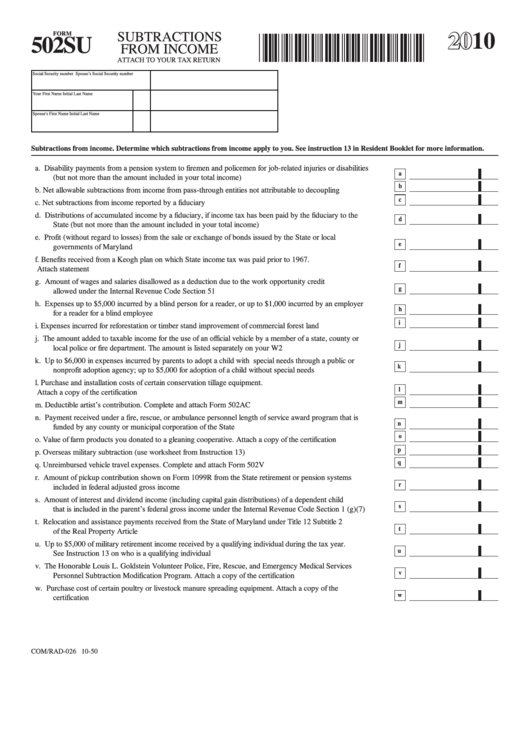

2010

502SU

SUBTRACTIONS

FORM

FROM INCOME

ATTACH TO YOUR TAX RETURN

10502S050

Social Security number

Spouse’s Social Security number

Your First Name

Initial

Last Name

Spouse's First Name

Initial

Last Name

Subtractions from income. Determine which subtractions from income apply to you. See instruction 13 in Resident Booklet for more information.

a. Disability payments from a pension system to firemen and policemen for job-related injuries or disabilities

a

(but not more than the amount included in your total income) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b

b. Net allowable subtractions from income from pass-through entities not attributable to decoupling. . . . . . . .

c

c. Net subtractions from income reported by a fiduciary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d. Distributions of accumulated income by a fiduciary, if income tax has been paid by the fiduciary to the

d

State (but not more than the amount included in your total income) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

e. Profit (without regard to losses) from the sale or exchange of bonds issued by the State or local

e

governments of Maryland . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

f. Benefits received from a Keogh plan on which State income tax was paid prior to 1967.

f

Attach statement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

g. Amount of wages and salaries disallowed as a deduction due to the work opportunity credit

g

allowed under the Internal Revenue Code Section 51. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

h. Expenses up to $5,000 incurred by a blind person for a reader, or up to $1,000 incurred by an employer

h

for a reader for a blind employee. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

i

i. Expenses incurred for reforestation or timber stand improvement of commercial forest land . . . . . . . . . . . .

j. The amount added to taxable income for the use of an official vehicle by a member of a state, county or

j

local police or fire department. The amount is listed separately on your W2 . . . . . . . . . . . . . . . . . . . . . . . . .

k. Up to $6,000 in expenses incurred by parents to adopt a child with special needs through a public or

k

nonprofit adoption agency; up to $5,000 for adoption of a child without special needs . . . . . . . . . . . . . . . . .

l. Purchase and installation costs of certain conservation tillage equipment.

l

Attach a copy of the certification. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

m

m. Deductible artist’s contribution. Complete and attach Form 502AC . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

n. Payment received under a fire, rescue, or ambulance personnel length of service award program that is

n

funded by any county or municipal corporation of the State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

o

o. Value of farm products you donated to a gleaning cooperative. Attach a copy of the certification . . . . . . . .

p

p. Overseas military subtraction (use worksheet from Instruction 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

q

q. Unreimbursed vehicle travel expenses. Complete and attach Form 502V . . . . . . . . . . . . . . . . . . . . . . . . . . . .

r. Amount of pickup contribution shown on Form 1099R from the State retirement or pension systems

r

included in federal adjusted gross income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

s. Amount of interest and dividend income (including capital gain distributions) of a dependent child

s

that is included in the parent’s federal gross income under the Internal Revenue Code Section 1 (g)(7). . . .

t. Relocation and assistance payments received from the State of Maryland under Title 12 Subtitle 2

t

of the Real Property Article . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

u. Up to $5,000 of military retirement income received by a qualifying individual during the tax year.

u

See Instruction 13 on who is a qualifying individual . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

v. The Honorable Louis L. Goldstein Volunteer Police, Fire, Rescue, and Emergency Medical Services

v

Personnel Subtraction Modification Program. Attach a copy of the certification . . . . . . . . . . . . . . . . . . . . . .

w. Purchase cost of certain poultry or livestock manure spreading equipment. Attach a copy of the

w

certification . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

COM/RAD-026 10-50

1

1 2

2