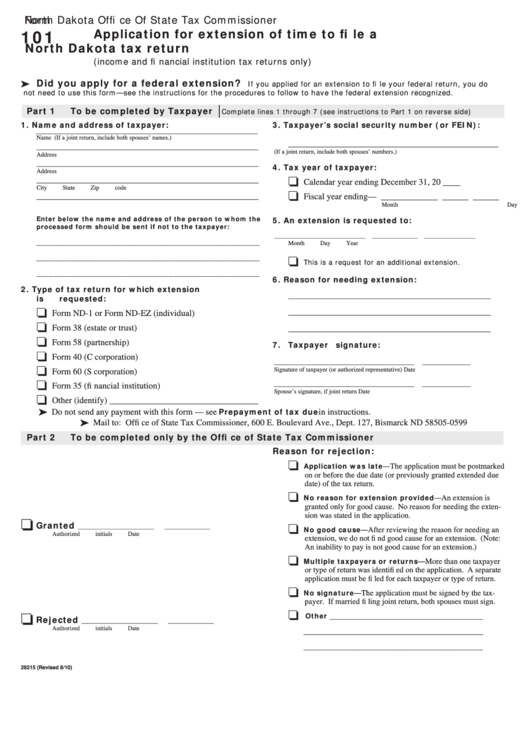

Form

North Dakota Offi ce Of State Tax Commissioner

Application for extension of time to fi le a

101

North Dakota tax return

(income and fi nancial institution tax returns only)

Did you apply for a federal extension?

If you applied for an extension to fi le your federal return, you do

not need to use this form—see the instructions for the procedures to follow to have the federal extension recognized.

Part 1

To be completed by Taxpayer

Complete lines 1 through 7 (see instructions to Part 1 on reverse side)

1. Name and address of taxpayer:

3. Taxpayer’s social security number (or FEIN):

Name (If a joint return, include both spouses’ names.)

______________________________________________________

_________________________________________________________

(If a joint return, include both spouses’ numbers.)

Address

_________________________________________________________

4. Tax year of taxpayer:

Address

_________________________________________________________

Calendar year ending December 31, 20 ____

City

State

Zip code

Fiscal year ending— _____________ ______ ______

_________________________________________________________

Month

Day

Year

Enter below the name and address of the person to whom the

5. An extension is requested to:

processed form should be sent if not to the taxpayer:

______________________________ _______________ _________________

______________________________________________________

Month

Day

Year

______________________________________________________

This is a request for an additional extension.

______________________________________________________

6. Reason for needing extension:

2. Type of tax return for which extension

____________________________________________________

is requested:

____________________________________________________

Form ND-1 or Form ND-EZ (individual)

Form 38 (estate or trust)

____________________________________________________

Form 58 (partnership)

7. Taxpayer signature:

Form 40 (C corporation)

______________________________________________

________________

Signature of taxpayer (or authorized representative)

Date

Form 60 (S corporation)

______________________________________________

________________

Form 35 (fi nancial institution)

Spouse’s signature, if joint return

Date

Other (identify) __________________________________

Prepayment of tax due

Do not send any payment with this form — see

in instructions.

Mail to: Offi ce of State Tax Commissioner, 600 E. Boulevard Ave., Dept. 127, Bismarck ND 58505-0599

Part 2

To be completed only by the Offi ce of State Tax Commissioner

Reason for rejection:

Application was late—

The application must be postmarked

on or before the due date (or previously granted extended due

date) of the tax return.

No reason for extension provided—

An extension is

granted only for good cause. No reason for needing the exten-

sion was stated in the application.

Granted

_________________________

_______________

No good cause—

After reviewing the reason for needing an

Authorized initials

Date

extension, we do not fi nd good cause for an extension. (Note:

An inability to pay is not good cause for an extension.)

Multiple taxpayers or returns—

More than one taxpayer

or type of return was identifi ed on the application. A separate

application must be fi led for each taxpayer or type of return.

No signature—

The application must be signed by the tax-

payer. If married fi ling joint return, both spouses must sign.

Other ___________________________________

Rejected

_________________________

_______________

Authorized initials

Date

_________________________________________

_________________________________________

28215 (Revised 8/10)

1

1