Form Ptr-1 - Property Tax Reimbursement Application - 2002

ADVERTISEMENT

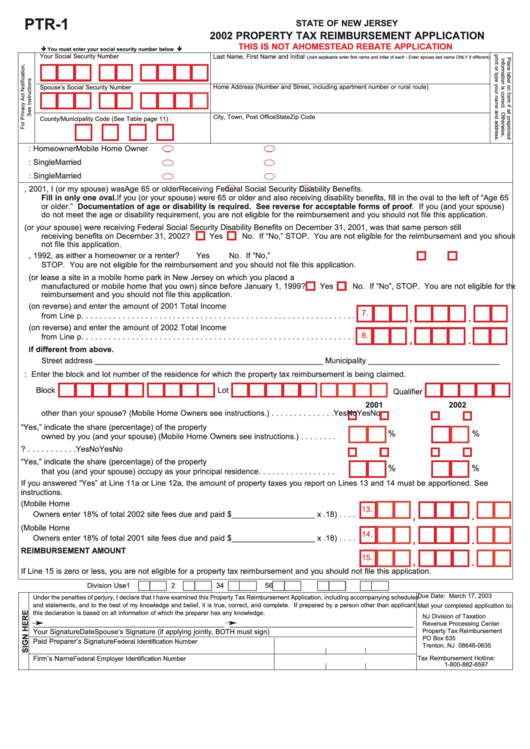

PTR-1

STATE OF NEW JERSEY

2002 PROPERTY TAX REIMBURSEMENT APPLICATION

THIS IS NOT A HOMESTEAD REBATE APPLICATION

You must enter your social security number below

Your Social Security Number

Last Name, First Name and Initial

(Joint applicants enter first name and initial of each - Enter spouse last name ONLY if different)

Home Address (Number and Street, including apartment number or rural route)

Spouse’s Social Security Number

City, Town, Post Office

State

Zip Code

County/Municipality Code (See Table page 11)

1. Residency Status:

Homeowner

Mobile Home Owner

2. Your 2001 Marital Status:

Single

Married

3. Your 2002 Marital Status:

Single

Married

4a. On December 31, 2001, I (or my spouse) was

Age 65 or older

Receiving Federal Social Security Disability Benefits.

Fill in only one oval. If you (or your spouse) were 65 or older and also receiving disability benefits, fill in the oval to the left of “Age 65

or older.” Documentation of age or disability is required. See reverse for acceptable forms of proof. If you (and your spouse)

do not meet the age or disability requirement, you are not eligible for the reimbursement and you should not file this application.

4b. If you (or your spouse) were receiving Federal Social Security Disability Benefits on December 31, 2001, was that same person still

receiving benefits on December 31, 2002?

Yes

No. If “No,” STOP. You are not eligible for the reimbursement and you should

not file this application.

5. Did you live in New Jersey continuously since before January 1, 1992, as either a homeowner or a renter?

Yes

No. If “No,”

STOP. You are not eligible for the reimbursement and you should not file this application.

6. Did you own and live in your New Jersey home (or lease a site in a mobile home park in New Jersey on which you placed a

manufactured or mobile home that you own) since before January 1, 1999?

Yes

No. If “No”, STOP. You are not eligible for the

reimbursement and you should not file this application.

7. Complete Income Worksheet A (on reverse) and enter the amount of 2001 Total Income

7.

from Line p. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

,

.

8. Complete Income Worksheet B (on reverse) and enter the amount of 2002 Total Income

8.

from Line p. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

,

.

9. Enter the address for which you are claiming the reimbursement if different from above.

Street address ____________________________________________________ Municipality ______________________________

10. Homeowners: Enter the block and lot number of the residence for which the property tax reimbursement is being claimed.

Block

Lot

Qualifier

11a. Did you share ownership of your principal residence with anyone

2002

2001

other than your spouse? (Mobile Home Owners see instructions.) . . . . . . . . . . . . . .

Yes

No

Yes

No

11b. If you answered “Yes,” indicate the share (percentage) of the property

%

%

owned by you (and your spouse) (Mobile Home Owners see instructions.) . . . . . . . .

12a. Does your principal residence consist of more than one dwelling unit? . . . . . . . . . . .

Yes

No

Yes

No

12b. If you answered “Yes,” indicate the share (percentage) of the property

%

%

that you (and your spouse) occupy as your principal residence. . . . . . . . . . . . . . . . .

If you answered “Yes” at Line 11a or Line 12a, the amount of property taxes you report on Lines 13 and 14 must be apportioned. See

instructions.

13. Enter your total 2002 property taxes due and paid on your principal residence. (Mobile Home

13.

Owners enter 18% of total 2002 site fees due and paid $___________________ x .18) . . . .

,

.

14. Enter your total 2001 property taxes due and paid on your principal residence. (Mobile Home

14.

Owners enter 18% of total 2001 site fees due and paid $___________________ x .18) . . . .

,

.

REIMBURSEMENT AMOUNT

15.

15. Subtract Line 14 from Line 13. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

,

.

If Line 15 is zero or less, you are not eligible for a property tax reimbursement and you should not file this application.

Division Use

1

2

3

4

5

6

Due Date: March 17, 2003

Under the penalties of perjury, I declare that I have examined this Property Tax Reimbursement Application, including accompanying schedules

and statements, and to the best of my knowledge and belief, it is true, correct, and complete. If prepared by a person other than applicant,

Mail your completed application to:

this declaration is based on all information of which the preparer has any knowledge.

NJ Division of Taxation

Revenue Processing Center

________________________________________________________ ______________________________________________________

Property Tax Reimbursement

Your Signature

Date

Spouse’s Signature (if applying jointly, BOTH must sign)

PO Box 635

Paid Preparer’s Signature

Federal Identification Number

Trenton, NJ 08646-0635

Firm’s Name

Tax Reimbursement Hotline:

Federal Employer Identification Number

1-800-882-6597

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2