Instructions For Form W-829 - Nebraska Department Of Revenue

ADVERTISEMENT

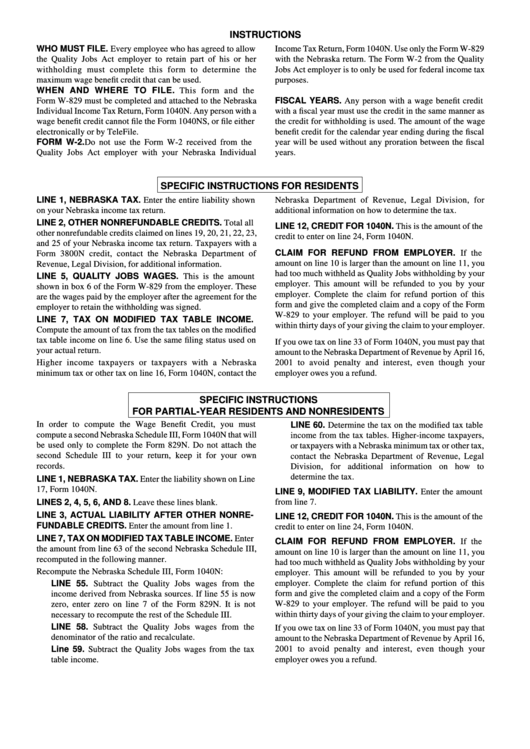

INSTRUCTIONS

WHO MUST FILE. Every employee who has agreed to allow

Income Tax Return, Form 1040N. Use only the Form W-829

the Quality Jobs Act employer to retain part of his or her

with the Nebraska return. The Form W-2 from the Quality

withholding must complete this form to determine the

Jobs Act employer is to only be used for federal income tax

maximum wage benefit credit that can be used.

purposes.

WHEN AND WHERE TO FILE. This form and the

FISCAL YEARS. Any person with a wage benefit credit

Form W-829 must be completed and attached to the Nebraska

Individual Income Tax Return, Form 1040N. Any person with a

with a fiscal year must use the credit in the same manner as

wage benefit credit cannot file the Form 1040NS, or file either

the credit for withholding is used. The amount of the wage

electronically or by TeleFile.

benefit credit for the calendar year ending during the fiscal

FORM W-2. Do not use the Form W-2 received from the

year will be used without any proration between the fiscal

Quality Jobs Act employer with your Nebraska Individual

years.

SPECIFIC INSTRUCTIONS FOR RESIDENTS

LINE 1, NEBRASKA TAX. Enter the entire liability shown

Nebraska Department of Revenue, Legal Division, for

on your Nebraska income tax return.

additional information on how to determine the tax.

LINE 2, OTHER NONREFUNDABLE CREDITS. Total all

LINE 12, CREDIT FOR 1040N. This is the amount of the

other nonrefundable credits claimed on lines 19, 20, 21, 22, 23,

credit to enter on line 24, Form 1040N.

and 25 of your Nebraska income tax return. Taxpayers with a

CLAIM FOR REFUND FROM EMPLOYER. If the

Form 3800N credit, contact the Nebraska Department of

amount on line 10 is larger than the amount on line 11, you

Revenue, Legal Division, for additional information.

had too much withheld as Quality Jobs withholding by your

LINE 5, QUALITY JOBS WAGES. This is the amount

employer. This amount will be refunded to you by your

shown in box 6 of the Form W-829 from the employer. These

employer. Complete the claim for refund portion of this

are the wages paid by the employer after the agreement for the

form and give the completed claim and a copy of the Form

employer to retain the withholding was signed.

W-829 to your employer. The refund will be paid to you

LINE 7, TAX ON MODIFIED TAX TABLE INCOME.

within thirty days of your giving the claim to your employer.

Compute the amount of tax from the tax tables on the modified

tax table income on line 6. Use the same filing status used on

If you owe tax on line 33 of Form 1040N, you must pay that

your actual return.

amount to the Nebraska Department of Revenue by April 16,

Higher income taxpayers or taxpayers with a Nebraska

2001 to avoid penalty and interest, even though your

minimum tax or other tax on line 16, Form 1040N, contact the

employer owes you a refund.

SPECIFIC INSTRUCTIONS

FOR PARTIAL-YEAR RESIDENTS AND NONRESIDENTS

In order to compute the Wage Benefit Credit, you must

LINE 60. Determine the tax on the modified tax table

compute a second Nebraska Schedule III, Form 1040N that will

income from the tax tables. Higher-income taxpayers,

be used only to complete the Form 829N. Do not attach the

or taxpayers with a Nebraska minimum tax or other tax,

second Schedule III to your return, keep it for your own

contact the Nebraska Department of Revenue, Legal

records.

Division, for additional information on how to

determine the tax.

LINE 1, NEBRASKA TAX. Enter the liability shown on Line

17, Form 1040N.

LINE 9, MODIFIED TAX LIABILITY. Enter the amount

LINES 2, 4, 5, 6, AND 8. Leave these lines blank.

from line 7.

LINE 3, ACTUAL LIABILITY AFTER OTHER NONRE-

LINE 12, CREDIT FOR 1040N. This is the amount of the

FUNDABLE CREDITS. Enter the amount from line 1.

credit to enter on line 24, Form 1040N.

LINE 7, TAX ON MODIFIED TAX TABLE INCOME. Enter

CLAIM FOR REFUND FROM EMPLOYER. If the

the amount from line 63 of the second Nebraska Schedule III,

amount on line 10 is larger than the amount on line 11, you

recomputed in the following manner.

had too much withheld as Quality Jobs withholding by your

Recompute the Nebraska Schedule III, Form 1040N:

employer. This amount will be refunded to you by your

employer. Complete the claim for refund portion of this

LINE 55. Subtract the Quality Jobs wages from the

form and give the completed claim and a copy of the Form

income derived from Nebraska sources. If line 55 is now

W-829 to your employer. The refund will be paid to you

zero, enter zero on line 7 of the Form 829N. It is not

within thirty days of your giving the claim to your employer.

necessary to recompute the rest of the Schedule III.

LINE 58. Subtract the Quality Jobs wages from the

If you owe tax on line 33 of Form 1040N, you must pay that

denominator of the ratio and recalculate.

amount to the Nebraska Department of Revenue by April 16,

Line 59. Subtract the Quality Jobs wages from the tax

2001 to avoid penalty and interest, even though your

employer owes you a refund.

table income.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1