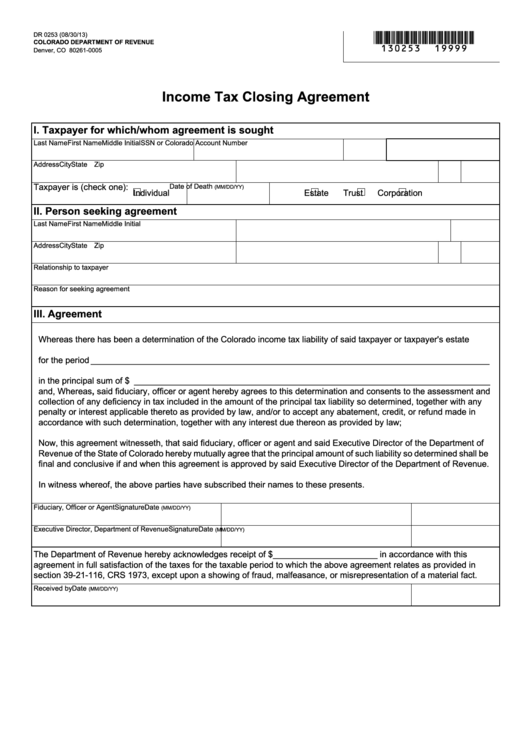

DR 0253 (08/30/13)

*130253==19999*

colorado department of revenue

Denver, CO 80261-0005

Income tax closing agreement

I. taxpayer for which/whom agreement is sought

Last Name

First Name

Middle Initial SSN or Colorado Account Number

Address

City

State Zip

Taxpayer is (check one):

Date of Death

(MM/DD/YY)

Individual

Estate

Trust

Corporation

II. person seeking agreement

Last Name

First Name

Middle Initial

Address

City

State Zip

Relationship to taxpayer

Reason for seeking agreement

III. agreement

Whereas there has been a determination of the Colorado income tax liability of said taxpayer or taxpayer's estate

for the period ____________________________________________________________________________________

in the principal sum of $ ___________________________________________________________________________

and, Whereas, said fiduciary, officer or agent hereby agrees to this determination and consents to the assessment and

collection of any deficiency in tax included in the amount of the principal tax liability so determined, together with any

penalty or interest applicable thereto as provided by law, and/or to accept any abatement, credit, or refund made in

accordance with such determination, together with any interest due thereon as provided by law;

Now, this agreement witnesseth, that said fiduciary, officer or agent and said Executive Director of the Department of

Revenue of the State of Colorado hereby mutually agree that the principal amount of such liability so determined shall be

final and conclusive if and when this agreement is approved by said Executive Director of the Department of Revenue.

In witness whereof, the above parties have subscribed their names to these presents.

Fiduciary, Officer or Agent

Signature

Date

(MM/DD/YY)

Executive Director, Department of Revenue

Signature

Date

(MM/DD/YY)

The Department of Revenue hereby acknowledges receipt of $ ______________________ in accordance with this

agreement in full satisfaction of the taxes for the taxable period to which the above agreement relates as provided in

section 39-21-116, CRS 1973, except upon a showing of fraud, malfeasance, or misrepresentation of a material fact.

Received by

Date

(MM/DD/YY)

1

1