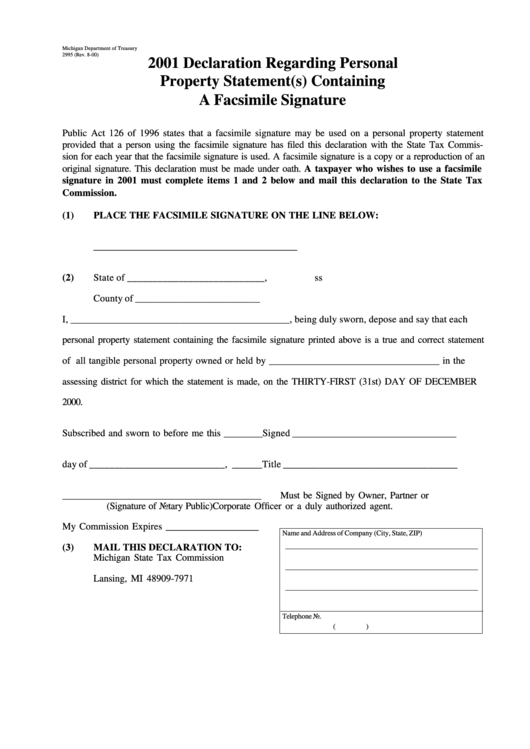

Form 2995 - 2001 Declaration Regarding Personal Property Statement(S) Containing A Facsimile Signature - Michigan Department Of Treasury

ADVERTISEMENT

Michigan Department of Treasury

2995 (Rev. 8-00)

2001 Declaration Regarding Personal

Property Statement(s) Containing

A Facsimile Signature

Public Act 126 of 1996 states that a facsimile signature may be used on a personal property statement

provided that a person using the facsimile signature has filed this declaration with the State Tax Commis-

sion for each year that the facsimile signature is used. A facsimile signature is a copy or a reproduction of an

original signature. This declaration must be made under oath. A taxpayer who wishes to use a facsimile

signature in 2001 must complete items 1 and 2 below and mail this declaration to the State Tax

Commission.

(1)

PLACE THE FACSIMILE SIGNATURE ON THE LINE BELOW:

_________________________________________

(2)

State of ___________________________,

ss

County of _________________________

I, ____________________________________________, being duly sworn, depose and say that each

personal property statement containing the facsimile signature printed above is a true and correct statement

of all tangible personal property owned or held by ___________________________________ in the

assessing district for which the statement is made, on the THIRTY-FIRST (31st) DAY OF DECEMBER

2000.

Subscribed and sworn to before me this ________

Signed _________________________________

day of ___________________________, ______

Title ___________________________________

________________________________________

Must be Signed by Owner, Partner or

(Signature of Notary Public)

Corporate Officer or a duly authorized agent.

My Commission Expires ___________________

Name and Address of Company (City, State, ZIP)

(3)

MAIL THIS DECLARATION TO:

Michigan State Tax Commission

P.O. Box 30471

Lansing, MI 48909-7971

Telephone No.

(

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1