Form Nh-1120-We - Combined Business Profits Tax Return - New Hampshire Department Of Revenue Administration

ADVERTISEMENT

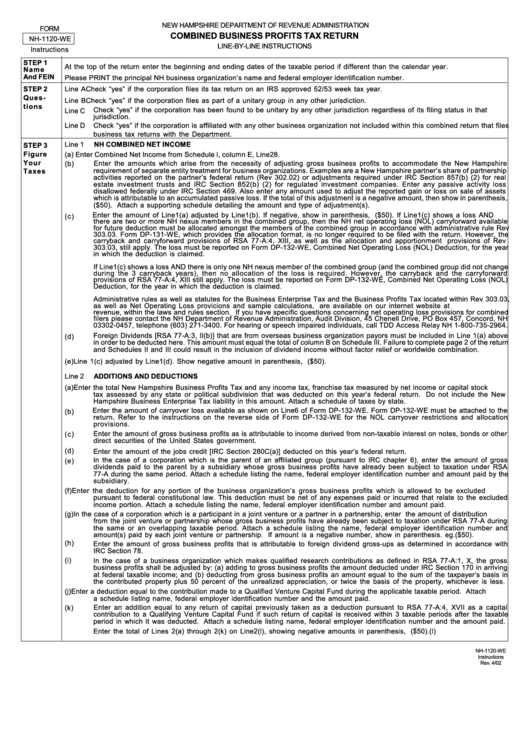

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

COMBINED BUSINESS PROFITS TAX RETURN

NH-1120-WE

LINE-BY-LINE INSTRUCTIONS

Instructions

STEP 1

At the top of the return enter the beginning and ending dates of the taxable period if different than the calendar year.

Name

And FEIN

Please PRINT the principal NH business organization’s name and federal employer identification number.

STEP 2

Line A

Check “yes” if the corporation files its tax return on an IRS approved 52/53 week tax year.

Ques-

Line B

Check “yes” if the corporation files as part of a unitary group in any other jurisdiction.

tions

Check “yes” if the corporation has been found to be unitary by any other jurisdiction regardless of its filing status in that

Line C

jurisdiction.

Line D

Check “yes” if the corporation is affiliated with any other business organization not included within this combined return that files

business tax returns with the Department.

Line 1

NH COMBINED NET INCOME

STEP 3

Figure

(a)

Enter Combined Net Income from Schedule l, column E, Line28.

Your

(b)

Enter the amounts which arise from the necessity of adjusting gross business profits to accommodate the New Hampshire

requirement of separate entity treatment for business organizations. Examples are a New Hampshire partner’s share of partnership

Taxes

activities reported on the partner’s federal return (Rev 302.02) or adjustments required under IRC Section 857(b) (2) for real

estate investment trusts and IRC Section 852(b) (2) for regulated investment companies. Enter any passive activity loss

disallowed federally under IRC Section 469. Also enter any amount used to adjust the reported gain or loss on sale of assets

which is attributable to an accumulated passive loss. If the total of this adjustment is a negative amount, then show in parenthesis,

e.g. ($50). Attach a supporting schedule detailing the amount and type of adjustment(s).

Enter the amount of Line1(a) adjusted by Line1(b). If negative, show in parenthesis, e.g. ($50). If Line1(c) shows a loss AND

(c)

there are two or more NH nexus members in the combined group, then the NH net operating loss (NOL) carryforward available

for future deduction must be allocated amongst the members of the combined group in accordance with administrative rule Rev

303.03. Form DP-131-WE, which provides the allocation format, is no longer required to be filed with the return. However, the

carryback and carryforward provisions of RSA 77-A:4, XIII, as well as the allocation and apportionment provisions of Rev

303.03, still apply. The loss must be reported on Form DP-132-WE, Combined Net Operating Loss (NOL) Deduction, for the year

in which the deduction is claimed.

If Line1(c) shows a loss AND there is only one NH nexus member of the combined group (and the combined group did not change

during the 3 carryback years), then no allocation of the loss is required. However, the carryback and the carryforward

provisions of RSA 77-A:4, XIII still apply. The loss must be reported on Form DP-132-WE, Combined Net Operating Loss (NOL)

Deduction, for the year in which the deduction is claimed.

