Fill out form, print and mail. You may need to

Prior to filling out this application, save the

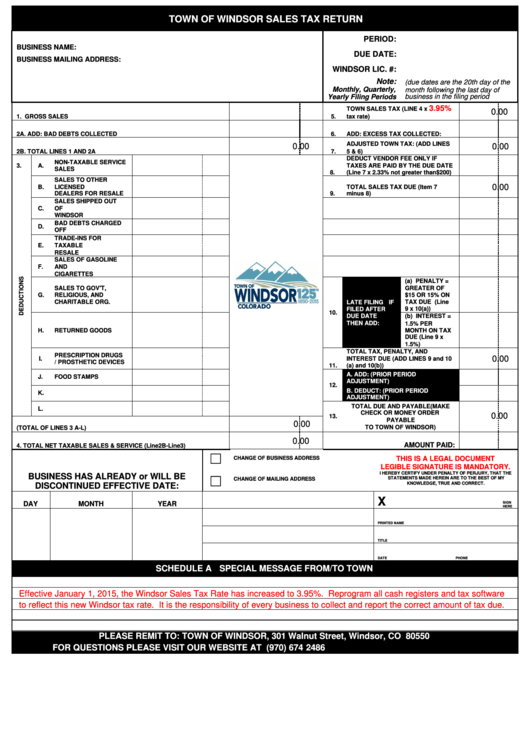

TOWN OF WINDSOR SALES TAX RETURN

Adobe Reader

download

prior to filling out form.

pdf on your computer or flash drive.

PERIOD:

BUSINESS NAME:

DUE DATE:

BUSINESS MAILING ADDRESS:

WINDSOR LIC. #:

Note:

(due dates are the 20th day of the

Monthly, Quarterly,

month following the last day of

Yearly Filing Periods

business in the filing period

3.95%

TOWN SALES TAX (LINE 4 x

0.00

.0

1. GROSS SALES

5.

tax rate)

2A. ADD: BAD DEBTS COLLECTED

6.

ADD: EXCESS TAX COLLECTED:

ADJUSTED TOWN TAX: (ADD LINES

0.00

0.00

2B. TOTAL LINES 1 AND 2A

7.

5 & 6)

DEDUCT VENDOR FEE ONLY IF

NON-TAXABLE SERVICE

3.

A.

TAXES ARE PAID BY THE DUE DATE

SALES

8.

(Line 7 x 2.33% not greater than$200)

SALES TO OTHER

0.00

B.

LICENSED

TOTAL SALES TAX DUE (Item 7

DEALERS FOR RESALE

9.

minus 8)

SALES SHIPPED OUT

C.

OF

WINDSOR

BAD DEBTS CHARGED

D.

OFF

TRADE-INS FOR

E.

TAXABLE

RESALE

SALES OF GASOLINE

F.

AND

CIGARETTES

(a) PENALTY =

SALES TO GOV'T,

GREATER OF

G.

RELIGIOUS, AND

$15 OR 15% ON

CHARITABLE ORG.

LATE FILING - IF

TAX DUE (Line

9 x 10(a))

FILED AFTER

10.

DUE DATE

(b) INTEREST =

THEN ADD:

1.5% PER

H.

RETURNED GOODS

MONTH ON TAX

DUE (Line 9 x

1.5%)

TOTAL TAX, PENALTY, AND

PRESCRIPTION DRUGS

0.00

I.

INTEREST DUE (ADD LINES 9 and 10

/ PROSTHETIC DEVICES

11.

(a) and 10(b))

A. ADD: (PRIOR PERIOD

J.

FOOD STAMPS

ADJUSTMENT)

12.

B. DEDUCT: (PRIOR PERIOD

K.

ADJUSTMENT)

TOTAL DUE AND PAYABLE(MAKE

L.

0.00 -1

CHECK OR MONEY ORDER

0.00

13.

PAYABLE

0.00

TO TOWN OF WINDSOR)

3.TOTAL DEDUCTIONS (TOTAL OF LINES 3 A-L)

0.00

AMOUNT PAID:

4. TOTAL NET TAXABLE SALES & SERVICE (Line2B-Line3)

☐

THIS IS A LEGAL DOCUMENT

CHANGE OF BUSINESS ADDRESS

LEGIBLE SIGNATURE IS MANDATORY.

I HEREBY CERTIFY UNDER PENALTY OF PERJURY, THAT THE

BUSINESS HAS ALREADY or WILL BE

☐

STATEMENTS MADE HEREIN ARE TO THE BEST OF MY

CHANGE OF MAILING ADDRESS

KNOWLEDGE, TRUE AND CORRECT.

DISCONTINUED EFFECTIVE DATE:

X

SIGN

DAY

MONTH

YEAR

HERE

PRINTED NAME

TITLE

DATE

PHONE

SCHEDULE A - SPECIAL MESSAGE FROM/TO TOWN

Effective January 1, 2015, the Windsor Sales Tax Rate has increased to 3.95%. Reprogram all cash registers and tax software

to reflect this new Windsor tax rate. It is the responsibility of every business to collect and report the correct amount of tax due.

PLEASE REMIT TO: TOWN OF WINDSOR, 301 Walnut Street, Windsor, CO 80550

FOR QUESTIONS PLEASE VISIT OUR WEBSITE AT OR CALL (970) 674 - 2486

1

1