Form Acd-31050 - Application For Nontaxable Transaction Certificates - 2003

ADVERTISEMENT

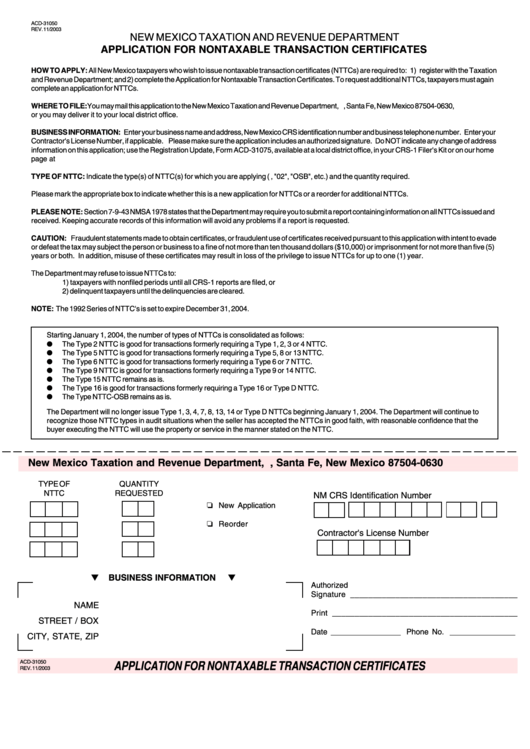

ACD-31050

REV. 11/2003

NEW MEXICO TAXATION AND REVENUE DEPARTMENT

APPLICATION FOR NONTAXABLE TRANSACTION CERTIFICATES

HOW TO APPLY: All New Mexico taxpayers who wish to issue nontaxable transaction certificates (NTTCs) are required to: 1) register with the Taxation

and Revenue Department; and 2) complete the Application for Nontaxable Transaction Certificates. To request additional NTTCs, taxpayers must again

complete an application for NTTCs.

WHERE TO FILE: You may mail this application to the New Mexico Taxation and Revenue Department, P.O. Box 630, Santa Fe, New Mexico 87504-0630,

or you may deliver it to your local district office.

BUSINESS INFORMATION: Enter your business name and address, New Mexico CRS identification number and business telephone number. Enter your

Contractor's License Number, if applicable. Please make sure the application includes an authorized signature. Do NOT indicate any change of address

information on this application; use the Registration Update, Form ACD-31075, available at a local district office, in your CRS-1 Filer's Kit or on our home

page at

TYPE OF NTTC: Indicate the type(s) of NTTC(s) for which you are applying (i.e., "02", "OSB", etc.) and the quantity required.

Please mark the appropriate box to indicate whether this is a new application for NTTCs or a reorder for additional NTTCs.

PLEASE NOTE: Section 7-9-43 NMSA 1978 states that the Department may require you to submit a report containing information on all NTTCs issued and

received. Keeping accurate records of this information will avoid any problems if a report is requested.

CAUTION: Fraudulent statements made to obtain certificates, or fraudulent use of certificates received pursuant to this application with intent to evade

or defeat the tax may subject the person or business to a fine of not more than ten thousand dollars ($10,000) or imprisonment for not more than five (5)

years or both. In addition, misuse of these certificates may result in loss of the privilege to issue NTTCs for up to one (1) year.

The Department may refuse to issue NTTCs to:

1) taxpayers with nonfiled periods until all CRS-1 reports are filed, or

2) delinquent taxpayers until the delinquencies are cleared.

NOTE: The 1992 Series of NTTC's is set to expire December 31, 2004.

Starting January 1, 2004, the number of types of NTTCs is consolidated as follows:

●

The Type 2 NTTC is good for transactions formerly requiring a Type 1, 2, 3 or 4 NTTC.

●

The Type 5 NTTC is good for transactions formerly requiring a Type 5, 8 or 13 NTTC.

●

The Type 6 NTTC is good for transactions formerly requiring a Type 6 or 7 NTTC.

●

The Type 9 NTTC is good for transactions formerly requiring a Type 9 or 14 NTTC.

●

The Type 15 NTTC remains as is.

●

The Type 16 is good for transactions formerly requiring a Type 16 or Type D NTTC.

●

The Type NTTC-OSB remains as is.

The Department will no longer issue Type 1, 3, 4, 7, 8, 13, 14 or Type D NTTCs beginning January 1, 2004. The Department will continue to

recognize those NTTC types in audit situations when the seller has accepted the NTTCs in good faith, with reasonable confidence that the

buyer executing the NTTC will use the property or service in the manner stated on the NTTC.

New Mexico Taxation and Revenue Department, P.O. Box 630, Santa Fe, New Mexico 87504-0630

TYPE OF

QUANTITY

NTTC

REQUESTED

NM CRS Identification Number

❏ New Application

❏ Reorder

Contractor's License Number

▼

▼

BUSINESS INFORMATION

Authorized

Signature _____________________________________

NAME

Print _________________________________________

STREET / BOX

Date ________________ Phone No. _______________

CITY, STATE, ZIP

ACD-31050

APPLICATION FOR NONTAXABLE TRANSACTION CERTIFICATES

REV. 11/2003

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2