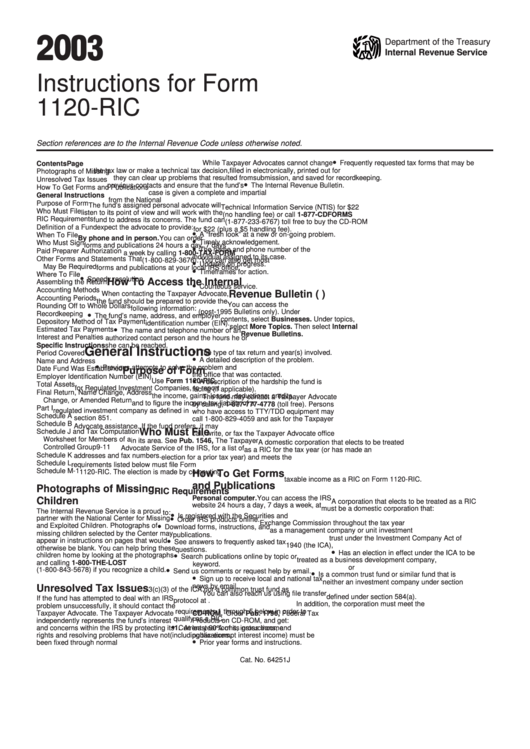

Instructions For Form 1120-Ric - U.s. Income Tax Return For Regulated Investment Companies - 2003

ADVERTISEMENT

03

2 0

Department of the Treasury

Internal Revenue Service

Instructions for Form

1120-RIC

U.S. Income Tax Return for Regulated Investment Companies

Section references are to the Internal Revenue Code unless otherwise noted.

•

While Taxpayer Advocates cannot change

Frequently requested tax forms that may be

Contents

Page

the tax law or make a technical tax decision,

filled in electronically, printed out for

Photographs of Missing Children . . . . . . . . 1

they can clear up problems that resulted from

submission, and saved for recordkeeping.

Unresolved Tax Issues . . . . . . . . . . . . . . . 1

•

previous contacts and ensure that the fund’s

The Internal Revenue Bulletin.

How To Get Forms and Publications

. . . . . 1

case is given a complete and impartial review.

Buy the CD-ROM on the Internet at

General Instructions . . . . . . . . . . . . . . . . 1

from the National

Purpose of Form . . . . . . . . . . . . . . . . . . . 1

The fund’s assigned personal advocate will

Technical Information Service (NTIS) for $22

Who Must File . . . . . . . . . . . . . . . . . . . . . 1

listen to its point of view and will work with the

(no handling fee) or call 1-877-CDFORMS

RIC Requirements . . . . . . . . . . . . . . . . . . 1

fund to address its concerns. The fund can

(1-877-233-6767) toll free to buy the CD-ROM

Definition of a Fund . . . . . . . . . . . . . . . . . 2

expect the advocate to provide:

for $22 (plus a $5 handling fee).

•

When To File . . . . . . . . . . . . . . . . . . . . . 2

A “fresh look” at a new or on-going problem.

By phone and in person. You can order

•

Timely acknowledgement.

Who Must Sign . . . . . . . . . . . . . . . . . . . . 2

forms and publications 24 hours a day, 7 days

•

The name and phone number of the

Paid Preparer Authorization . . . . . . . . . . . . 2

a week by calling 1-800-TAX-FORM

individual assigned to its case.

Other Forms and Statements That

(1-800-829-3676). You can also get most

•

Updates on progress.

May Be Required . . . . . . . . . . . . . . . . 2-4

forms and publications at your local IRS office.

•

Timeframes for action.

Where To File . . . . . . . . . . . . . . . . . . . . . 3

•

Speedy resolution.

How To Access the Internal

Assembling the Return . . . . . . . . . . . . . . . 4

•

Courteous service.

Accounting Methods . . . . . . . . . . . . . . . . . 4

Revenue Bulletin (I.R.B.)

When contacting the Taxpayer Advocate,

Accounting Periods . . . . . . . . . . . . . . . . . 5

the fund should be prepared to provide the

You can access the I.R.B. on the Internet at

Rounding Off to Whole Dollars . . . . . . . . . . 5

following information:

(post-1995 Bulletins only). Under

•

Recordkeeping . . . . . . . . . . . . . . . . . . . . 5

The fund’s name, address, and employer

contents, select Businesses. Under topics,

Depository Method of Tax Payment

. . . . . 5

identification number (EIN).

select More Topics. Then select Internal

•

Estimated Tax Payments . . . . . . . . . . . . . 5

The name and telephone number of an

Revenue Bulletins.

