Form S1 - Special Event Sales Tax Return - City Of Pueblo

ADVERTISEMENT

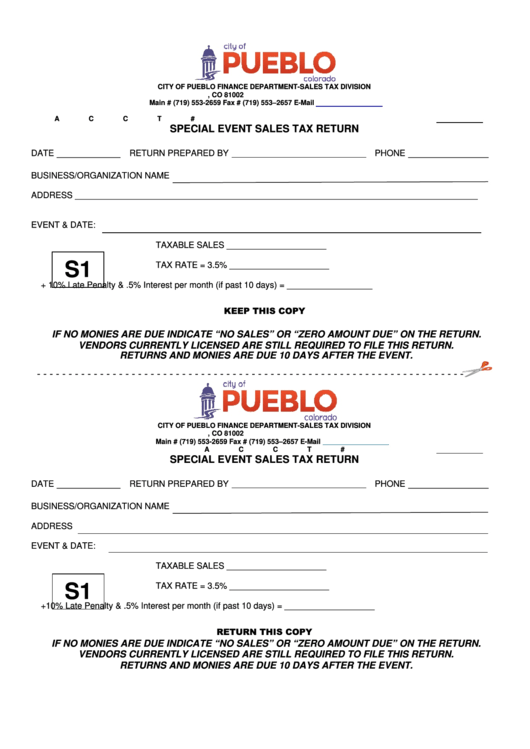

CITY OF PUEBLO FINANCE DEPARTMENT-SALES TAX DIVISION

P.O. BOX 1427 PUEBLO, CO 81002

Main # (719) 553-2659 Fax # (719) 553–2657 E-Mail

salestax@pueblo.us

ACCT#

SPECIAL EVENT SALES TAX RETURN

___________

______________

DATE

RETURN PREPARED BY

PHONE

BUSINESS/ORGANIZATION NAME

ADDRESS _____________________________________________________________________________________

EVENT & DATE:

TAXABLE SALES _____________________

S1

TAX RATE = 3.5% _____________________

+ 10% Late Penalty & .5% Interest per month (if past 10 days) = __________________

KEEP THIS COPY

IF NO MONIES ARE DUE INDICATE “NO SALES” OR “ZERO AMOUNT DUE” ON THE RETURN.

VENDORS CURRENTLY LICENSED ARE STILL REQUIRED TO FILE THIS RETURN.

RETURNS AND MONIES ARE DUE 10 DAYS AFTER THE EVENT.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

-

CITY OF PUEBLO FINANCE DEPARTMENT-SALES TAX DIVISION

P.O. BOX 1427 PUEBLO, CO 81002

Main # (719) 553-2659 Fax # (719) 553–2657 E-Mail

salestax@pueblo.us

ACCT#

SPECIAL EVENT SALES TAX RETURN

___________

______________

DATE

RETURN PREPARED BY

PHONE

BUSINESS/ORGANIZATION NAME

ADDRESS

EVENT & DATE:

TAXABLE SALES _____________________

TAX RATE = 3.5% _____________________

S1

+10% Late Penalty & .5% Interest per month (if past 10 days) = ___________________

RETURN THIS COPY

IF NO MONIES ARE DUE INDICATE “NO SALES” OR “ZERO AMOUNT DUE” ON THE RETURN.

VENDORS CURRENTLY LICENSED ARE STILL REQUIRED TO FILE THIS RETURN.

RETURNS AND MONIES ARE DUE 10 DAYS AFTER THE EVENT.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1