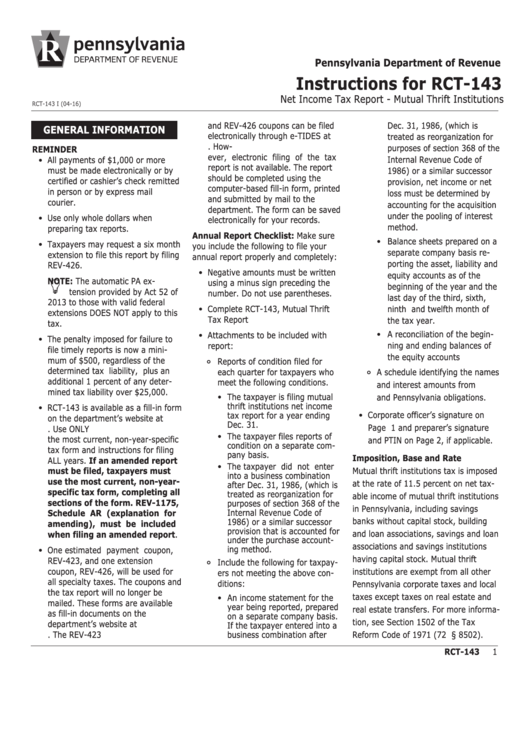

Instructions For Rct-143 - Net Income Tax Report - Mutual Thrift Institutions

ADVERTISEMENT

Pennsylvania Department of Revenue

Instructions for RCT-143

Net Income Tax Report - Mutual Thrift Institutions

RCT-143 I (04-16)

and REV-426 coupons can be filed

Dec. 31, 1986, (which is

GENERAL INFORMATION

electronically through e-TIDES at

treated as reorganization for

•

How-

purposes of section 368 of the

REMINDER

ever, electronic filing of the tax

Internal Revenue Code of

All payments of $1,000 or more

report is not available. The report

must be made electronically or by

1986) or a similar successor

should be completed using the

certified or cashier’s check remitted

provision, net income or net

computer-based fill-in form, printed

in person or by express mail

loss must be determined by

and submitted by mail to the

courier.

•

accounting for the acquisition

department. The form can be saved

under the pooling of interest

Use only whole dollars when

electronically for your records.

•

method.

preparing tax reports.

•

Annual Report Checklist: Make sure

Balance sheets prepared on a

Taxpayers may request a six month

you include the following to file your

separate company basis re-

extension to file this report by filing

annual report properly and completely:

•

porting the asset, liability and

REV-426.

Negative amounts must be written

equity accounts as of the

NOTE: The automatic PA ex-

using a minus sign preceding the

beginning of the year and the

tension provided by Act 52 of

number. Do not use parentheses.

•

last day of the third, sixth,

2013 to those with valid federal

Complete RCT-143, Mutual Thrift

ninth and twelfth month of

extensions DOES NOT apply to this

Tax Report

the tax year.

•

•

tax.

•

A reconciliation of the begin-

Attachments to be included with

The penalty imposed for failure to

ning and ending balances of

report:

file timely reports is now a mini-

the equity accounts

mum of $500, regardless of the

° Reports of condition filed for

determined tax liability, plus an

each quarter for taxpayers who

° A schedule identifying the names

additional 1 percent of any deter-

meet the following conditions.

•

and interest amounts from U.S.

mined tax liability over $25,000.

•

The taxpayer is filing mutual

and Pennsylvania obligations.

•

thrift institutions net income

RCT-143 is available as a fill-in form

tax report for a year ending

Corporate officer’s signature on

on the department’s website at

•

Dec. 31.

Page 1 and preparer’s signature

Use ONLY

The taxpayer files reports of

the most current, non-year-specific

and PTIN on Page 2, if applicable.

condition on a separate com-

tax form and instructions for filing

•

pany basis.

Imposition, Base and Rate

ALL years. If an amended report

The taxpayer did not enter

must be filed, taxpayers must

Mutual thrift institutions tax is imposed

into a business combination

use the most current, non-year-

at the rate of 11.5 percent on net tax-

after Dec. 31, 1986, (which is

specific tax form, completing all

treated as reorganization for

able income of mutual thrift institutions

sections of the form. REV-1175,

purposes of section 368 of the

in Pennsylvania, including savings

Internal Revenue Code of

Schedule AR (explanation for

banks without capital stock, building

1986) or a similar successor

amending), must be included

provision that is accounted for

and loan associations, savings and loan

when filing an amended report.

•

under the purchase account-

associations and savings institutions

ing method.

One estimated payment coupon,

having capital stock. Mutual thrift

REV-423,

and

one

extension

° Include the following for taxpay-

coupon, REV-426, will be used for

institutions are exempt from all other

ers not meeting the above con-

all specialty taxes. The coupons and

ditions:

•

Pennsylvania corporate taxes and local

the tax report will no longer be

taxes except taxes on real estate and

An income statement for the

mailed. These forms are available

year being reported, prepared

real estate transfers. For more informa-

as

fill-in

documents

on

the

on a separate company basis.

tion, see Section 1502 of the Tax

department’s

website

at

If the taxpayer entered into a

The REV-423

business combination after

Reform Code of 1971 (72 P.S.§ 8502).

RCT-143

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5