Interest and Penalties . . . . . . . . . . . . . . . . 5

authorized contact person and the hours he or

Specific Instructions . . . . . . . . . . . . . . . 6

she can be reached.

•

General Instructions

The type of tax return and year(s) involved.

Period Covered . . . . . . . . . . . . . . . . . . . . 6

•

A detailed description of the problem.

Name and Address . . . . . . . . . . . . . . . . . 6

•

Previous attempts to solve the problem and

Date Fund Was Established . . . . . . . . . . . . 6

Purpose of Form

the office that was contacted.

Employer Identification Number (EIN) . . . . . 6

•

Use Form 1120-RIC, U.S. Income Tax Return

A description of the hardship the fund is

Total Assets . . . . . . . . . . . . . . . . . . . . . . 6

for Regulated Investment Companies, to report

facing (if applicable).

Final Return, Name Change, Address

the income, gains, losses, deductions, credits,

The fund may contact a Taxpayer Advocate

Change, or Amended Return . . . . . . . . . 6

and to figure the income tax liability of a

by calling, 1-877-777-4778 (toll free). Persons

Part I . . . . . . . . . . . . . . . . . . . . . . . . . . 6-9

regulated investment company as defined in

who have access to TTY/TDD equipment may

Schedule A . . . . . . . . . . . . . . . . . . . . . . . 9

section 851.

call 1-800-829-4059 and ask for the Taxpayer

Schedule B . . . . . . . . . . . . . . . . . . . . . . . 9

Advocate assistance. If the fund prefers, it may

Who Must File

Schedule J and Tax Computation

call, write, or fax the Taxpayer Advocate office

Worksheet for Members of a

in its area. See Pub. 1546, The Taxpayer

A domestic corporation that elects to be treated

Controlled Group . . . . . . . . . . . . . . . 9-11

Advocate Service of the IRS, for a list of

as a RIC for the tax year (or has made an

Schedule K . . . . . . . . . . . . . . . . . . . . . . 11

addresses and fax numbers.

election for a prior tax year) and meets the

Schedule L . . . . . . . . . . . . . . . . . . . . . . 12

requirements listed below must file Form

Schedule M-1 . . . . . . . . . . . . . . . . . . . . 12

How To Get Forms

1120-RIC. The election is made by computing

taxable income as a RIC on Form 1120-RIC.

and Publications

Photographs of Missing

RIC Requirements

Personal computer. You can access the IRS

Children

A corporation that elects to be treated as a RIC

website 24 hours a day, 7 days a week, at

must be a domestic corporation that:

The Internal Revenue Service is a proud

to:

•

Is registered with the Securities and

•

partner with the National Center for Missing

Order IRS products online.

Exchange Commission throughout the tax year

•

and Exploited Children. Photographs of

Download forms, instructions, and

as a management company or unit investment

missing children selected by the Center may

publications.

trust under the Investment Company Act of

•

appear in instructions on pages that would

See answers to frequently asked tax

1940 (the ICA),

otherwise be blank. You can help bring these

•

questions.

Has an election in effect under the ICA to be

•

children home by looking at the photographs

Search publications online by topic or

treated as a business development company,

and calling 1-800-THE-LOST

keyword.

or

•

(1-800-843-5678) if you recognize a child.

Send us comments or request help by email.

•

Is a common trust fund or similar fund that is

•

Sign up to receive local and national tax

neither an investment company under section

news by email.

Unresolved Tax Issues

3(c)(3) of the ICA nor a common trust fund as

You can also reach us using file transfer

defined under section 584(a).

If the fund has attempted to deal with an IRS

protocol at ftp.irs.gov.

In addition, the corporation must meet the

problem unsuccessfully, it should contact the

requirements 1 through 5 below in order to

Taxpayer Advocate. The Taxpayer Advocate

CD-ROM. Order Pub. 1796, Federal Tax

qualify as a RIC.

independently represents the fund’s interest

Products on CD-ROM, and get:

•

and concerns within the IRS by protecting its

Current year forms, instructions, and

1. At least 90% of its gross income

rights and resolving problems that have not

publications.

(including tax-exempt interest income) must be

•

been fixed through normal channels.

Prior year forms and instructions.

derived from the following items.

Cat. No. 64251J

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12