

of 3.0%. Lodg

ging tax is in add

dition to the sale

es tax due on th

hese

sales.

LINE 6:

Add excess

tax collected. I

f sales taxes co

ollected during th

he reporting per

riod exceed the

amount calcula

ated on Line 4 y

you must report

and

remit the e

excess on this li

ne.

LINE 7:

Net adjusted

sales tax, the to

otal of lines 5, an

nd 6.

LINE 8:

Enter the de

duction for vend

dor's fee allowed

d, which is 3.33

% of line 8. Th

here is a maximu

um allowable de

eduction of $200

0.00. NO VEND

DOR

FEE IS AL

LLOWED ON LA

ATE RETURNS.

LINE 9:

Enter total sa

ales tax due, line

e 7 minus line 8.

LINE 10:

Enter total co

onstruction and b

building materia

ls purchases rep

ported on Sched

dule B.

LINE 11:

Enter the am

mount of use tax

due on construc

ction and building

g materials, line

10 x 3.0%.

LINE 12:

Enter total sa

ales and use tax

x due, line 9 plus

s line 11.

LINE 13:

Enter the tota

al penalty & inte

erest on line 13.

Returns are du

ue the 20

of the

e month followin

g the reporting p

period. Penalty

is calculated as

s the

th

greater of

f $10.00 or 15%

of the total sales

s tax due. Intere

est is calculated

d at a rate of 1.5%

% per month late

e times the total

l sales tax due.

The

Town has

s established a

a penalty and in

nterest calculato

or to assist in

calculating the

e correct amoun

nt due. Acces

s this calculato

or at

ark

estax.

LINE 14:

Enter total ta

ax, penalty and in

nterest due to th

e Town, add line

es 12 and 13.

LINE 15:

Enter prior p

period adjustmen

nts for over or u

underpayments.

Examples incl

ude prior period

d overpayments

summarized on

n a Notice of Cr

redit

Balance o

or prior period

underpayments

s summarized o

on a Notice of

Deficiency. B

Be sure to inclu

ude documentat

tion of the ove

r or

underpaym

ment with your ta

ax return form s

o that the Town

can verify accur

racy of the adjus

stment.

LINE 16:

Total due an

d payable to the

e Town of Parker

r. Add lines 14,

and 15. Make y

your check paya

able to the Town

of Parker. Plea

ase ensure the

amount on

n line 16 matche

es the amount re

emitted to the To

own.

SALE OF

A BUSINESS

If your bus

siness has been

n sold to a new o

owner, sales tax

may be due on

the selling price

e of the tangible p

personal

property a

assets, except fo

or inventory to be

e resold. Report

t the taxable sal

es amount and t

tax due on the S

Sales Tax

Return for

r Purchase of a B

Business. A cop

py of the sale/pu

urchase agreeme

ent must be incl

uded when filing

g the

return. Se

ee Municipal Co

de Section 4.03

.030 definition o

of “Sale or sale a

and purchase” fo

or a list of types o

of

business s

sales that are no

ot subject to sale

es tax. The Sale

es Tax Return fo

or Purchase of a

Business can b

be found

online at w

arkeronlin

Last Update: 3

.20.2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1