Administrative rules as well as statutes for the Business Enterprise Tax and the Business Profits Tax located within Rev 303.03,

as well as Net Operating Loss provicions and sample calculations, are available on our internet website at

revenue, within the laws and rules section. If you have specific questions concerning net operating loss provisions for combined

filers please contact the NH Department of Revenue Administration, Audit Division, 45 Chenell Drive, PO Box 457, Concord, NH

03302-0457, telephone (603) 271-3400. For hearing or speech impaired individuals, call TDD Access Relay NH 1-800-735-2964.

Foreign Dividends [RSA 77-A:3, II(b)] that are from overseas business organization payors must be included in Line 1(a) above

(d)

in order to be deducted here. This amount must equal the total of column B on Schedule III. Failure to complete page 2 of the return

and Schedules II and III could result in the inclusion of dividend income without factor relief or worldwide combination.

(e)

Line 1(c) adjusted by Line1(d). Show negative amount in parenthesis, e.g. ($50).

Line 2

ADDITIONS AND DEDUCTIONS

(a)

Enter the total New Hampshire Business Profits Tax and any income tax, franchise tax measured by net income or capital stock

tax assessed by any state or political subdivision that was deducted on this year’s federal return. Do not include the New

Hampshire Business Enterprise Tax liability in this amount. Attach a schedule of taxes by state.

Enter the amount of carryover loss available as shown on Line6 of Form DP-132-WE. Form DP-132-WE must be attached to the

(b)

return. Refer to the instructions on the reverse side of Form DP-132-WE for the NOL carryover restrictions and allocation

provisions.

(c)

Enter the amount of gross business profits as is attributable to income derived from non-taxable interest on notes, bonds or other

direct securities of the United States government.

(d)

Enter the amount of the jobs credit [IRC Section 280C(a)] deducted on this year’s federal return.

In the case of a corporation which is the parent of an affiliated group (pursuant to IRC chapter 6), enter the amount of gross

(e)

dividends paid to the parent by a subsidiary whose gross business profits have already been subject to taxation under RSA

77-A during the same period. Attach a schedule listing the name, federal employer identification number and amount paid by the

subsidiary.

(f)

Enter the deduction for any portion of the business organization’s gross business profits which is allowed to be excluded

pursuant to federal constitutional law. This deduction must be net of any expenses paid or incurred that relate to the excluded

income portion. Attach a schedule listing the name, federal employer identification number and amount paid.

(g)

In the case of a corporation which is a participant in a joint venture or a partner in a partnership, enter the amount of distribution

from the joint venture or partnership whose gross business profits have already been subject to taxation under RSA 77-A during

the same or an overlapping taxable period. Attach a schedule listing the name, federal employer identification number and

amount(s) paid by each joint venture or partnership. If amount is a negative number, show in parenthesis. eg.($50).

(h)

Enter the amount of gross business profits that is attributable to foreign dividend gross-ups as determined in accordance with

IRC Section 78.

(i)

In the case of a business organization which makes qualified research contributions as defined in RSA 77-A:1, X, the gross

business profits shall be adjusted by: (a) adding to gross business profits the amount deducted under IRC Section 170 in arriving

at federal taxable income; and (b) deducting from gross business profits an amount equal to the sum of the taxpayer’s basis in

the contributed property plus 50 percent of the unrealized appreciation, or twice the basis of the property, whichever is less.

(j)

Enter a deduction equal to the contribution made to a Qualified Venture Capital Fund during the applicable taxable period. Attach

a schedule listing name, federal employer identification number and the amount paid.

(k)

Enter an addition equal to any return of capital previously taken as a deduction pursuant to RSA 77-A:4, XVII as a capital

contribution to a Qualifying Venture Capital Fund if such return of capital is received within 3 taxable periods after the taxable

period in which it was deducted. Attach a schedule listing name, federal employer identification number and the amount paid.

(l)

Enter the total of Lines 2(a) through 2(k) on Line2(l), showing negative amounts in parenthesis, e.g. ($50).

NH-1120-WE

Instructions

Rev. 4/02

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4